Let’s be honest: of the potential risks in 2020, we cannot pretend we had identified the outbreak of a new bat-transmitted virus that would cripple the world’s most dynamic economic area for weeks… But here we are, and beyond the sadness of the death toll and the dramatic impact on millions of people’s lives, we are left trying to assess the impact of this outbreak on the global economy and financial markets.

This unexpected development raises several unanswered questions: how long will it take before the virus’s spread is curbed in China, Asia and in the rest of the world? How long will safety measures hinder economic activity? What will be the magnitude and duration of the impact on economic activity, e.g., consumption, investment, corporate results? The answers to these questions ranges anywhere from “relatively quick and benign” to “long and significant”, and currently it is impossible in our to have any certainty about them.

However, there are several elements that we do know, and which we can rely on when forming a view. First, before the virus outbreak, the global economy was still improving, extending the encouraging trend of Q4 last year. Therefore there was positive economic momentum when the virus crisis erupted. Second, China will use all possible economic levers to soften the blow to its economy. To a lesser extent, all central banks around the developed and emerging world are likely to maintain or even reinforce their general supportive stance in 2020. Finally, household consumption, the main driver of GDP growth in developed economies, remains supported by low and declining unemployment, rising asset prices and cheap credit. Given that these elements are all positive, they will contain or mitigate the impact of the virus outbreak on global economic activity.

Add to this mix a confused start to the US Democratic Party Primary, thus lowering the risk of electing a “market unfriendly” president, and it creates an environment where supportive “knowns” balance unknown potential downside risks, as far as we know, at least. Therefore, at this stage, we maintain our constructive views on risk assets, remain exposed to Chinese equities and reinforcer our allocation of US equities based on the strength of the US economy and the implicit support of the Fed. We also maintain our positive view on bonds and duration, which still offer value in a world of very low or negative cash rates, and bring diversification in portfolios in the event of a further deterioration of the global situation.

Our monthly view on asset allocation (March 2020)

Thursday, 02/20/2020Let’s be honest: of the potential risks in 2020, we cannot pretend we had identified the outbreak of a new bat-transmitted virus that would cripple the world’s most dynamic economic area for weeks… But here we are, and beyond the sadness of the death toll and the dramatic impact on millions of people’s lives, we are left trying to assess the impact of this outbreak on the global economy and financial markets.

The “known” counter balance the “unknown” for now

Economic backdrop in a nutshell and global economic review and summary

Developed economies

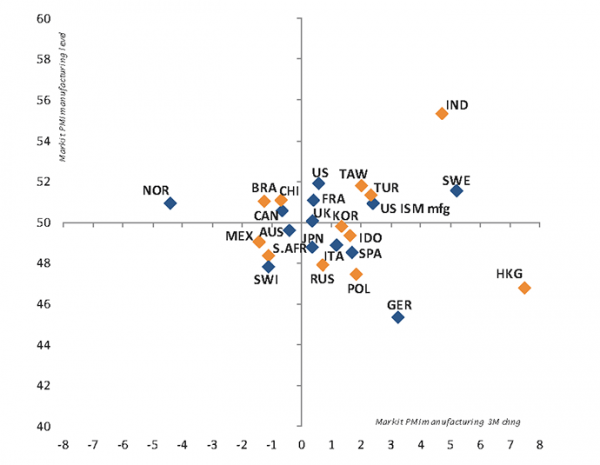

The coronavirus outbreak obviously raises uncertainties on the global growth outlook, and poses downside risks to the encouraging dynamic at play since last autumn.

Before having tangible elements and data on the extent of the impact, the US economy was still on a path of slightly-above-potential expansion, supported by robust consumption and domestic demand, and a pickup in industrial activity indicators. The widely watched gauge of industrial activity, the ISM Manufacturing Index, bounced up from a 4-year low in January, signaling a resumption of the expansion in the sector after 5 months in the contraction zone. The economy continues to create jobs (225k in January) and consumer confidence is close to cyclical highs. As subdued inflation and coronavirus downside risks will likely keep the Fed on the cautious/accommodative side, monetary policy should favor economic growth in this election year, provided the virus outbreak doesn’t affect supply chains, travel and activity for too long.

This analysis may also apply to Europe, although the Eurozone’s situation is more fragile as it experienced a pronounced slowdown last year and several key sectors are very linked to China’s demand (carmakers, luxury goods…). The sensitivity of Eurozone’s economic activity to the coronavirus economic impact is therefore important, even if consumer confidence and domestic consumption still hold firm for the moment. The UK is experiencing some form of “relief recovery” after the dissipation of political uncertainties and the prospect of a significant fiscal stimulus to be announced in the spring. The SNB has had to face the strengthening CHF without really being able to react after it formally came under US watch for currency intervention.

In developed Asia, growth dynamics were mild but positive in Japan and in Australia, but the virus outbreak is likely to have at least a temporary negative impact on economic activity during Q1.

There are several elements that we know, and on which we can rely when forming a view.

Emerging economies

All countries in Asia will experience a slowdown over Q1 as the coronavirus outbreak and the resulting travel restrictions, supply chain disruptions and precautionary measures will significantly impact economic activity. Obviously, since China is at the center of the outbreak it is likely to get hit the most, but all South-East Asian economies will be affected. It is difficult at the moment to estimate how deep and for how long the impact will be felt, but February and March economic data will help assess the situation.

Among the large emerging economies, India stands out as displaying strong economic growth. Being largely domestic-oriented, it may not be excessively impacted by the coronavirus outbreak and might continue to thrive in the months ahead, bolstered by supportive economic policies.

_Adrien Pichoud

Asset Valuation & Investment Strategy Group Review

Risk and duration

The risk preference was left unchanged at “mild preference”. The potential impact of even a severe and sustained lockdown of large parts of the Chinese economy doesn’t appear sufficient to trigger or bring back global recession concerns at this stage. While a large-scale global spread of COVID-19 cannot be totally ruled out, the most likely scenario is one of a V-shaped rebound in Chinese and Asian activity after a temporary sharp drop.

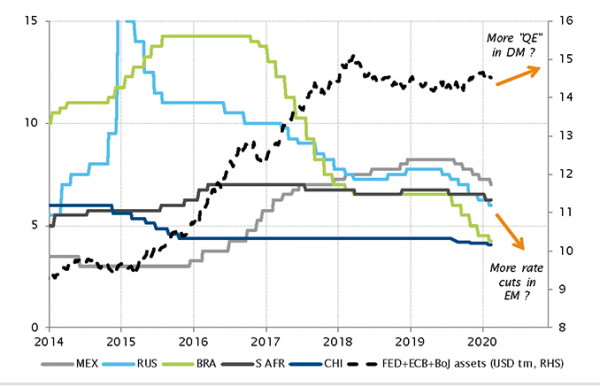

Moreover, the monetary policy easing put in place in China and across most emerging market central banks (and if necessary, in developed markets, too) will nevertheless provide support and liquidity in the months ahead.

Therefore, our constructive scenario for global growth might experience a pause in the coming months with the resumption of a positive trend postponed towards the second half of the year.

On the duration front, our preference was also left unchanged at “mild preference”. Raising the duration level last month helped to mitigate the volatility of equity markets. But in this new “coronavirus” context, some exposure to duration is still a useful diversifier to hedge against risky assets. Even though valuations are more expensive than one month ago, they can be warranted as monetary policy expectations, central bank actions and their communications have been further tilted toward the dovish side.

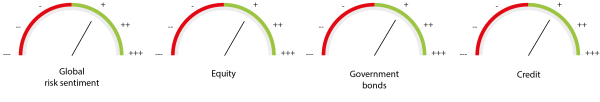

The risk and duration stance has been kept unchanged at mild preference but US equities have been upgraded at the same preference level as Chinese equities.

Equity

Following the initial coronavirus outbreak, the equity market correction was rapidly offset by a rebound.

In this context, we did not bring any changes in the geographical allocation apart from upgrading the United States to “preference” on a par with China, making both markets our two top preferences.

The enhanced preference for US equities at valuations that are certainly not cheap but cannot be considered as outrageously expensive, either, is based on: (a) the resilience of the macroeconomic momentum of the US economy, (b) the support of the Fed’s accommodative monetary policy reinforced by the coronavirus outburst and (c) the now elevated probability of Trump’s re-election, which would be perceived positively by markets.

Finally, we chose to maintain our positive stance towards Chinese equity markets. We believe that there is no reason to give up now as valuations have become even more attractive and a significant monetary and fiscal stimulus may well be on the horizon.

Bond markets

We maintain a positive bias (“mild preference”) toward government bonds and credit as both are supported essentially by attractive relative valuation vs. cash, especially in EUR (and CHF).

We keep a “mild disinclination” score for emerging market debt (hard and local currency) with valuations being in the expensive camp. We therefore favour taking on emerging market exposure in a multi asset portfolio through equities rather than debt in the current environment. Nevertheless, on a standalone basis, emerging market debt is still likely to deliver positive total returns.

Moreover, in the emerging market debt local space, we raised our preference for Russia and Indonesia to “mild preference” along with Mexico and Poland. Overall valuation levels and the potential for some further rate cuts are supporting those markets.

Forex

The British pound is still scored at “mild preference” after last year’s rather positive Brexit developments.

Gold remains the preferred alternative currency for the diversification it brings into portfolios (scored at “mild preference”).

The US dollar is favoured over the euro despite the greenback’s higher valuation since it offers a better growth outlook and especially a positive yield differential.

Finally, the Japanese yen is ranked at “mild preference” for its diversifier characteristic in a risk-off environment.

_Maurice Harari

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)