Just like in the biographical film "Catch Me if You Can" where the elusive protagonist avoids apprehension by forging new lives, the US and European credit markets transform constantly and present new opportunities.

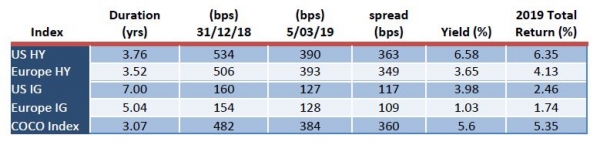

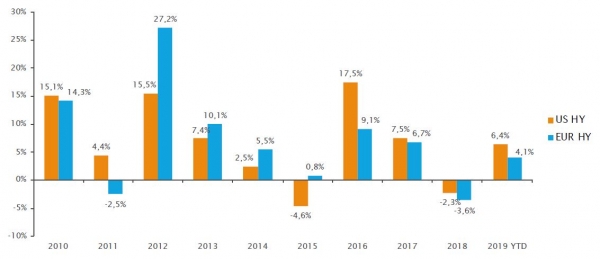

Credit markets rebounded from their December sell-off as fears over slowing global growth have moderated and more importantly as expectations of rising interest rate in the U.S. and Europe have decreased materially. Nevertheless, the health status of credit markets remains a concern for investors who are worried about leverage levels, use of proceeds, the level of defaults and return expectations for 2019. Let’s have a closer look at all of the above and evaluate the current credit opportunity:

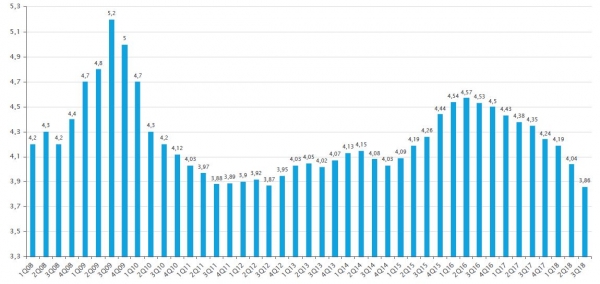

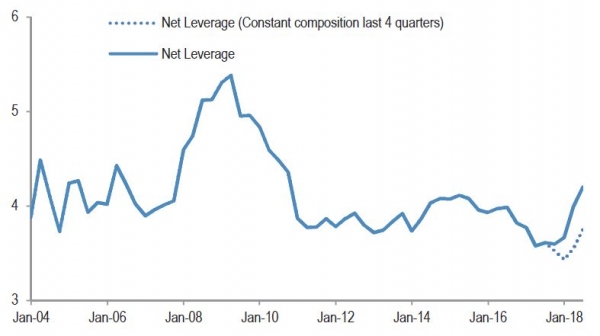

The U.S. high yield leverage level paints a positive image for the asset class’s fundamentals as it has been decreasing for nine consecutive quarters and is in fact at post-crisis lows. More precisely, leverage decreased to 3.86x in the third quarter of 2018 down from 4.04x in the second quarter of the same year, and compared to a post-crisis high of 4.57x in the second quarter of 2016.