Recurring concerns about possible causes (e.g., trade tariffs) or symptoms (e.g., flatter yield curve) about the US economic cycle is legitimate at this stage, but still premature. While disappointments may be inevitable after stronger-than expected growth posted over the last few quarters, it won’t be an outright recession – as long as inflation behaves well and monetary policy isn’t too restrictive. As the maxim goes "the Cycle dies when the Fed puts a bullet in its forehead", either by policy misstep or the hand of inflation.

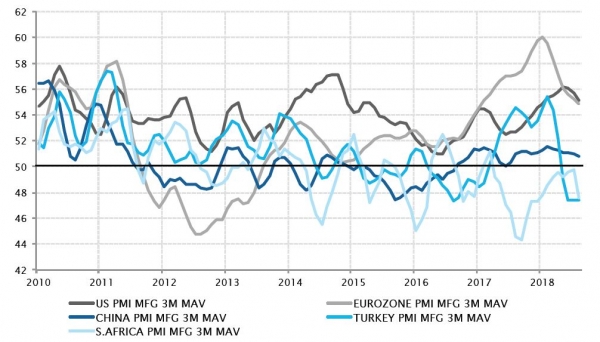

Applying the same reasoning to Europe, given current ECB posture and core inflation level, we shouldn’t be excessively concerned by the poor economic performances in euro area. These, to some extent, are due to the bloc economies producing less than their potential.

There is still plenty of catch-up potential in domestic demand. Thus, with absolutely no signs of economic exuberance, we may see a prolonged period of contraction. Encouragingly, recent tangible signs of stabilisation in eurozone activity, coupled with decent to strong growth elsewhere on the continent, should help restore confidence beyond the Italian budget saga.

This leave us with China, where the government is now trying to mitigate and indirectly reverse the slowdown in credit expansion it triggered last year. A bottoming out in China activity, still on the cards, should help to lift sentiment towards non-US equities and EM assets more specifically.

As a result, we haven’t changed our key stance to favour equities over bonds. Tactically, eurozone and Japan equities were upgraded and, thus, our relative preference for US equities, while still in place, was indirectly reduced. As long as the music is playing, we should keep dancing.

_Fabrizio Quirighetti