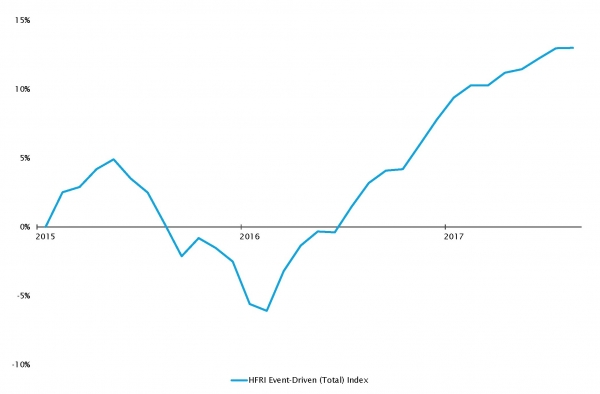

The period was characterised by strong performance across the hedge fund industry. We were especially glad to see our equity long bias allocation benefiting from the equity rally, while dedicated strategies extracted alphas too. Investors were focused more on fundamentals such as earnings, rather than on the macroeconomic environment. It is a welcome change in dynamic compared to previous years, with markets switching back and forth from risk-on to risk-off on the back of central banks’ interventions or wording.

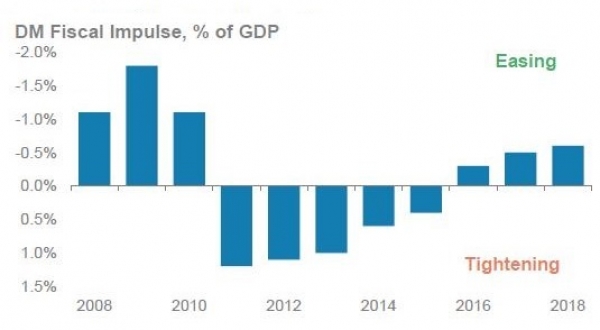

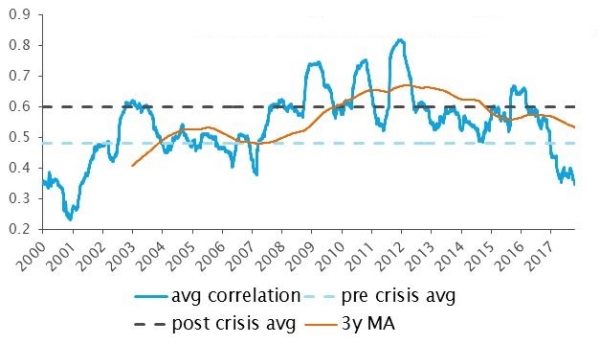

So far in 2017, we are observing a reduction of the intra-stock correlation and rising dispersion, both creating a wealth of additional opportunities. The Fed’s balance sheet reduction, tightened policy and the ECB’s tapering getting closer should all continue to improve the environment.

We are working to develop our hedge fund strategy allocation, focusing in particular on new technologies, namely quantitative machine learning and more broadly on all systematic methodologies, moving away from the classical price and fundamental data analysis. The technology is in its early days but we think it might develop quickly.

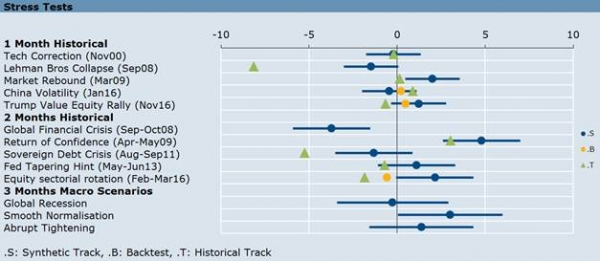

At the end of this document, we are sharing with you our conviction on portfolio risk management and the need for a strong quantitative analysis system.