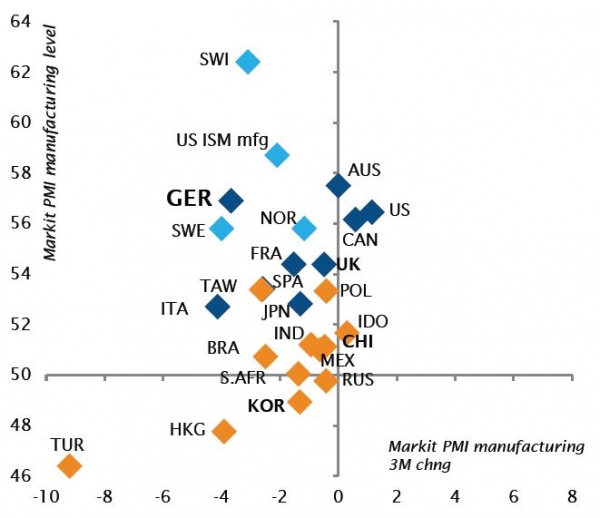

Tension is now palpable as uncertainties surrounding the economic outlook in emerging markets and, to a lesser extent, Europe and Japan have grown. Being in the firing line of sheriff Trump makes investors uneasy and it is hard to gauge the resilience of these economies in the face of the potential trade impact. These concerns have thus continued to hurt sentiment.

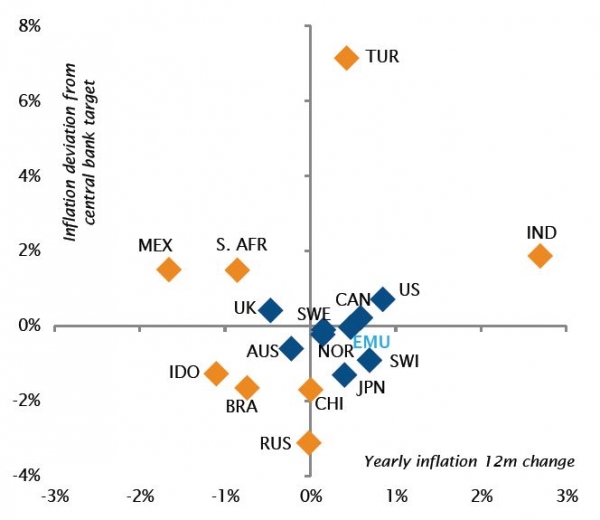

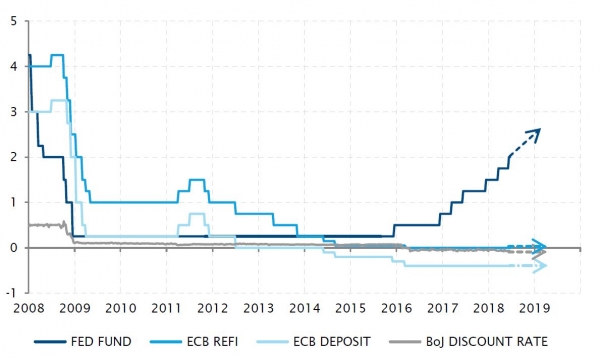

In the meantime, overall economic, as well as EPS, growth is and is expected to remain quite solid. It is very likely not going to be as strong as we were expecting at the beginning of the year, but still decent enough to be a support for equity markets. However, investors should now also recognize that the great inflation scare that would have pushed rates much higher and potentially led to a meltdown of bond prices and, through a ripple effect, of some stretched-to-lofty valuations in risky assets hasn’t really materialised. Inflation isn’t roaring back, Fed rate hikes have been clearly telegraphed for the next six months and the ECB and BoJ have dashed expectations of any significant monetary policy tightening in the near future.

So, the music hasn’t completely stopped yet: low rates in the rest of developed market economies are keeping US long rates at unusually low levels given the US economic outlook in terms of growth, inflation and budget deficit. And, as usual, the US is the main beneficiary of this scenario of strong domestic - and somewhat insulated economic growth - and low global rates in developed economies.

At this point, like bounty hunters, we believe that the bravery to chase improved equity risk premia by upgrading our risk stance by a notch will be rewarded going forward. Bravery isn’t expected to rhyme with genius or boldness: so we will be boring by adding, across the board and without any sectorial tilts, to US equities. Happy ending or not, the US market always wins.

_Fabrizio Quirighetti