2020 has started the way last year ended: with investors’ unabated appetite for equities and credit spreads in a seemingly frantic quest for return and yield. The combination of positive economic dynamics and supporting monetary policies continues to create very favorable conditions for investment and several potential risks have seemingly vanished: at the end of the day, no recession, no trade war escalation, no messy Brexit, no monetary policy tightening… In such a context, even a sudden (and, in the end, short-lived) spike in geopolitical tensions was unable to spook markets. US and even European equity markets keep climbing to new all time highs, demand for credit on the primary market keeps hitting records and EM assets continue to rally. What a start to the year!

Let’s be clear: we think that this optimism is largely warranted and we continue to think that 2020 will be a positive year for equities and credit. Global growth likely troughed at the end of last summer after two years of slowdown and monetary easing policies at the central banks of developed and emerging economies. One shouldn’t be surprised that low rates and positive prospects for economic and earning growth fuel investors’ appetite for risk!

In this context, however, paying close attention to asset valuations is useful for translating macroeconomic views into portfolios. Equity valuations are not outrageously expensive on our assessment, but they certainly have become less attractive recently, and some earning growth confirmation is now necessary to sustain the upward trend. As a result, while we maintain our constructive view on risk assets, we refrain from further increasing equity exposure for now, except for China, where valuations are still attractive. Conversely, while declining downside risks to growth warranted a reduced exposure to long term bonds at the end of last year, this month gradually improving valuations have led us to raise our exposure to duration. Higher rate levels, even if not high in absolute terms, and positive yield curvesbring value to long term bonds in USD and EUR, with prospects of performance contribution and diversification.

In the context of Japanification, identifying mini-cycles is key and, from that angle, 2020 still looks essentially supportive for equities. Still, investing in assets with improved valuations is also key to navigating the compressed economic cycles and managing overall market volatility while staying invested.

Our monthly view on asset allocation (February 2020)

Friday, 02/07/20202020 has started the way last year ended: with investors’ unabated appetite for equities and credit spreads in a seemingly frantic quest for return and yield. The combination of positive economic dynamics and supporting monetary policies continues to create very favorable conditions for investment and several potential risks have seemingly vanished: at the end of the day, no recession, no trade war escalation, no messy Brexit, no monetary policy tightening… In such a context, even a sudden (and, in the end, short-lived) spike in geopolitical tensions was unable to spook markets. US and even European equity markets keep climbing to new all time highs, demand for credit on the primary market keeps hitting records and EM assets continue to rally. What a start to the year!

Grab valuations’ opportunities

Economic backdrop in a nutshell and global economic review and summary

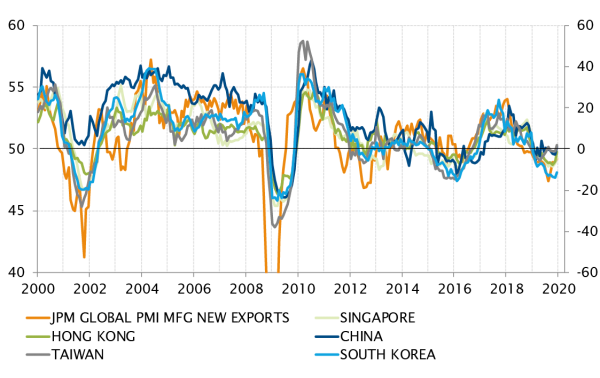

Encouraging signs of a global cyclical improvement have been confirmed by the economic data of the last weeks of 2019. In hindsight, the global economy likely troughed in the middle of H2 2019 and now looks set to experience a synchronized pick-up in growth momentum. This pick-up is possibly most visible across South East Asia, which benefits most from the combination of receding trade tensions between the US and China, and targeted economic policy easing in China. However, export-driven economies like South Korea, China or Taiwan would not enjoy this reversal without the resilience of final domestic demand in developed economies. US & European consumers have maintained a steady pace of spending that now warrants unleashing the capex retained last year due to elevated trade uncertainties.

As such, the industrial sector is regaining color and driving a rebound in GDP growth rates across most large economies. They are due to grind higher toward, and possibly slightly above, respective potential growth rates. Nothing spectacular given demographic and productivity trends, but a better environment than the slowdown experienced in 2018 and 2019.

Growth

Global growth will likely rebound in 2020 after having recorded its slowest year in 10 years in 2019. The pickup is likely to be most visible in the most “cyclical” economies and sectors, the ones that have been most under pressure during the past two years’ slowdown.

Inflation

As the world experiences Japanification, upward inflationary pressures are rare. Although the expected positive growth trend should support a reversal in the downward inflation trend in several economies, one shouldn’t expect a significant inflation acceleration in 2020. Structural headwinds such as technologies and high debt are still there to contain pricing pressures.

Monetary policy stance

2019 was a year of global monetary policy easing. Credit conditions are now accommodative across most developed economies, and in several large emerging economies. This year, 2020 will likely see stable monetary conditions without any need for additional easing as growth picks up. Nevertheless, there is no reason to reverse course and hike up rates again in the absence of effective inflationary pressures.

Global economic review

Developed economies

Despite a surprising drop in the ISM manufacturing index, the US economy remains on a steady path of growth, slightly above its long term potential of 1.8%. Having been one of the few large economies to barely slow down in 2019, it has little potential for a significant reacceleration but its main driver, household consumption, remains supported by low unemployment, a buoyant real estate market and cheap credit. A rather favorable backdrop as the Presidential campaign starts to really warm up.

The Eurozone also benefits from reduced uncertainties regarding global trade and Brexit. However, for the time being this translates more into a stabilization rather than a real rebound in industrial activity indicators. In the meantime, household consumption remains firm and maintains GDP growth while the Lagarde-led ECB sticks to its very accommodative stance. In the UK, recent indicators have suggested some further loss of steam but it might rather be the lagged impact of the Autumn’ Brexit uncertainties. Indeed, with the immediate no-deal Brexit risk out of the way and the solid majority held by Boris Johnson’s government that could give way to a significant fiscal spending plan, the prospects are quite encouraging for a growth recovery in 2020 for the UK.

The Japanese economy is stabilizing after the temporary volatility triggered by the VAT rate hike in October. In the meantime, Australia hasn’t experienced yet a resumption in economic momentum, possibly suffering from the wild-fire spillover.

This pick up is possibly most visible across South East Asia.

Emerging economies

Chinese economic data have been confirming a break in the 2-year slowdown trend with an uptick in manufacturing and services, positive surprises in retail sales and industrial production and GDP growth landing at 6% for 2019. Targeted monetary and fiscal policy easing, and the removal of trade-related uncertainties after the signing of the Phase 1 deal, support an encouraging outlook for China and the region, as the resumption of the export and trade cycle also benefits South Korea, Taiwan etc.

_Adrien Pichoud

Asset Valuation & Investment Strategy Group Review

Risk and duration

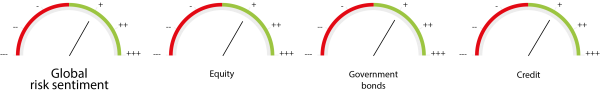

The risk preference was left unchanged at “mild preference” as we maintain a constructive view on risky assets.

The central economic scenario remains positive with rather encouraging economic trends, especially in Asia, on the one hand, and still accommodative monetary policies across the globe, on the other.

In terms of valuation levels, no asset has absolute cheap or attractive valuations, but in relative terms (based on our Equity Risk Premium framework) we find that equities offer better value compared to government bonds or corporate credit.

Moreover, if the economic rebound gets confirmed in the coming months, it will support earnings growth and appetite for equities, on the back of absolute improved valuation levels and also from a relative value angle in an environment with still accommodative monetary policies and low interest rates.

The duration scoring was raised at the same level as the risk level (i.e. «mild preference).

Valuation of nominal government bonds have improved from their expensive levels last quarter. At the same time US dollar and euro yield curves now exhibit some positive steepness that makes long term bonds more attractive than cash again.

On the inflation front, pressures remain very mild or non existent across the board with a limited risk of accelerating in the months ahead coupled with central banks (especially the Fed and the ECB) maintaining accommodative monetary policies in 2020 with limited risk of rate hikes.

Also, at current interest rate levels duration exposure can provide a useful hedge in case of an unexpected spike in volatility while adding diversification with downside protection.

The risk stance has been kept unchanged at “mild preference” while duration was upgraded at the same level as the risk following the latest repricing of long term interest rates with the aim of bringing some diversification effect to portfolios.

Equity and bond markets

No change in the geographical allocation of the equity part, even if valuations have generally deteriorated yet still offer more value in relative terms compared to bonds.

In terms of equity allocation, we maintain a preference for emerging market (especially China) equities and also a mix between growth and cyclicals. In this context, we placed Mexican equities back at “mild preference,” in line with the overall emerging market region score.

In the bond asset allocation, we upgraded nominal government bonds to “mild preference” (same level as linkers) on the back of better valuations.

We are still constructive on credit (investment grade, high yield and subordinated debt) and emerging markets (local bonds upgraded to “mild disinclination”).

Forex

The British pound is still scored at “mild preference” after the latest rather positive Brexit developments.

Gold remains the preferred alternative currency for the diversification it offers a portfolio and (scored at “mild preference”).

The US dollar is favoured to the euro not only because of the greenback’s higher valuation, but also that it offers a better growth outlook and especially a positive yield differential.

Finally, the Japanese yen is ranked at “mild preference” for its diversifier characteristic in a risk-off environment.

_Maurice Harari

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)