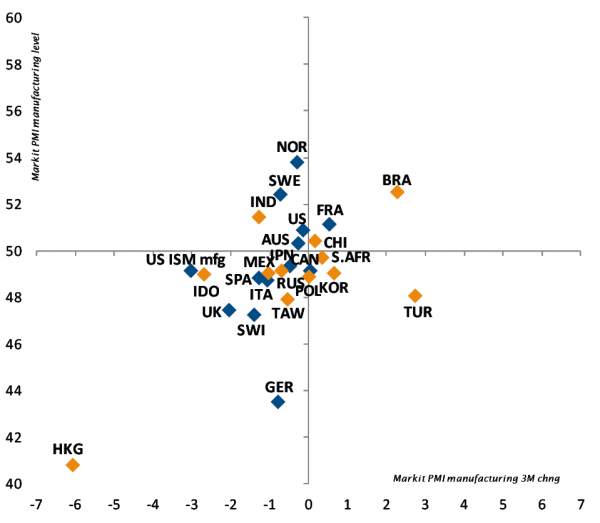

The back-to-school season has been pretty eventful but has not provided much more clarity on the macroeconomic situation. The jury is still out on whether the continuing decline in industrial activity will ultimately drag the global economy into some form of recession, or if household consumption and the support of central banks will keep growth afloat in the coming months.

A few additional layers of uncertainties may even have appeared in the recent weeks. Firstly, investors have been reminded of the highly volatile situation in the Middle East and the sensitivity of energy prices to geopolitical developments in the region.

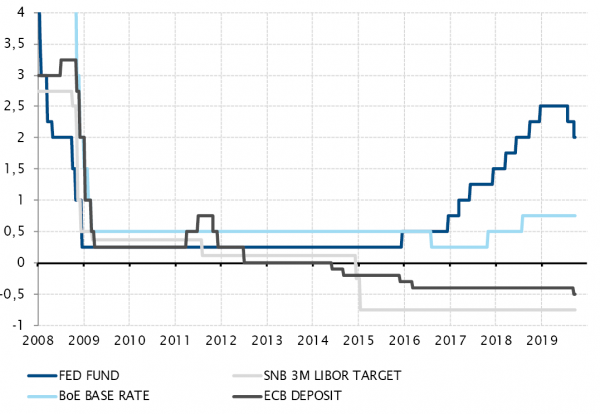

Secondly, while the Fed and the ECB both unsurprisingly announced additional steps to ease credit conditions, unusual dissensions appeared within the two institutions on the merits of these actions. A significant number of members from either institution were openly against the decisions taken in September, to the point of triggering the resignation of one member of the ECB Governing Council, and two official votes being cast against the rate cut among the 10 voting members of the Fed. The vagueness surrounding the economic outlook has led to cracks in the prevailing consensus on the need to use monetary policy to respond to low growth and inflation.

Another consensus of the past decade is being increasingly challenged: fiscal balancing. A growing chorus of voices is calling for a more active use of fiscal policy, especially in the context of (very) low rates for a (very) long time. From fiscally orthodox Germany to the Brexit-plagued UK, from early US presidential campaign debates to Japan, the debate over public spending is gaining more focus as a potential solution to address slowing economic growth, growing inequalities and environmental issues.

The outlook is by definition uncertain and the very essence of investment. Human nature (and good year-to-date performance) may currently render investors more sensitive to very real negative news and downside risks: continuing slump in industrial activity, tentative “hawkish” rebellions within central banks, geopolitical risks… But the resilience of final demand in developed economies, low rates, potential support of fiscal policy, and the fact that financial market prices already point to a significant economic weakness should not be discarded. For now, this situation still warrants maintaining a balanced positioning in portfolios. A thin line to walk, for sure, but possibly the only way to avoid being wrong-footed when the outlook eventually becomes less uncertain.

_Adrien Pichoud