Given Theresa May is determined to leave the single market, the UK’s membership in the European Medicines Agency has been thrown into doubt. The agency has recently announced it will relocate its headquarters from London to Amsterdam, but the bigger question remains around the potentially catastrophic impact that adding borders and tariffs to this industry will have on the UK’s pharma players who currently export £11bn worth of products to patients across the EU. Any disruption to this free flow of trade could be catastrophic.

Across the pond, Donald Trump is adding fuel to the fire and putting further pressure on sentiment by announcing drug companies are "getting away with murder" and promising to drive down prices. Given European healthcare companies are interconnected with the US, Trump’s comments transcend the Atlantic and weigh on these stocks.

Finally, the news that big tech is entering the scene caused billions to be wiped off healthcare valuations earlier this year. Months of speculation that Amazon will turn its disruptive instincts to healthcare has weighed on share prices in every sub-sector of the industry, from drug makers to insurers and pharmacy benefits managers.

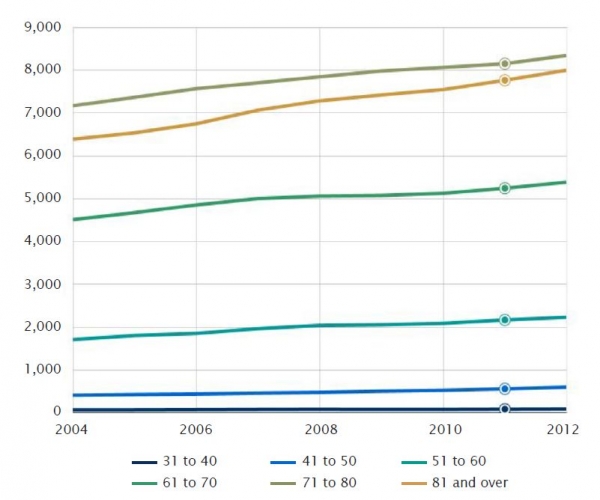

However, despite these headwinds, there is still potential for growth in the healthcare space for one simple reason: demographics. The share of those aged 80 years or above in the EU is projected to more than double between 2016 and 2080, from 5.4 % to 12.7 %.

(Eurostat http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=demo_pjangroup&lang=en)

Moreover, the negative sentiment hanging over the industry is providing compelling opportunities to pick up quality companies at attractive valuations for contrarian investors like us. From proton therapy to ostomy, I discuss four sectors that are rising to the challenge of sustaining a better quality of life for the world’s greying population.