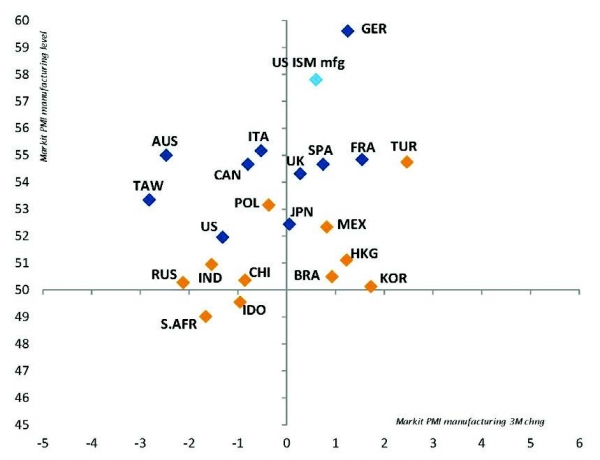

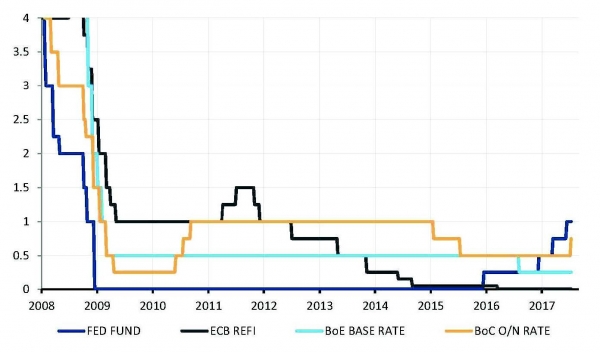

The economic backdrop remains favourable with positive global growth momentum, especially outside the US, and a lack of inflationary pressures allowing central banks to remain on the accommodative side. In other words, the Goldilocks environment continues to prevail. On the markets, everything continues to fly high or higher (except obviously for the dollar). Asset classes across the spectrum remain quite expensive, and exhibit historically low volatility. All of this is underpinned by extraordinary loose monetary policies. After a spike at the end of June / beginning of July, upward pressures on rates diminished rapidly with neither the Fed or the ECB in any rush take a more hawkish stance. As a result, EM assets continued to post strong performance as they benefit – even more than developed market – from a weak greenback, low rates and positive growth momentum: the perfect contextual trifecta. Moreover, they offer relatively attractive valuations compared to DM assets. So still more of the same. The question is, should asset allocators bother to intervene in the current climate?

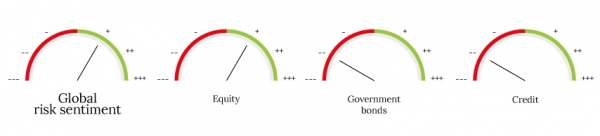

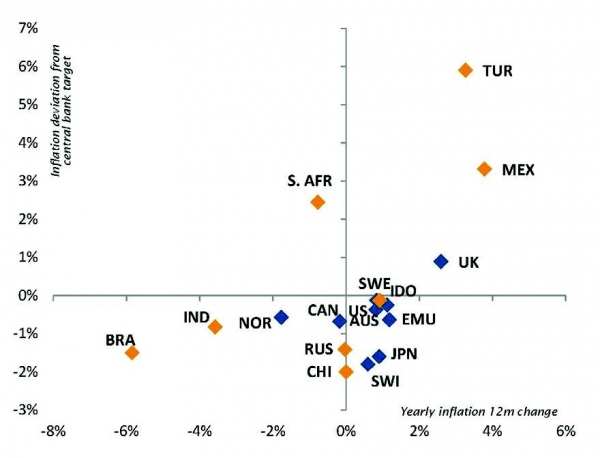

But there is cause for concern: the more the market serenity lasts and the more fragile markets become. While our next significant move will certainly be a risk reduction, we are clearly struggling to find negative catalyst in the short term. Perhaps the Jackson Hole Economic Policy Symposium at the end of August as central banks monetary policies normalization tentative remains the major imminent threat. In fact, lofty overall assets valuations, especially in the fixed income, are due to their current overall exceptionally loose monetary policies themselves. While there were no changes in our geographical preferences in the equities space, some of our preferences in the bond universe were shifted marginally. EM hard currency debt was downgraded for valuation purposes from mild preference to mild disinclination. Inflation-linked bonds were upgraded to a mild disinclination as real yields improved somewhat. Furthermore, they should offer more resilience in a rising rates environment, especially if complacency around low inflation comes under pressure. As "you can observe a lot by just watching" (Yogi Berra), the overly accommodative stance from developed market central banks could also be challenged if inflation surprises, even temporarily, on the upside.

Indeed, by examining recent market development, it seems that economic figures related to prices and wages have now a much broader and larger impact on markets than the ones associated purely or uniquely to (real) growth. In other words, as there is now a broad consensus according in our opinion about steady but unspectacular growth, the inflation question and the consequences it may have on monetary policies has become pivotal for markets. In the meantime, we prefer to remain invested and to benefit from low volatility to buy some cheap protections on equities as well as on rates.

_Fabrizio Quirighetti