The past three months have been truly extraordinary and difficult for just about everyone in the world. From an investor’s point of view, this period has upended many longstanding economic data series and challenged “conventional wisdom” regarding the link between equity performance and earning revisions, and correlations among asset classes. Who could have imagined 30 million new US jobless claims in just six weeks, PMI surveys below 30 or even 20 across major economies, a 30% equity rally amid sharp downward earning revisions and unprecedented uncertainty regarding the outlook, stable long-term rates despite this rebound in equity markets, or egative oil prices, just to mention a few? The Covid-19 crisis is now entering its second phase. After the initial shock and take-cover emergency reaction, governments are trying to balance two apparently opposing necessities: set conditions for the resumption of economic activity while keeping the pandemic “under control”, i.e. within the limits of health system’s ability to take care of those affected. This phase will be no less difficult from an investment point of view, but investors have at least a few tangible elements to rely on for navigating markets in the months ahead.

Regarding how long the “global economic pause” will last, all developed economies are gradually moving toward phased relaxing of the initial rigid social distaning measures in order to allow economic life to resume its course. The risk of the pandemic resurging is the Sword of Damocles hanging over the outlook, but it seems reasonable to expect GDP to start recovering ahead of the summer. Recovering the level of economic activity prevailing before the crisis will take time, probably several quarters, but at least the dreaded scenario of a long-lasting depression seems to have been avoided.

The pace of this economic recovery will likely be the best gauge of how effective recent government interventions have been. Beyond mandatory support to the health care system, the fundamental aim of the public spending and guarantees is indeed to contain the blow to productive capacities so that businesses and households won’t be bankrupt when social distancing measures are finally eased. It is still too early to assess how much will be achieved on that front. Most companies have stopped providing earning guidance, and investors keep pace with the recovery to gain confidence on sales and earning prospects.

It is also still too difficult to gauge how much has already been priced in financial markets. The relief from probably avoiding a sustained depression thanks to government interventions may have fueled the April rally in equity markets. By the same token, however, we have a better sense of the pandemic’s spread and risk, which also rules out the scenario of a rapid return to the pre-crisis levels. Between these two extremes, the span of outcomes is pretty wide. For investors, it requires finding a balance between being exposed to the expected gradual economic recovery and remaining wary of all the numerous risks and unknowns in the months ahead (including those not directly related to the pandemic, such as political or geopolitical ones).

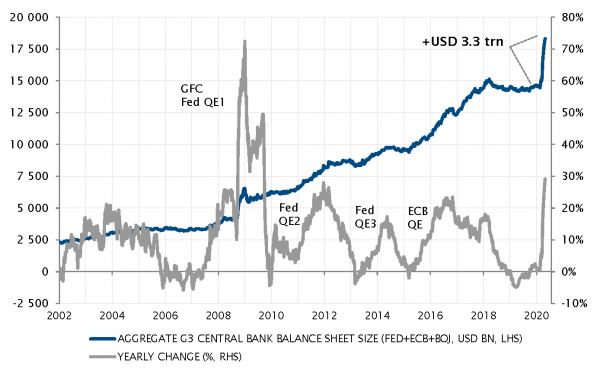

In this context, we maintain the stance adopted since early April. Portfolios keep a defensive tilt, but we believe that High Grade corporate bonds offer very attractive opportunities supported by central bank policies that have addressed the acute liquidity issue of March. The same cannot be said of the High Yield bond market and Emerging Market debt, for which uncertainties regarding the economic outlook outweigh the impact of very accommodative monetary policies. We now see little potential for further decline in long term rates, and fewer diversification benefits of government bonds than in the past, with the exception of inflation-linked government bonds that still offer value, along with gold, given currently depressed inflation expectations and negative real rates. Finally, we maintain our equity allocation close to a neutral level, while tilting geographical and sectorial exposure toward quality and balance sheet strength and keeping protections against a still possible second downside movement.

_Adrien Pichoud