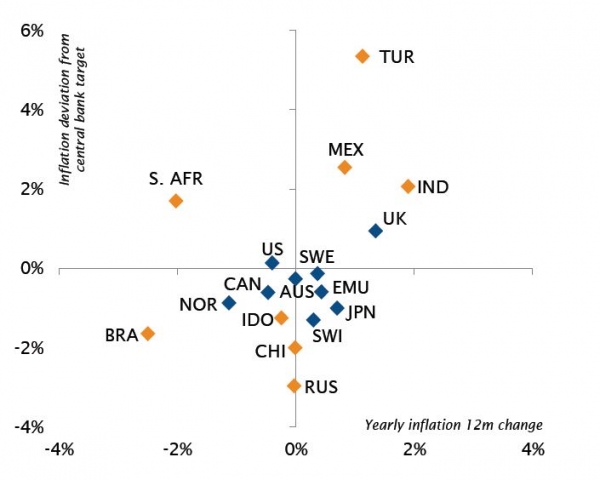

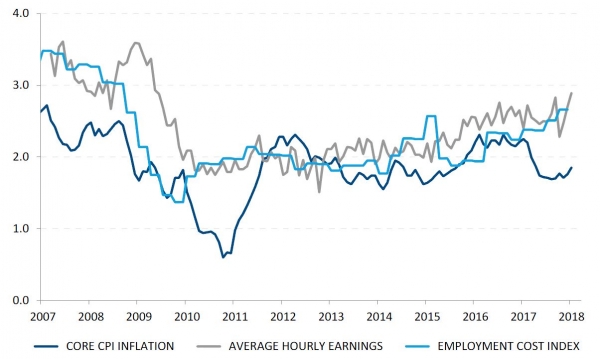

The return of volatility at the beginning of February resulted from the unwinding of the great goldilocks consensus: inflation is now gradually converging towards major developed markets central banks’ targets. While we do not think it will get out of control, central banks will thus normalise gradually in synch with the nominal growth trend and so valuations will have to adjust somewhat lower. But, we do not think we are at the beginning of a major and lasting bear market as earnings growth will not nose dive in the foreseeable future.

It’s all about finding a new equilibrium by applying a lower current multiple to higher expected earnings. This phase of adjustment should theoretically be very gradual. But, in practice, it will now be expected to move in violent jolts, triggered sometimes by exaggerated or unfounded fears. This greater uncertainty, compared to the overcrowded goldilocks consensus of last year, may offer sizeable opportunities for those who keep a cool head and tactically navigate through these sawtooth markets. As the postman always rings twice, it’s a safe bet that the demon of inflation and the spectre of a bond bear market associated with it will come back to haunt investors in the next few months.

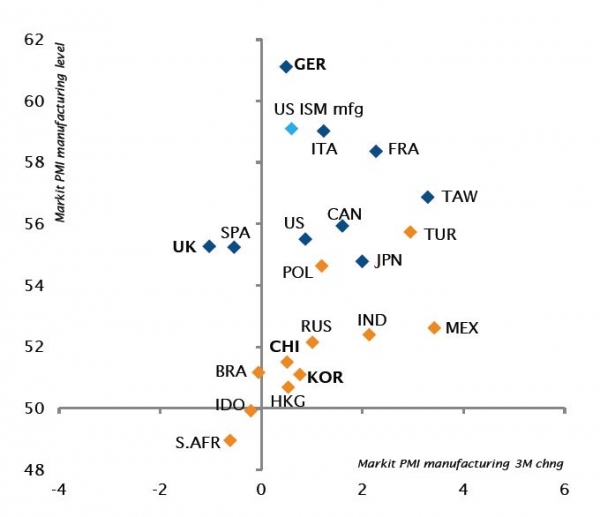

As part of this process, valuations in nominal bonds has already improved markedly as they have adjusted to more hawkish central bank communications and inflation trending higher. Thus, we should now be more at ease with duration compared to a few months ago, especially as economic growth momentum and surprise indices are not accelerating anymore (momentum is fading away and economic surprise indices are declining). Consequently, our duration stance was tactically upgraded to "mild disinclination". So, in simple English, long-term rates are expected to stabilise or remain quite range bound in the next few weeks. This may lead to a stabilisation and potentially even a rebound in prices for risky assets. With less evidence of overheating, rates and inflation should not creep up further and valuations should not experience another leg down, at least in the short term. Because of this, the portfolio’s overall risk stance was kept in "mild preference".

While the bull market isn’t over, neither perhaps is the correction. Markets may indeed be spooked again in between April and June by a second round of upward pressures on rates as the inflation base effect will be less favourable (i.e. the annual inflation rate may temporarily jump). Based on our economic cycle analysis, our asset valuation review and our risk balancing framework, we should be able to hedge tactically against the next volatility spike. Inflation’s bark is unfortunately sometimes worse than its bite.

_Fabrizio Quirighetti