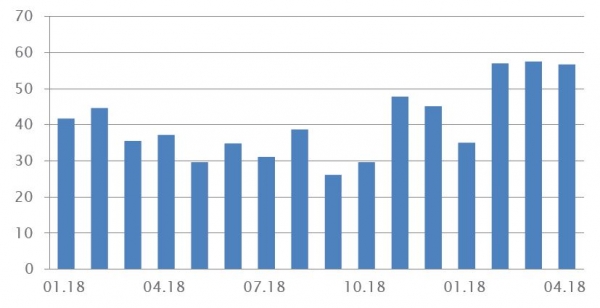

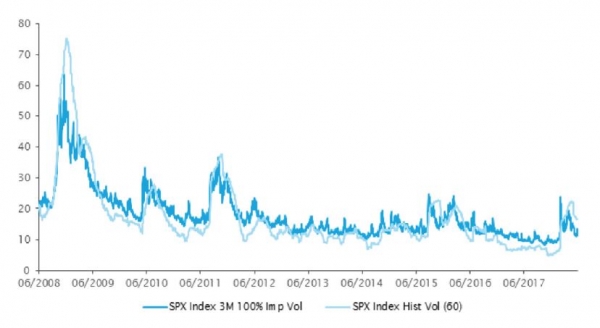

In the first four months of 2018 we have seen the return of volatility to the equity market. We expected a rise from last year’s abnormally low levels of volatility. The increase of the portfolios’ arbitrage allocation during 2017 was beneficial, mainly to Fixed Income and Volatility Arbitrage. Both were positive during the February and March sell off.

The "trade war" between China and the US, the rising US interest rate and huge trend reversals have created significant performance dispersions among hedge funds. We have seen some managers taking more risk (e.g. higher concentration) due to 2017’s low volatility and some of these were damaged by idiosyncratic events over the period. Nevertheless, generally hedge funds finished the period slightly down but still positive, depending on the indices.

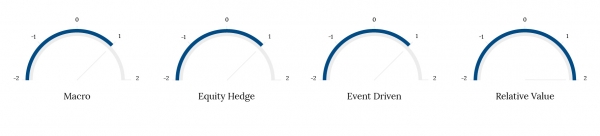

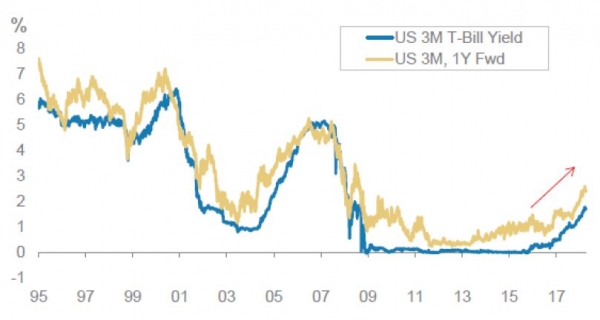

We are convinced that the current environment is favourable to hedge funds. Investors struggle to allocate capital, and this asset class can provide returns with useful downside protection for the uncertainty expected in the next few years. We expect normalisation to continue, but Federal Reserve tightening and tapering in Europe should profit rates trading and increase opportunities in the equity market. It will also help maintain the increased volatility and dispersion that favour most of strategies.

At the end of this insight, you can read our view on blockchain and cryptocurrencies.