The resumption of talks between the US and China, declining political risk in the UK and a third Fed rate cut in four months have supported another leg up in equity markets. This movement should probably be seen as a reversal of the insidious pessimism that developed throughout the summer, when the fear of recession was growing amid tariff escalation, weaker economic data and US yield curve inversion. As this fear has receded, equities and long-term interest rates have logically adjusted upward and now appear more in line with a scenario of global growth stabilization at a low but positive level.

Now the question is: what’s next? Is there still some upside potential for equity markets after the recent rally and strong 2019 performance? We believe those year-to-date performances have to be taken with a pinch of salt: the fact that the last significant correction on equity markets coincided exactly with the end of the year in 2018 gives a somewhat misleading impression that should be balanced by a few facts. At the beginning of October this year, the US equity market was up almost 20% in 2019… but was almost flat over 12 months. At the end of November 2019, the annualized performance of the US equity market over the past two years was just above 10%, similar to the average annualized EPS growth over the same period (even if momentum slowed in 2019). And putting the US aside, no major equity market has yet reached a new historical high this year.

Given this context, we maintain a constructive view on equity markets. We acknowledge that valuations are no longer as cheap as they were throughout the summer, but neither are they expensive in a world of ultra-low interest rates. Since monetary policies will remain very accommodative and bond yields very low, equities continue to offer the most compelling relative value across traditional asset classes as long as global economic momentum picks up next year as we expect. Of course, there may be some volatility and pullback at any time, with any tweet, especially after the recent rally. We therefore maintain hedges in portfolios (long-term US Treasury, Gold, options). But as long as the supportive economic context prevails, the positive trend on equity markets seems to be there and we don’t want to fight it.

Our monthly view on asset allocation (December 2019)

Friday, 12/06/2019The resumption of talks between the US and China, declining political risk in the UK and a third Fed rate cut in four months have supported another leg up in equity markets. This movement should probably be seen as a reversal of the insidious pessimism that developed throughout the summer, when the fear of recession was growing amid tariff escalation, weaker economic data and US yield curve inversion. As this fear has receded, equities and long-term interest rates have logically adjusted upward and now appear more in line with a scenario of global growth stabilization at a low but positive level.

Don’t fight the trend

Economic backdrop in a nutshell and global economic review and summary

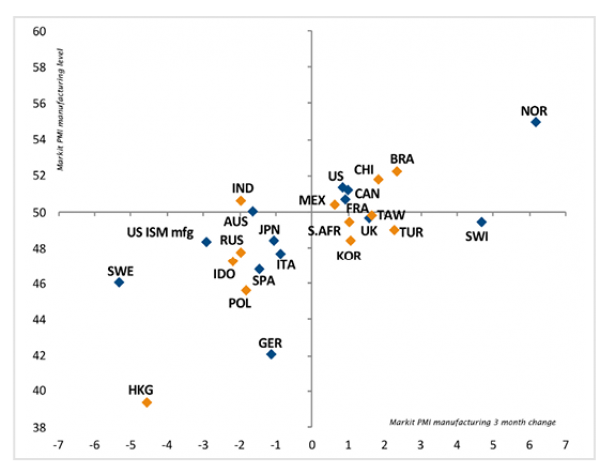

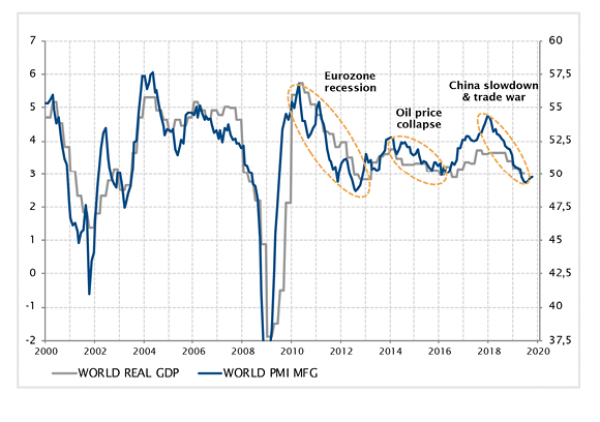

Some encouraging signs at last! Cyclical indicators finally picked up in the past few weeks after several months of decline, suggesting that the long-awaited global growth stabilization may finally be about to materialize. Indices of industrial activity and of economic confidence have indeed picked up in Europe and in the US as they already had in China since the end of the summer. The expected support from resilient domestic demand is the main driver of this stabilization, and recent progress on trade and Brexit have likely helped. As a result, the once-rising risk of a global recession in 2020 now appears to be receding.

Risks to the macroeconomic outlook remain tilted to the downside as the current soft level of GDP growth leaves the global economy quite vulnerable to an external shock, be it another twist in US/China discussions, some geopolitical event, a shock in energy prices or something else. But the mere fact that the so-far almost straight slowing dynamic is not extending further helps to support a constructive view for next year. Confirmation of this pickup in growth will be eagerly awaited in the coming months.

We might then look at the latest global growth slowdown as one more mini-cycle the world economy has been experiencing in the last decade, after the 2012 European-caused one and the 2015 oil price-driven one. This kind of mini-cycle may become a recurring characteristic of the increasingly Japanified global economy. In a world of low real and nominal growth, high debt levels, growing share of services in GDP and rising technology penetration, business cycles tend to become milder as the accumulation of excess capacity, subsequently followed by sharp adjustments causing “real” recessions, becomes much less likely. In such a framework, the world economy may well be on the verge of a mini-cycle of growth reacceleration.

Growth

GDP growth seems to be troughing in major economies and about to resume a mild positive dynamic that will bring back GDP growth toward or slightly above long-term potential.

Inflation

No change on that front. Inflation rates are still low in absolute terms and below the central bank’s target across the board. Market-based medium-term inflation expectations remain at an uncomfortably low level for central banks.

Monetary policy stance

The broad-based monetary easing trend witnessed in 2019 is coming to an end as cyclical momentum picks up. Central banks already run quite accommodative monetary policies and may no longer have a reason for easing them further. That said, it is too early to even think about reversal of the trend. We expect stable monetary policies in the major areas in 2020.

Global economic review

Developed economies

The US economy exhibited reassuring economic data last month after the soft patch of the previous months. Activity indicators rebounded both in the manufacturing and service sectors, job creations remained firm, confidence surveys marginally improved, providing a sense of growth resilience that was also corroborated by GDP growth around 2% in Q3. Amid persistently low inflation, the Fed delivered a third rate cut in four months to lower the Fed Fund rate to 1.75%, but also signaled that the mini-rate cut cycle was likely over unless economic conditions were to deteriorate significantly further.

Industrial activity indicators in the Eurozone and more generally across Europe rose, too, up from the worryingly low levels reached at the end of the summer. As domestic demand and activity in the service sector have remained firm, the dreaded prospect of a recession has somewhat receded. Spain was a likely temporary exception in this context, with a slowdown in activity likely to reflect political uncertainties around general elections and the impact of unrest in Catalonia.

Japanese economic indicators drifted lower as expected after the VAT rate increase, but this growth softness is likely to be only mild and temporary.

Emerging economies

The Chinese economy appears to stabilize at a sub-6% GDP growth level, with still mixed economic data but no longer a slowing trend. Targeted economic policy measures, and the likely de-escalation of trade tensions help to support activity, except in Hong Kong where protests continue to weigh heavily on economic activity.

While still strong, economic momentum is softening somewhat in Poland after the elections, as the impact of the pre-election fiscal stimulus is starting to fade away.

_Adrien Pichoud

Asset Valuation & Investment Strategy Group Review

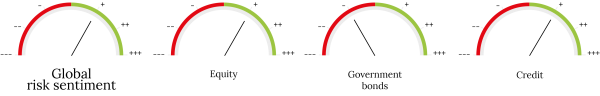

Risk and duration

The risk preference was left unchanged at “mild preference” as we maintain a constructive view on risky assets into the year end. The initial positive impact of the Brexit and US/China trade news last month are mostly priced in after the latest upward leg we saw in equity markets. Moreover, the recent encouraging developments on the economic front with some activity signs of stabilization in Europe and in the US warrant maintaining a positive stance with respect to risk assets. If this economic rebound is confirmed in the coming months, it will support earnings growth and appetite for equities on the back of absolute improved valuation levels as well as from a relative value angle in an environment with still accommodative monetary policies and low interest rates.

The duration scoring remained at “mild disinclination” due to a lack of inflation and somewhat dovish central banks. Encouraging signs on the macro-economic front suggest long-term government rates have some more upside potential (even if contained by the still mild growth and inflation outlook for 2020). However, from a valuation perspective, long-term government bonds are less expensive than a month ago and they continue to provide a useful diversification effect and downside protection. The combination of limited perceived downside risks and portfolio diversification dimension warrant maintaining this “mild disinclination” attitude for duration.

The risk stance has been kept unchanged at “mild preference” as we maintain a constructive view towards risky assets into the year end, taking into account the latest encouraging developments on the economic front especially in Europe and in the US.

Equity markets

No change in the geographical allocation of the equity portion of the portfolio even if valuations have generally deteriorated, they still offer relatively more value than bonds. Within the Eurozone, the French market stands out as quite attractive as the combination of structural reforms and some fiscal support feed through company earnings. In terms of sectors, US banks are deemed attractive while we stay away from European banks. Within the EM world, the Indian equity market continued to exhibit relatively expensive valuations, but still offers value from a portfolio construction perspective as it is diversifying and uncorrelated to other EM markets.

Bond markets

No change in the bond asset allocation. We continue to maintain a preference for inflation linked bonds over nominal government bonds due to the low breakeven levels. We are still constructive on investment-grade and high-yield credit, and our preference for EM hard currency debt over EM local currency remains valid.

The only adjustment was to upgrade French nominal government bonds to “mild disinclination” as long term rates rebounded to levels that are less outrageously expensive (offering now-positive yield curve slope vs EUR cash rates).

The downgrade of Turkey (local debt) last month was reversed as geopolitical tensions induced by Turkey’s intervention in Syria have significantly cooled down. We also raised our preference for Poland (local debt) to “mild preference”, as a few downside risks have been fading away and it offers an attractive alternative to EUR denominated ultra low yields.

Forex

The British pound is still scored at “mild preference” after the latest rather positive Brexit developments.

Gold remains the preferred alternative currency for the diversification it offers a portfolio and (scored at “mild preference”).

The US dollar is favoured to the euro not only because of the greenback’s higher valuation, but also that it offers a better growth outlook and especially a positive yield differential.

Finally, the Japanese yen is ranked at “mild preference” for its diversifier characteristic in a risk-off environment.

_Maurice Harari

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)