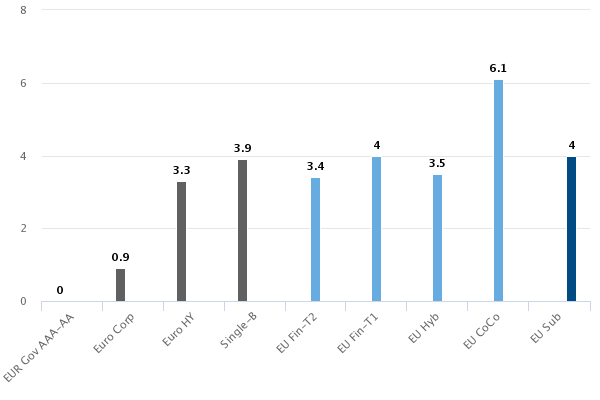

It is commonly believed that in a context of low rates there is a high risk of loss on bonds, since interest rates and spreads can only go up. This means, therefore, that liquidity and short-term positions are preferable.

As we see it, choosing liquidity and short-term positions generates high opportunity cost. Actually, in our opinion, the performance that can be achieved is a good deal higher than yields at maturity, because of the curve slope and of this particular macroeconomic environment.

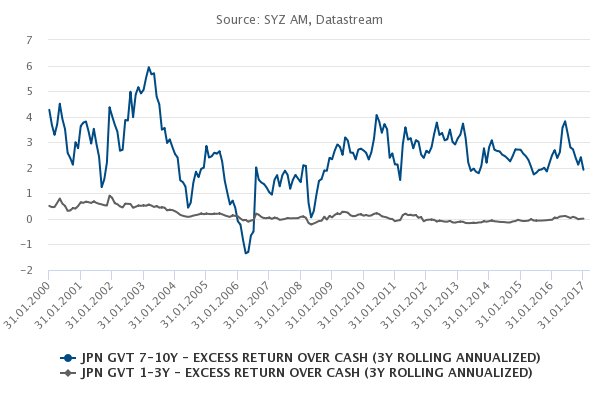

The experience in Japan shows that those who invested in long-term bonds netted better performance by at least 2-3 percentage points, and not just compared to theoretical yields but also against short-term investments. This would be the opportunity cost of giving up on long term maturity. Our suggestion is to keep a little duration risk in your portfolio.