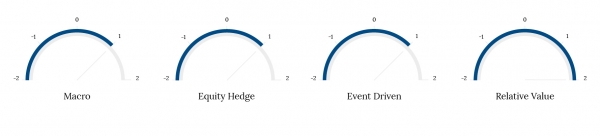

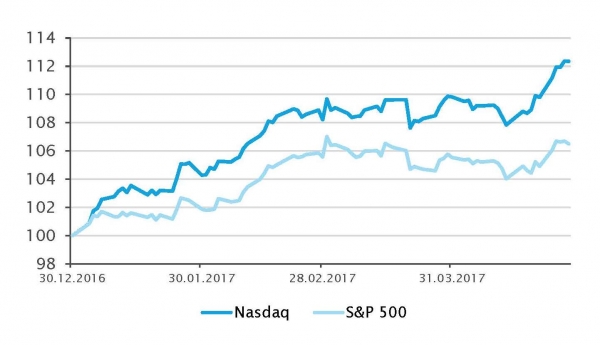

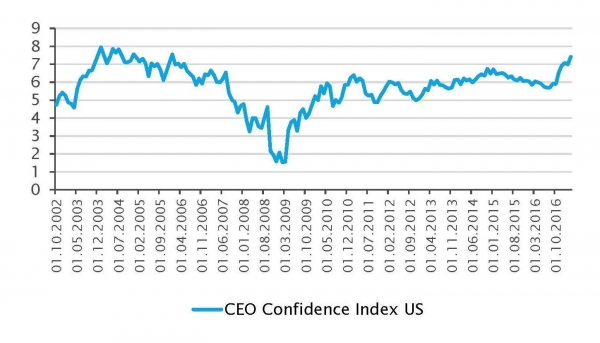

Hedge funds have started the year with positive performance across all strategies, global markets delivered robust gains as business and consumer confidence levels broadly improved. Indeed, it’s the first time since the crisis that we have witnessed healthy growth across the US, Europe and Asia simultaneously. Undoubtedly, President Trump’s pledge to cut taxes and invest in infrastructure has provided a lot of steam for equity markets to rally. The Federal Reserve also hiked interest rates echoing the numbers that confirm an improving economic environment.

Obviously despite the good numbers risk remains central to our discussions with hedge fund managers, and while they may have a constructive outlook, many believe that the Fed could derail the current momentum by raising rates too quickly. Political risk remains high as President Trump has to deliver on his promises to keep markets happy.

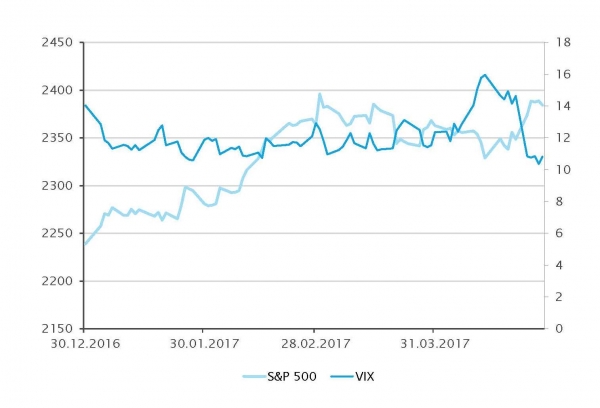

While hedge fund managers were able to extend their positive run since Q4 2016, the lack of volatility remained an overhang on performance and so far, remains the last hurdle for active managers to fully take advantage of their opportunity set. Interestingly, this is where we believe hedge fund managers – and all active managers –will make a difference. It is our belief that the reduction of AUM among active managers, coupled with the normalization of interest rates, will potentially increase the prospects to a return for a market environment that rewards hedge fund’s investment styles.