Here we go again – the desperate hunt for yield is back. In a world with more than $13trn of negative-yielding debt, and where holding cash in developed market (DM) currencies is punitive, there is no alternative (TINA).

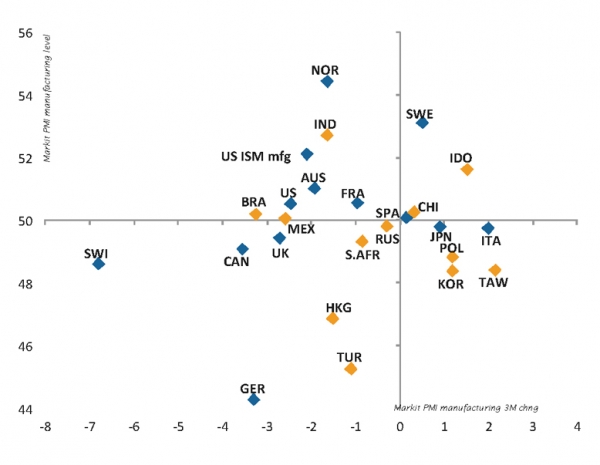

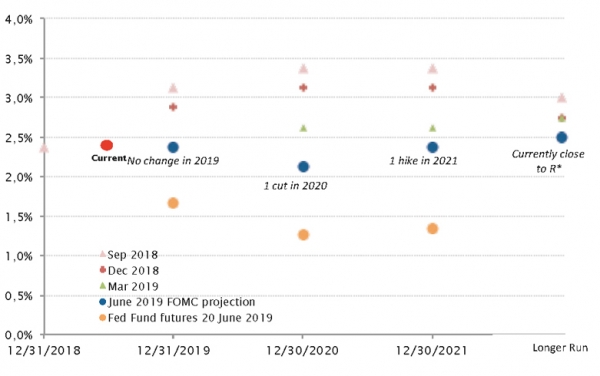

This is courtesy of ultra-dovish DM central bankers who will do whatever they can to jump-start nominal growth. We do not underestimate their creativity, but we are challenging the efficiency of low rates and unconventional measures for economic growth and inflation. Unfortunately, lower rates do not mean more nominal growth, as the key issues are structural. Slowing growth and inflation coupled with rising debt is not a new trend. Low rates are not the remedy, but merely a way to extend and pretend.

A report from the BIS found 12% of publicly listed companies around the world can already be described as zombie firms – where earnings do not cover interest payments. Not yet convinced? Think about Italian government debt or unfunded liabilities around the world, or just ask a Japanese central banker.

So, let’s be pragmatic about our current positioning, which can be summed up as keeping a low-to-moderate equity beta and reloading debt carry. Equity markets are stuck in a certain range, where they are now more prone to further volatility than gains. The Fed will perhaps not deliver as much as is priced in this summer, and earnings growth will likely continue to disappoint, as downside risks to growth materialise.

As far as the fixed income allocation and duration stance is concerned, our message is stay invested, keep a certain level of duration, favour emerging market (EM) debt and add to European credit. Rates are negative on Germany and France government bonds, as well as on 5Y Spain and Portugal bonds. Furthermore, European spread valuations remain quite attractive, and investment grade credit could be the target of the ECB’s next round of QE.

In this context of low rates, it still makes sense to lean into growth stocks – in the technology sector – scour EMs for opportunities and stay exposed to high quality investments offering resilient and stable income streams.

Last but not least, we still like the Japanese yen and gold as diversifiers. The ‘barbarous relic’ is coming back into favour as the credibility of central bankers, and thus fiat money, will continue to be challenged going forward. Markets have suddenly realised the US economy is just one recession away of falling into the same liquidity trap as Japan and Europe, meaning even cash rates in US dollar may cross the Rubicon in a not so distant future.

_Fabrizio Quirighetti