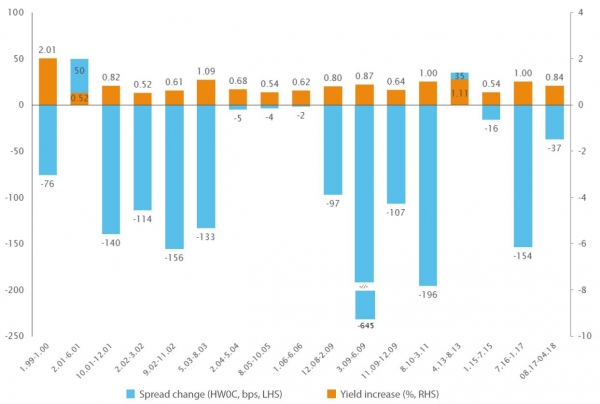

It’s common knowledge that rising interest rates impose challenging times on traditional Fixed Income instruments. But not all FI asset classes are born equal; High Yield bonds, even though part of the fixed income family, have historically produced consistently attractive returns through a range of market conditions. The reason behind this exists partly in the relationship between high yield, traditional fixed income and equites.

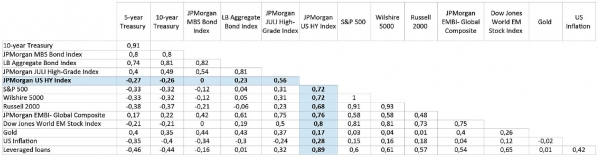

High yield’s long term correlation with 5-year and 10-year Treasuries has been negative. Equivalently, the correlation to equities is positive and above 0.70, indicating that high yield returns behave more like equities than bonds (table 1). This particular characteristic emphasizes the diversification benefit of allocating to high yield as part of a strategic allocation.