The Turkish lira crisis and limited contagion in vulnerable emerging market (EM) assets have not derailed the overall supportive economic backdrop. This is especially true for developed markets and the US economy: growth, inflation and monetary policy dynamics have not changed and will stay constant, as long as the EM crisis remains contained to a few structurally flawed economies – which is our base case scenario. As a result, despite the rout in several EM assets, ongoing trade tariff tensions and concerns about the Italian budget, we are maintaining a pro-risk stance, still favouring well-insulated US equities, which were at the heart of our risk preference increase in June.

While it could be tempting at this stage to increase duration, in order to hedge – or at least mitigate – risk in the portfolio, the decorrelation benefits are currently quite meagre. As long as the global picture remains unchanged – growth and inflation are not expected to nose dive – it would be wiser to directly decrease the risk within the portfolios. Given current valuations and our economic analysis, the path of least resistance for rates is still tilted to the upside. Our duration stance was thus kept as a mild disinclination.

Markets have been challenging this year; equity performances within the NASDAQ were extremely divergent – with a few emblematic stocks reaping all the rewards – while the rest of developed markets are struggling and several EMs are even experiencing bear markets. Stein’s Law, which states ‘if something cannot go on forever, it will stop’, applies to this phenomenon. Thus, we need to have an idea of if and when the rest of global equities will catch up to the US, or rather if the NASDAQ will close the gap. Our economic cycle, asset valuation and risk balancing committees favour the latter suggestion: a rebalancing towards value over growth should happen before year-end.

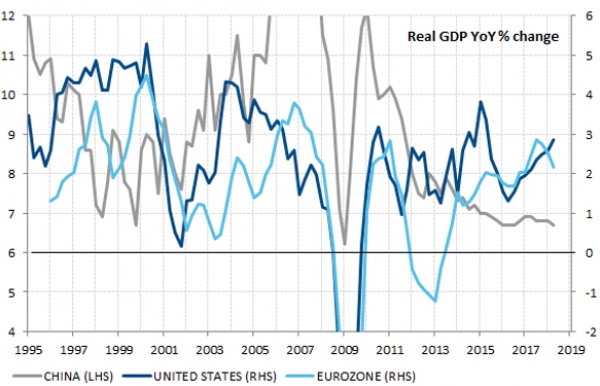

As far as the catalyst is concerned, and to answer the ‘when’ question, this will only be once we see less divergence in growth, inflation and monetary policy dynamics across major economies. Once investors are convinced growth in Europe and China is bottoming out and US growth will not accelerate further, or once the Fed approaches neutral rates and the ECB and BOJ become less dovish, laggards should start to outperform current market cheerleaders. If we are proved right, US dollar strength should end, lifting price and sentiment across the world – to the detriment of current optimism around the US technology sector.

_Fabrizio Quirighetti