Despite the macro gloom, markets are supported by a number of constructive tailwinds. Ongoing positive – albeit lagging – economic momentum, ultra-low interest rates, ultra-accommodative central banks and profligate governments have combined to form a powerful cocktail for revenue or income-generating assets. Equity valuations remain, generally speaking, on the cheap side versus bonds and rates.

While we are tentatively optimistic in our positioning, now is not the time to be brave. Instead, we have moved to a neutral stance on equities. In the short term, a combination of weaker macroeconomic momentum, Covid-19 resurgence and US election turmoil creates downside risks that demand more visibility. Patience will deliver opportunity further down the track.

Now is not the time to be brave on equities

Friday, 10/23/2020We are living in extraordinary times. As second wave fears ripple out across Europe, uncertainty over Brexit reigns and a changing of the guard looms in the US, one might expect valuations to be at historic lows. But while sectors impacted by Covid-19 have been de-rated, tech-infused equity markets continue to breach all-time highs.

Reducing equities exposure

We have thus nudged our portfolio to a more neutral stance by cutting exposure to core US equity ETFs and blended active quality and value strategies. However, the less favourable macroeconomic environment is balanced by strong fiscal and monetary policy support. This creates a backstop for a potential new sharp negative shock to activity and warrants a constructive macroeconomic view for the coming 12-18 months.

The configuration of Congress might impact the size and composition of fiscal spending in 2021, but there will be opportunities to raise the risk exposure in portfolios according to the final electoral outcome. Depending on the election result, namely in a scenario where the president and the two chambers of Congress would be Democrats, fiscal stimulus in 2021 could significantly spur some sectors of the US economy.

Any news of an effective vaccine against Covid-19 would also have a positive impact on the growth outlook, especially on sectors most sensitive to social interactions. We maintain a watching brief on events.

Core eurozone equity markets are attractive, given the super-low rate context in Europe, but cautiousness is warranted regarding peripheral eurozone markets. These are less attractive from a valuation standpoint and more prone to disappointment or negative shocks in the months ahead, especially as macro momentum is losing steam in Europe. Euro strength is also a potential headwind for export-oriented European companies.

Within emerging markets, Asia ex-China and eastern Europe are still favoured over Latin America and MENA. We continue to avoid countries displaying a combination of structural financial fragilities, reliance on commodity exports, currency and political risks.

We have also increased our exposure to China through a local A-share China ETF. The Chinese market is still quite attractive given its domestic earning growth prospects, even after a strong summer performance. Domestic-oriented fiscal and monetary policies provide solid support to domestic Chinese equities.

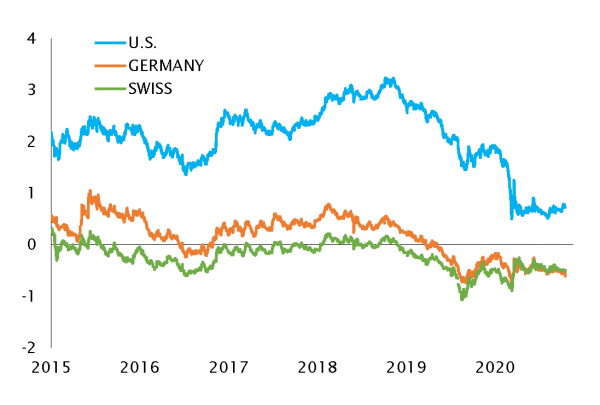

Exercising caution on duration

While exposure to long-term rates remains attractive given the positive slope of some yield curves, the potential for an increase in long-term rates, especially US dollar rates, in case of a Biden victory and a Democratic sweep in the Congress, leads us to take a tactically more cautious stance on duration exposure.

In the euro government rate complex, German rates remain very expensive after the decline experienced in September. Value can be found in peripheral euro government long-term bonds, both in absolute terms – they still offer positive yields – and relative to negative euro cash rates.

In the credit space, our preference for investment grade credit is maintained, and this remains our preferred fixed income sub-asset class, given attractive risk-adjusted expected return in an ultra-low-rate environment. Valuations are obviously less juicy than a few months ago, and the deterioration in fundamentals warrants a tilt toward quality and diversification. However, investment grade credit clearly remains attractive when compared to cash and government rates, while central banks provide a backstop.

We maintain a mild preference for high yield, as valuations are still generally attractive. However, the loss of economic momentum and the deterioration in credit fundamentals may prevent a further rapid and broad-based spread compression and warrants remaining selective within the asset class.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)