The Great Recession of 2007-2008 and the ensuing debt crisis of 2011-2012 have pushed the euro area to Mordor and a "no future" economic land locked in a weak growth environment, plagued by high unemployment, mounting bad loans and lack of reforms. Dark clouds have been so persistent over the euro area that populism and political backlash raised to a point where the probability of disintegration has recently moved to a very likely event. It was especially frightening as this danger was coming from France, one of the founding members of the European project, which (re)conciliates both peripheral and core characteristics. In other words, the dark night was nigh despite Gandalf-Draghi doing whatever it took to avoid the worst.

Fortunately, like a good Hollywood movie, there has been a sudden and almost unbelievable turnaround which has brought a new wind of hope and freshness: according to the outcome of the first round of French presidential elections, the unknown Frodo-Macron is likely to be the next President. It’s like there was suddenly light at the end of the tunnel and with a clear and almost blue sky, investors are realizing that the economic outlook of the euro area isn’t as dark as previously perceived. Indeed, real GDP growth is currently running at around 2% –a level not seen since the short term recovery of 2010 – which is comparable, if not better, than the performance of the US market and is clearly higher than its potential – estimated around 1%. Moreover, there is a pent-up demand as unemployment rates should continue to fall from extremely high levels. The situation regarding bad loans should improve with a rising nominal growth tide, and a welcome dose of hope and reforms may jump start moribund investments by both domestic and foreigners companies.

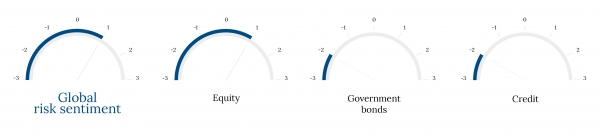

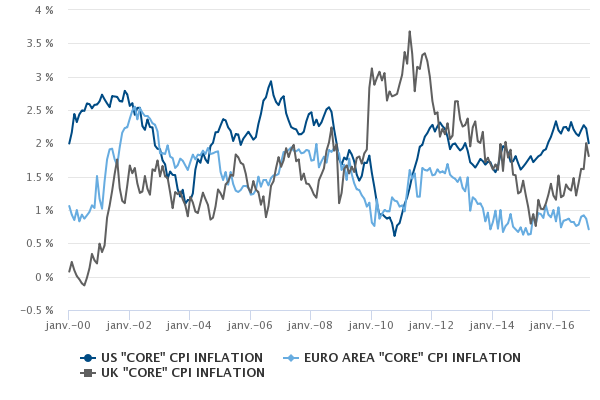

In summary, the European recovery is quite new (and somewhat unexpected) compared to the eight consecutive years of expansion for the US economy. Trumpenomics and reflation hopes are already starting to fade away, while Macron may now be seen as the saviour who resuscitates the euro and the French’s splendour. As a result, we believe it’s now time to reload some risk in the portfolios and more specifically in European equities, which benefits from relatively interesting valuations and should thus attract significant foreign flows which had deserted markets in the last few years. Our duration stance has been downgraded slightly as there is now upward risk to German rates if investors start to price in a European tapering. We are still in a global scenario similar to Japan’s lost decades, at least as long as any meaningfully socio-economic-political reforms have been implemented. Europe is currently heading towards the top of the band’s range while US is probably already moving down. If we are right, US Treasuries are to be the "least worst" place to be in the govies space and the strong US dollar era is certainly behind us.

_Fabrizio Quirighetti