2018 was a challenging year. Many conflicting forces collided, with the Fed hiking rates on the back of rising inflation, low unemployment and solid growth, while macro turmoil triggered sharp market reversals. Hedge fund performances in 2018 were down on average across most strategies, although they outperformed the MSCI World TR. It was difficult to find a profitable investment, but our uncorrelated strategy was the exception. It was robust in the last months of the year and finished in positive territory.

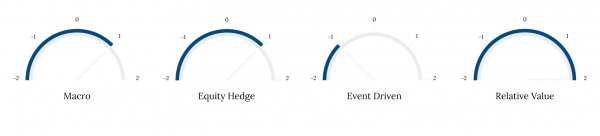

In terms of strategies, the worst performers were the managers with equity beta exposure, as the global deleveraging initiated from October until 21 December caught many off guard. The most resilient strategies were short-term quant and arbitrage strategies, which profited from the increase in equity volatility.

New challenges arose and managers had to adapt quickly to a new paradigm, characterised by the below.

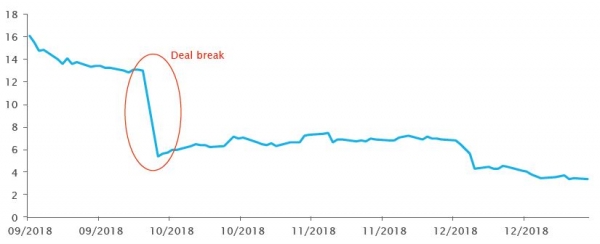

- Donald Trump weighs on markets. His sometimes brutal tweets and decisions have a direct effect on hedge fund strategies, i.e. merger arbitrage. These are particularly sensitive to the US-China trade war, and Trump’s actions are forcing these managers to review their investment processes.

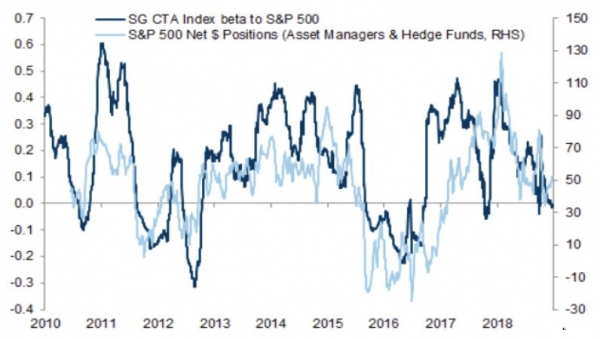

- Impact of volatility constrained instruments such as risk parity, systematic and passive products, which gathered massive assets over last few years and became major market drivers.

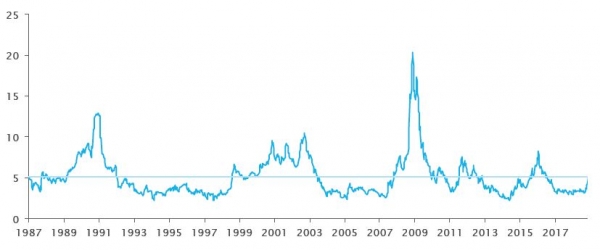

- The liquidity gap has become a recurring theme and market driver. Following the Global Financial Crisis, new regulations forced proprietary desks to shut down, and with ongoing Fed tightening, the liquidity gap acted as a catalyst to the fundamental increase in volatility.

We have increased our allocation in favour of shorter-term players – both systematic and discretionary – and to volatility arbitrage, more likely to capitalise on the current end-of-cycle environment.