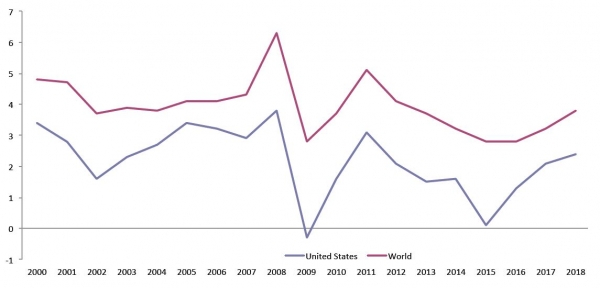

For most of the period since the Financial Crisis inflation has largely been the least of investor concerns. In fact, if anything, in places like Europe and Japan, the challenge was stimulating inflation, rather than any attempts to control its rise. Today however, the focus is increasingly on inflation, with market watchers keeping a close eye on this figure, which, should it start to increase in a steady manner, could spell trouble for investors – especially given where we are in the market cycle.

Time to dust off the inflation playbook

Friday, 10/26/2018Investors have recently become more concerned about inflation, which has led to both equity market volatility and a jump in bond yields. In our note, we share our thoughts on this important macro factor and what investors should consider when seeking to mitigate the impacts.

On the one hand, a rise in inflation is welcomed as it can be an indication of a growing economy (output gap closing). Unchecked however, inflation can become a material problem whose remedy (high interest rates and liquidity withdrawals) could put the brakes on global growth – or worse.

Inflationary house of cards is growing

Today, investors who are concerned about the future direction of inflation have a number of reasons to rightly be concerned. Higher oil prices, geopolitics, trade wars, rising incomes (in the U.S.) and persistently low interest rates (with the exception perhaps of the United States, which is arguably well ahead of its peers in terms of monetary tightening) either collectively or individually could results in an inflation shock. What is more, moves in inflation tend not to be smooth. Rather, inflationary shocks often manifest themselves quickly, with little or no warning, making it very hard for policymakers to react.

We do not believe that an inflation shock is imminent, but we do believe it is prudent to start to plan for such an event. Talk of U.S. inflation has picked up materially, perhaps a bit too precipitously given that inflation today is not an issue. That said, it is clear that the Fed is on a tightening path in part to ensure that inflation remains contained. So far, the Fed’s tightening path has been transparent and expected – something welcomed by the market. However, recent spikes in market volatility and looming U.S. mid-term elections as well as a less clear 2019 interest rate trajectory have all contributed to investor unease.

A crucial responsibility of any central bank is to control inflation…

We have already recently seen the IMF in October lowers its global growth forecast for both 2018 and 2019. While the growth revision was minor and the outlook still positive, this itself could be the start of a pattern of events that could put upward pressure on inflation. Lower growth on top of rising prices is a toxic combination for stable inflation.

How are we protecting our portfolios against inflation

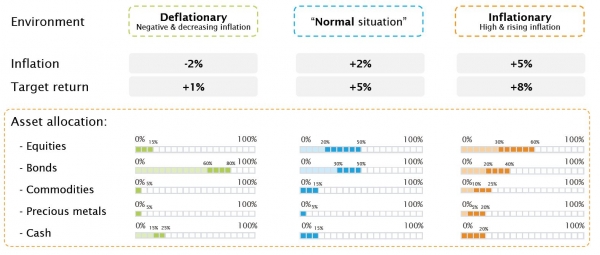

In the first instance, while eroded purchasing power is a direct consequence of inflation, we should point out that there are broadly three* different ‘types’ of inflation that we are always mindful of:

- Inflation: driven by rising wages, rising costs, lack of supply, increase in money supply, (i.e. above potential growth)

- Deflation: generally driven by oversupply issues, which lowers the value of items (i.e. below potential growth)

- Normal: full-potential economic growth (i.e. no output gap)

The approach to mitigate the effects of each of these is different. So the first challenge for any investor is to identify the inflationary environment that one wishes to hedge against. As a consequence of this analysis, an investor can then position themselves appropriately. Fortunately, one will not be faced with different kinds of inflation at the same time. However, an incorrect positioning relative to a current or expected inflationary environment can be quite painful.

Today, we are likely looking at inflation pressures coming from an accumulation of excess money supply in financial markets that could move into the economy and rising costs due to energy. But they are also trade war related (protectionism results in a higher cost of goods as barriers against competition are erected and cost imports are penalized by tariffs or outright banned). At the same time, fiscal stimulus still adds fuel to the fire as it is like putting the economy on steroids at a time when it is already growing strongly. We are not yet in any danger from stagflation, but should there be a severe market correction that depresses global growth, this could become a threat.

*But more specific regimes such as hyperinflation or stagflation are also considered.

Only a flexible asset allocation can consistently outperform inflation in any environment

Our approach has been to adopt a flexible approach to inflation protection. Our top-down macro assessment serves as the guide to our inflation outlook and helps to define portfolio construction both more generally in terms of allocations to and within assets classes, but also with regard to inflation.

Moreover, while inflation protection is important, we know that investors are also looking for returns or in the case of inflation protection solutions, ‘real returns’ – returns in excess of inflation. Clearly, producing a 3% return in a zero inflationary environment may be satisfactory, whereas producing 5% return when inflation is at or above 7% would not be.

Conclusion

Again, for the moment, inflation expectations seem to be well anchored in the U.S. (the reality is that is it is U.S. which is the important market to follow, as any changes to its health will impact the rest of the world). However, as we have seen in the past, it does not take much to go from clear skies and into the eye of the storm. One would expect during risk-off scenario that there would be a flight to quality and bond yields would fall (although this has only been the case since 2000’s when we entered into a "financial repression world" with real rates depressed and often in negative territory). All eyes will be on future inflation measures as we approach the end of 2018. Inflation is rightfully a risk that should be taken seriously, but with the right analysis and planning, its impacts can be mitigated – or even profited from.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)