Suddently the global economy has been brought to an almost complete stop to try to contain the spread of Covid-19. Following measures taken in China and Asia’s two month ago, Europe and now the United States have also adopted lockdown measures of their own. The first available economic data reflect a brutal drop in activity, particularly visible in the service sector where social distancing has had its bluntest impact. Adding to the already long list of concerns and uncertainties, oil prices are falling to multi-decade lows amid tensions between Saudi Arabia and Russia, further increasing pressure on an already shaken industrial sector. Faced with this unprecedented combination of large supply and demand shocks, a swift and significant reduction in portfolio risks was warranted in March.

Central banks and governments have reacted very rapidly to try to minimize the impact of these shocks on the economy. We have witnessed rate cuts all over the globe, as well as the relaunch and expansion of asset purchase programs. Liquidity facilities have been deployed extensively by most central banks in order to prevent a gridlock of the financial system. In the meantime, governments have announced large budget programs that, beyond each country’s specificities, all have the same purpose: to minimize the potential damages of this sudden stop on productive capacities (i.e. prevent business shutdown and layoffs as much as possible), and provide support to households and businesses who will face a partial or total loss of revenues during the lockdown period.

As of now, there is no doubt that all major economies will experience a sharp decline in economic activity, a recession, from the end of Q1 till the beginning of Q2 at least. Beyond this, however, a high degree of uncertainty remains at all levels due to this unprecedented situation. We have now identified three key unknowns when it comes to financial markets:

- How long will this period of “global economy on pause” last?

Of course, this crisis is primarily a health crisis and the lockdown measures are designed to slow and contain the spread of the virus. Once the speed of propagation is seen as slowing down, or if cures are identified to help the health system to deal with this pandemic, the exit of the current situation will become possible, and with it the possibility to try assessing the cost and damages caused to the economies (which is virtually impossible at the moment).

- How efficient will large government programs be in mitigating the short-term economic impact?

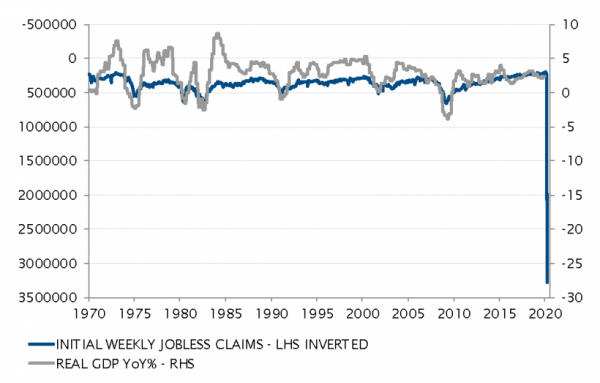

Large numbers and comprehensive measures have been announced but their success will depend on their implementation. For instance, how efficient will the US program be in limiting the unavoidable rise in unemployment rate and avoid reaching levels last seen 90 years ago in the Great Depression? The next few weeks might already provide some hints on that front.

- How much is already priced by financial markets currently in terms of economic and earning disruption?

Equity, credit and rate markets have all adjusted at an unprecedented speed in March, in a rush for liquidity that barely left any asset class(?) in positive territory.

It is too early to be able to answer these questions. The impact on the economy could be even larger than currently perceived, the pandemic could get even more out of control, fiscal and monetary policy measures could prove to be too little or ineffective in addressing a crisis that, unlike most historical precedents, didn’t start from within the financial system. Furthermore, financial markets may not yet have grasped the full extent of those possible damages. For all these reasons, maintaining the cautious stance that has characterized portfolios so far is still warranted, both on the equity and fixed income sides of the allocation.

However, after this initial large shock has passed, we have to acknowledge a few tangible elements. All scientists around the globe are now working relentlessly to identify all possible means of improving the testing process, deal with the symptoms and lower the pressure on the healthcare system, and ultimately discover a vaccine. All governments are now looking for realistic plans for the gradual and partial resumption of economic activity, while remaining committed to bearing the cost of the temporary lockdown. It is increasingly apparent that this situation of economic lockdown cannot be maintained for too long and that life (at the very least, economic life) will have to resume while the virus is still present at some point. Possible international cooperation (little visible so far) might improve the efficiency of this process.

For these reasons, and since equity markets have already discounted a significant part of the negative shock, it is no longer appropriate to maintain an excessively cautious positioning in portfolios. Starting to reduce the amplitude of the significant underweight in equity exposure is now warranted, even if portfolios remain clearly tilted defensively. Gradual, incremental steps designed to rebalance portfolio exposure and provide better participation on the upside can be made. For larger and more structural movements, we will need more clarity regarding the three unknowns outlined above.

_Adrien Pichoud