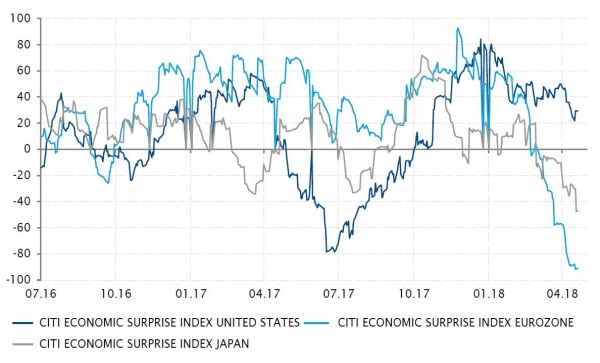

While there haven’t been many changes in the economic backdrop, which overall remains supportive, noise levels have nonetheless risen significantly. Concerns about tariffs, trade wars and geopolitical tensions have completely overshadowed the positive impact of tax cuts, which should be felt on earnings growth over the next few quarters. Looking forward, investors are also wondering if the expected increase in the US budget deficit, to pay for this fiscal gift, will change the dialogue around monetary policy. Speaking of monetary policy, the flattening of the US yield curve is also raising concerns as it has usually signalled a more difficult period ahead.

It is too soon to have a clear-cut view, but we do not believe that these headlines will really drive earnings for the foreseeable future. We expect rhetoric around tariffs to have a limited impact on growth and inflation, although we acknowledge that uncertainties surrounding this issue may be a temporary drag on spending or hiring plans. The noise around tariffs has hurt sentiment in both financial markets and surrounding business investment, which has unfortunately affected the valuations investors are willing to pay. On this point, it’s worth mentioning the change in the volatility regime since February, especially true of the US equity markets, which have seen significant day-to-day, as well as intra-day, index price variations. The risk contribution of the US market, generally deemed as the most defensive or the least risky among the different large equity markets, has increased above other markets. The fate of the technology sector may also be playing a role in this unusual rise in US equity risk. As far as the slope of the yield curve is concerned, flattening always happens when central banks tighten and there will certainly be a slowdown ahead (i.e. the steepest part of the recovery is behind us). However, it could be quite far away. Back in mid-2005, the difference between the 10Y and 2Y UST was close to the current level of about 50bps, and it even inverted temporarily in the first quarter of 2006. So, the yield curve cannot be used as a timely indicator.

In this context, we are keeping some preference for risk and a mild disinclination for duration. Valuations have become marginally more attractive on equities, and to a lesser extent credit, but not significantly enough to trigger additional buy opportunities. Conversely, the recent rate decrease, especially in continental Europe, has made nominal government bonds more expensive. We haven’t yet downgraded duration, as it has regained some decorrelation characteristics and inflation has remained subdued. The only notable change is that we now prefer EM hard currency debt vs EM local debt (downgraded to a mild disinclination). This asset class should continue to benefit from an overall improving macroeconomic backdrop (growth catching-up, inflation decreasing and potentially less restrictive monetary policy ahead), sounder structural fundamentals (less reliance on external money to fund contained budget or current account deficits) and should thus be spared from Trump’s gyrations and the gradual monetary policy normalisation in developed markets.

_Fabrizio Quirighetti