In an environment where most asset classes went up, the hedge fund industry had one of its best years in a decade. Most strategies were up, except for macro systematic managers who struggled to read the markets with their fundamental models. For equity market neutral funds, it was a positive but difficult year, mainly due to more frequent factor rotations and short squeezes.

The Fed’s decision to cut interest rates again pushed asset prices to their highest levels and volatility to the lowest. It caused large increases in equity allocations and leverage in risk-based strategies like risk parity. In case of volatility increase, we can expect major deleveraging just like we experienced in late 2018. Will the coronavirus be the trigger?

In our constant search for alpha, we believe that three themes will stand out over the next 12 months. First, convertible bond arbitrage should benefit from higher volatility at stocks level and an increase of US new issuances. Secondly, we believe there is value to be found in Japan. Thanks to recent reforms under Prime Minister Shinzo Abe, Japan’s corporate sector is undergoing profound changes. More details could be found in the “Our Conviction” section of this publication. Finally, our third investment theme is “Machine Learning.” This revolutionary technology is profoundly altering our experience of the world as computers develop their own algorithms. It has created a race for data, and for investors, a search for alpha in the market. Machine Learning is today an investable technology working to optimise portfolios and create investments and forecast models.

September to December 2019

Friday, 02/21/2020In an environment where most asset classes went up, the hedge fund industry had one of its best years in a decade. Most strategies were up, except for macro systematic managers who struggled to read the markets with their fundamental models. For equity market neutral funds, it was a positive but difficult year, mainly due to more frequent factor rotations and short squeezes.

- Hedge funds had one of their best years in a decade

- Most strategies were up, except for macro systematic managers

- Asset prices reached new all-time highs

- Convertible arbitrage should benefit from higher volatility to come

- A new era of corporate activity in Japan brings opportunities

The situation so far

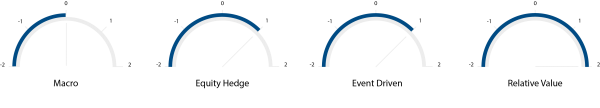

Macro

From September to December 2019, Macro managers posted negative performances overall. Small managers detracted more than larger ones, counterbalancing the trend so far this year.

The worst performers were systematic funds, particularly in the first half of the period, before slightly rebounding. They were mainly hurt by short-term positions and trading around names in rallying bonds and equity markets coupled with rather muted volatility.

Discretionary managers did better and only had a minor correction mid-period. The bulk of their profits came late in the period, mainly from fixed income relative value and equities trading.

Trend followers lost money over the period, particularly in the first half as they failed to capture the effects of most global 10-year sovereign bond yields edging higher as US-China trade worries remained. They were holding long bond positions.

Our outlook

We expect more volatile markets which should be supportive for discretionary macro and short-term systematic macro managers. A choppier market may be harder to navigate for medium to long term trend followers.

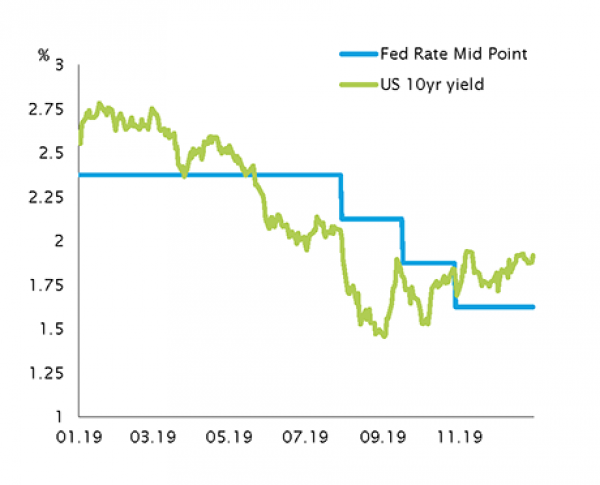

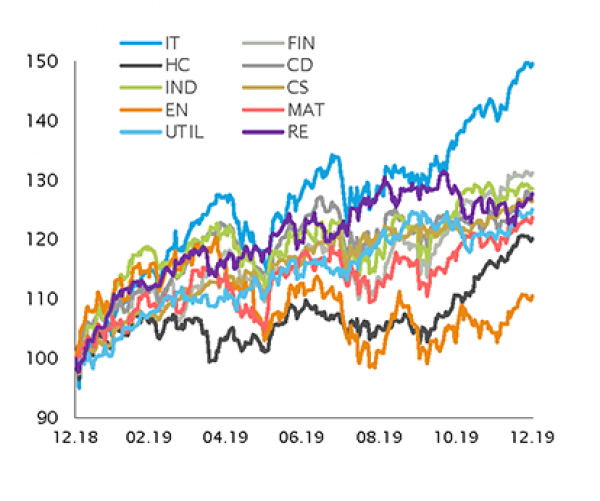

Equity hedge

During the period under review, equity markets rallied double digits in most regions with dispersion across sectors. Persistent style rotations were also a characteristic in the period, helping Financials be a top performer. Despite global short-term rate cuts, the US 10-year yield went back up from 1.5% to almost 2%, thus causing underperformance in bond-proxy sectors like utilities, real estate and consumer staples.

Directional funds with higher net exposures outperformed, broadly speaking, those with lower nets. However, sharp rotations from growth to value stocks caused alpha to be lower for some managers in the space. This also caused a headache for market neutral managers who tended to be long growth and short value, posting flat to negative performance from September to the end of the year.

It comes as no surprise that in these last 4 months of rallying equities equity hedge managers have increased their leverage.

Our outlook

We remain cautious on equity markets into 2020 after 2019 showed returns not seen for over half a decade. Political tensions surrounding US-China trade and recently between the US and Iran, as well as continued uncertainty regarding Brexit, provide the grounds for our prudent stance.

Event driven

In the last four months of the year, event-driven strategies posted disparate performances in an environment of rallying equity markets. Some strategies struggled a bit, like distressed/restructuring funds, while others posted performances close to that of equity indices.

Activism was the top performing strategy in the space, as managers, who tend to hold highly concentrated and net long exposures to equities, captured a good portion of the equity rally. Activists were particularly exposed to top performing sectors in the period such as IT and financials.

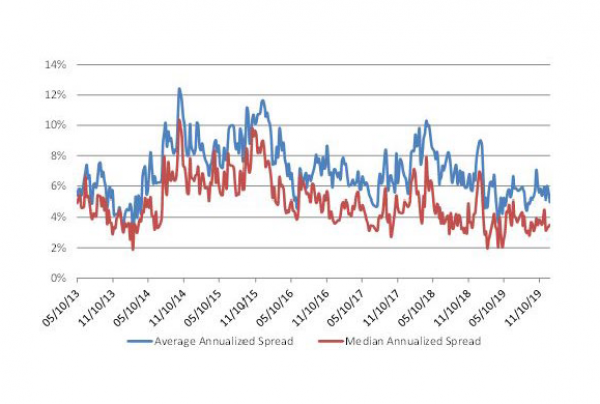

Merger arbitrageurs posted satisfactory performance over the period, despite extremely tight spreads. The situation was worse for non-USD managers due to the high cost of financing. Global M&A deal flow slowed down toward the end of the year and stabilized at a respectable level.

Our outlook

Despite renewed optimism apparent in the CEO Confidence Index, levels remain close to those of the pre-Trump era. We think there are no particular reasons the global transaction landscape to improve given the few changes in the trade war outlook, with the exception of financing that has recently become cheaper. We see opportunities in Japan, where Prime Minister Abe helped to embrace corporate change after years of lethargy.

Relative value

Over the last four months of 2019, relative value managers made money, wiping out overall muted-to-negative performances in the middle of the year and boosting the good ones in the first few months.

In early September, multi-portfolio managers’ platforms were hurt by style rotations, namely from growth to value stocks.

Also early in the period covered by this publication, interest rate arbitrageurs were impacted by their basis trade books after a repo squeeze in the market, although they were later fueled by the increase in rate volatility that boosted their returns.

Volatility arbitrageurs managed to profit from the volatility caused by the above events. Managers who focus only on equity volatility struggled during the period.

Despite low equity market volatility, convertible arbitrage managers benefited from stock-specific movement. They also gained profits from a robust new issuance market.

Our outlook

We continue to favor convertible arbitrage as it can take advantage of more volatile environments while maintaining its position in the equity market. This strategy is also backed by a favorable corporate action pipeline and improved US new issuances, thanks to a new tax law.

Our convictions

We have recently witnessed that the corporate governance landscape has evolved in Japan over the last few years in favor of corporate activity.

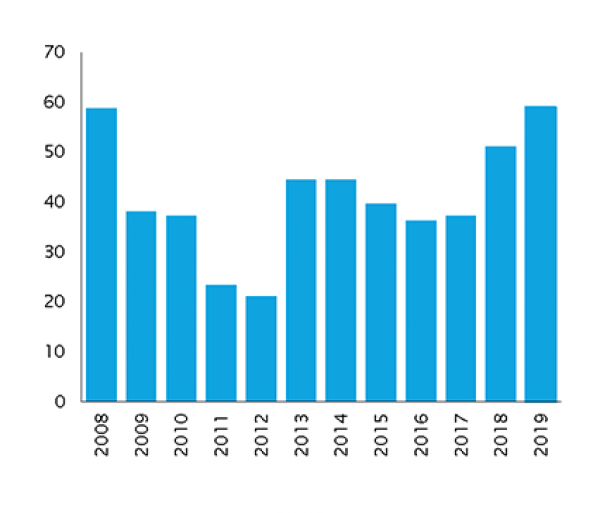

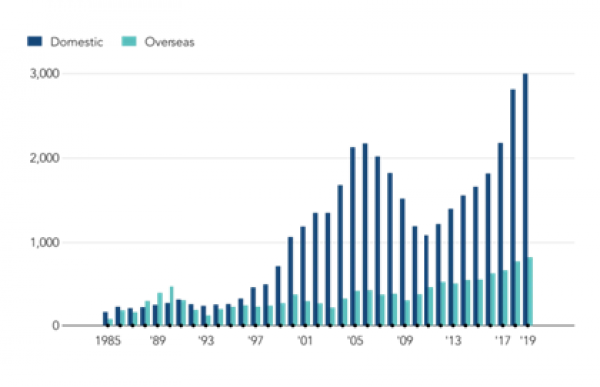

After many years of lethargy and rigid behavior among CEOs in Japan, the number and pace of corporate changes in Japan has drastically evolved as seen in the chart below. As part of the Abenomics package, the Japanese government now encourages shareholder engagement and pushes companies to improve return on equity and corporate governance. These improvements in corporate governance have led to an acceleration of subsidiary takeover bids by takeover companies, led by the Hitachi Group and other major companies. Fueled by activist shareholders refusing to accept the stagnation of the past, major corporate events including hostile takeovers, contested bids, corporate restructurings and friendly mergers are now a common occurrence in Japan.

In the third quarter of 2019, Japan’s Ministry of Finance released an amendment to the Foreign Exchange and Foreign Trade Act in an effort to protect Japan’s assets from other countries. The initial decision was to decrease the ownership threshold above which foreign investors in Japan would require pre-acquisition notification for investments in key industries. After complaints from hedge funds and other foreign investors, Japan’s Ministry of Finance decided to make a few exceptions and exempt foreign financial institutions, a category that includes foreign hedge funds.

We believe this is the right time to play the Japan theme. In our portfolios, we are in the process of implementing a new position in a Japan market neutral fund with a catalyst approach. We are also reinforcing our conviction in a Japan multi-strategy fund with an activist approach as we believe these strategies will be able to profit from opportunities in this new era of corporate activity in Japan.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)