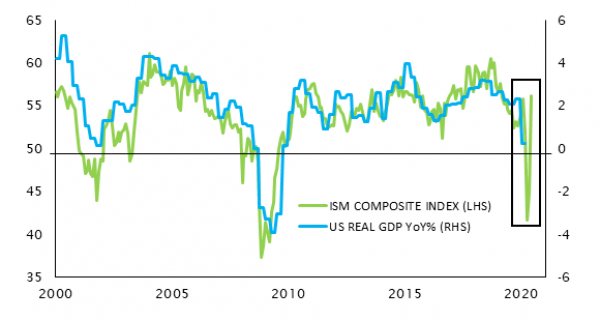

There is no doubt the global economy has experienced an unprecedented brutal and steep recession, but this is a ‘known known’, and the recovery is already underway. Our central base case scenario puts the probability of a short but steep recession at 60%. If Developed market countries will still all leave the year with their GDP figures in the red, China’s robust recovery is likely to save them from a negative end of year tally.

Still darkening the global picture is also high levels of unemployment and its uncertain impact on consumption. A second wave may well materialise indeed, but we don’t see another lock-down on the scale of the first outbreak. What matters most, is that the trough in GDP is behind us and we are now in the recovery phase, albeit from a low base. As much in life, it is the direction of travel that ultimately matters.

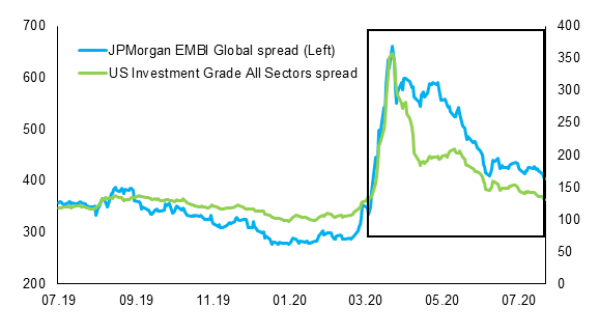

The second half of 2020 may well be remembered for continual spikes in volatility. With this in mind, we have ensured diverse sources of protection from uncorrelated assets – from equity puts to long-term US treasuries.