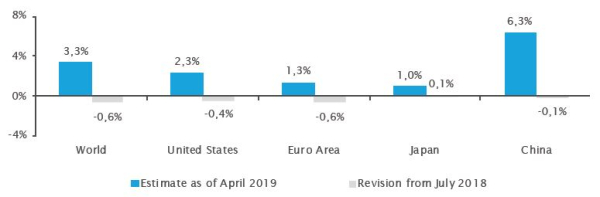

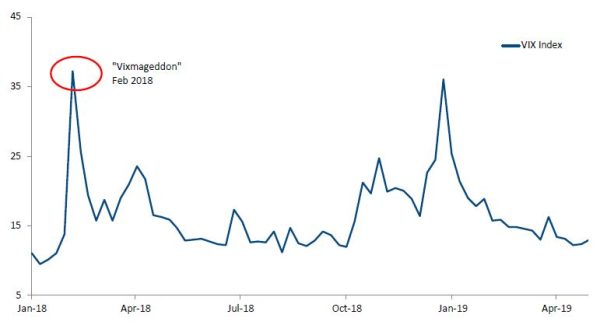

Since 2017, market participants have been enjoying a "goldilocks" environment where accommodative monetary policies support "just right" economic growth and inflation. This idyllic situation did not last for long; goldilocks was mauled by bears in the second half of 2018. China’s domestic consumer spending weakened amid trade wars and confidence in the euro area dropped. External demand, especially from emerging Asia, softened. Germany and Italy flirted with technical recessions, while prospects of an disorderly Brexit dented confidence. This global malaise led to downward revisions to GDP growth estimates (chart 1) and financial markets paid a heavy performance price.

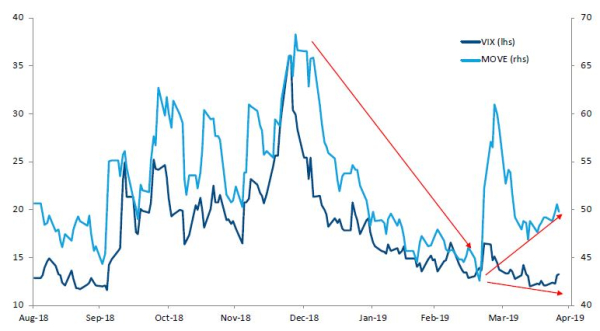

This dull picture improved somewhat in 2019 when the Federal Reserve slammed the brakes on additional rate hikes, creating a "silverlocks" condition where monetary policy once again became accommodative, but this time in a less than robust economic backdrop. The return of dovish policy was welcome at first but has since created markets with feet of clay. Price appreciations have been the result of cheap money rather than economic growth, making valuations extremely fragile.