It’s easy to adopt a contrarian philosophy, but execution is difficult. Contrarian investors need to have high conviction in their philosophy and their process, as well as the guts and gumption to go against the herd. Investor antipathy and hostility towards certain stocks, sectors and countries is what gets me excited. The property market collapse in 2007-2008, the peripheral European crisis in 2012, the Russian-Ukrainian tensions in 2014, oil price plummeting to below $30 in 2015 and the Italian banking crisis in 2016 are all areas we invested in when sentiment was at its worst and fear was at its highest. So where are we currently hunting and adding exposure to now?

Daring to be different

Wednesday, 11/01/2017An interesting way of creating a unique product is to zig where everyone else zags. Apple did this by bringing out the white iPod when most devices were either black or grey, Christian Louboutin stood out by introducing red-bottomed heels, and creating a portfolio is no different. Being contrarian in the small and mid-cap universe, our fund looks very different to our peers’; it offers different performance cycles and low levels of overlap while delivering consistent alpha.

Commotion in the Cancer Market - ION Beam Applications

Cancer is the leading cause of death in the developed world, the second leading cause of death in the developing world and the global incidence of cancer is expected to rise by over 60% in the next 15 years. With this structural driver as a backdrop, companies developing and manufacturing cancer treatment solutions are expected to see strong demand. Radiotherapy is currently the most common way to treat cancer and its market is a neat duopoly shared by Elekta and Varian. However, there is a disruptive technology in this space which has been gaining traction at an exponential rate – proton therapy - in which Belgium’s Ion Beam Applications is the market leader with a 50% global share. Proton therapy is an advanced type of cancer radiotherapy that uses a beam of protons to target and eradicate tumours. Its advantages are huge: it minimises exposure to healthy tissue, reduces the risk of secondary cancers and can improve patients’ quality of life by reducing side effects. It is therefore no surprise this field is expected to post a 15% CAGR to 2035. In the short term, however, IBA is out of favour. The company has delivered three profit warnings in the last nine months, mainly because delays in the construction process have halved the share price. Our long-term investment horizon allows us to see past these temporary, cyclical factors and invest in a company that benefits from high barriers to entry in a structurally attractive oligopoly, a strong backlog equating to over €1bn in sales and a rock-solid balance sheet which can support future growth.

Victims of Absent Volatility – Flow Traders

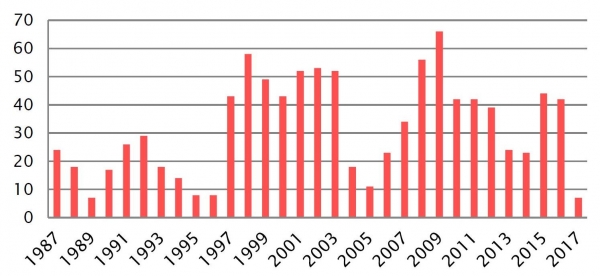

Currently, one area that excites us is stocks exposed to the low volatility plaguing equity markets. Since early 2016, volatility has been declining. Q3 of 2017 saw the lowest quarterly volatility since late 2006 in both Europe and the US and so far this year, the European Stoxx 600 has moved by more than 1% on just seven trading days – that’s less than 4% of the time, its lowest proportion since 1989. These conditions pose challenges to market making businesses like Flow Traders, a global liquidity provider that specializes in exchange traded products (ETPs). Flow Traders is currently suffering from earnings downgrades and weak sentiment, as multi-decade lows in volatility have impacted trading velocity and therefore reduced their revenue capture and margin. Despite this, there are several reasons for making the investment case. They are the market leader in Europe with a c20% share, and the company is essentially a geared play on the huge secular growth in the ETP industry (global ETP assets under management have grown at ~28% CAGR in the last 15yrs). Supporting the investment case further is a 4.7% dividend yield and double digit FCF yields.

Digging for Diamonds – Lucara Diamond Corp

2017 has been an ugly year for most diamond companies. Shares of many of the junior diamond miners have fallen by c30% YTD, driven by a sluggish diamond market and compounded by mine setbacks, political tensions and low prices for certain types of stones. Our feeling is that this area has been oversold and thus presents interesting opportunities – notably in Lucara Diamond Corp. Lucara is a pure play diamond mine whose principle asset, the Karowe mine in Botswana, is one of the world's key producers of large, exceptional stones. In November 2015, Lucara made history when it recovered the 1,109 carat Lesedi La Rona (meaning "our light" in Botswana's Tswana language). The largest gem-quality diamond to be recovered in the last 100 years and the second largest to ever be recovered was recently sold to Graff for $53m. While 2017 has been a difficult year for the company as a change in the mine’s operator temporarily hampered volumes and the company suffered from a lack of newsflow around new and large discoveries, it gave us an attractive entry point. Uncovering this hidden gem in the small and mid-cap universe highlights our research edge – buying unknown and unloved stocks and taking advantage of short-term pessimism.

Conclusions

Going against the herd can be uncomfortable, hence the importance of having a robust research process. In the small and mid-cap world, the significance of having vigorous stock selection criteria is even more pertinent given the fact that many investors are often dissuaded from looking down the market cap structure, due to long held misconceptions around the risks of investing in this space. Our process aims to dispel these misconceptions by buying high quality companies with rock solid balance sheets that are cheap because they are out of favour. This way we avoid paying “the small-cap premium” but still capture the higher alpha and growth associated with this segment of the market.

In a world where investors face continuing challenges in the search for returns, it is becoming more obvious that to beat the market, it is necessary to be different. Contrarianism in small and mid caps - executed carefully - represents an attractive option for those looking to avoid crowded trades and hold exposures that are diametrically opposite to the herd.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)