There are not many things that keep me up at night except for my grandchildren when they come to spend the night at our home. This is because I am not a central banker. Not so long ago, the threat of a currency crisis or a recession kept policymakers awake, but now it is ‘Japanification’. The prospect of Europe or the US following Japan into years of weak growth, deflation and low interest rates gives them sleepless nights precisely because they lack the tools to fight it effectively.

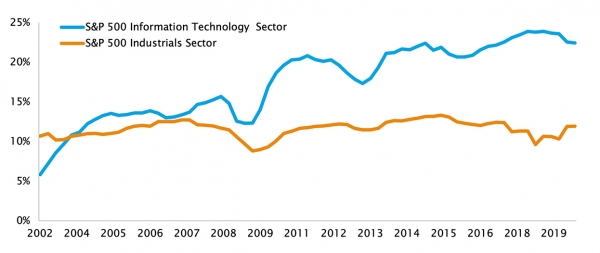

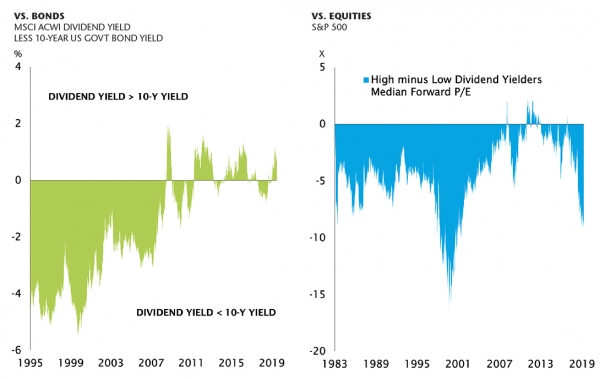

For now, Europe and North America have sidestepped the worst of that fate thanks to the unprecedented resources injected into financial markets by central banks. However, prolonged monetary easing has implications for productivity. It props up businesses with cheap credit that would otherwise struggle to survive and inflates asset prices.

As investors, the threat of this new paradigm has profound implications for us all. It changes the cost of cash and the nature of risk. But even more profoundly, it changes the fortunes of our real economies, stunting investment in the underlying real assets and testing the abilities of entrepreneurs to build and to make a difference.

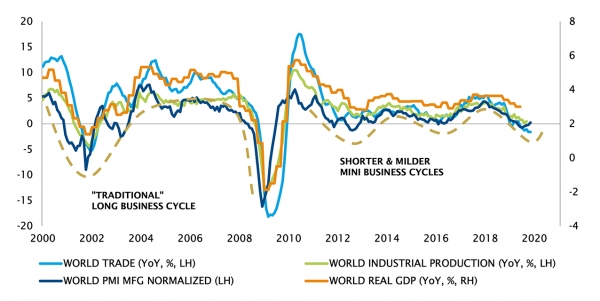

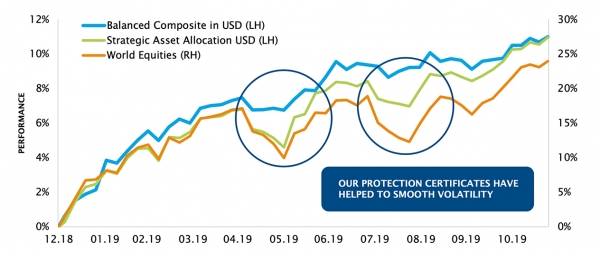

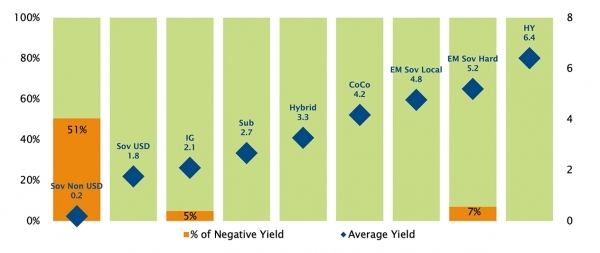

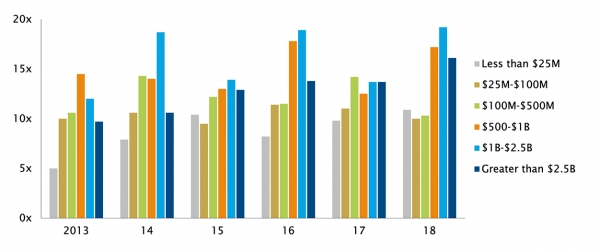

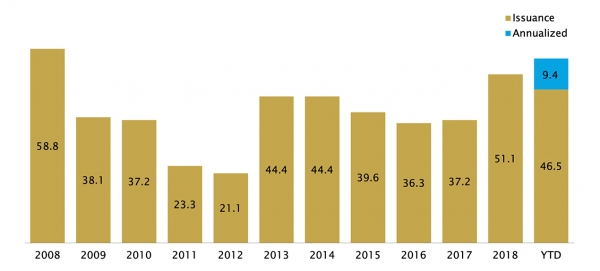

After the experience of 2019, when markets eventually recovered from their late 2018 losses, the greatest lessons should be that all investors need to be reactive, and above all, stay invested. We expect that Japanification will mean we have to adjust to shorter, and less extreme, economic cycles. We also see better returns in equities, carry opportunities in fixed income as well as investment grade credit and subordinated bonds. In addition, we continue to work on opportunities in private markets and a number of liquid alternative themes. As we try to anticipate the challenges for investors ahead, we believe that these strategies will help identify paths to profitable portfolios in 2020.

Happy reading.

_Eric Syz