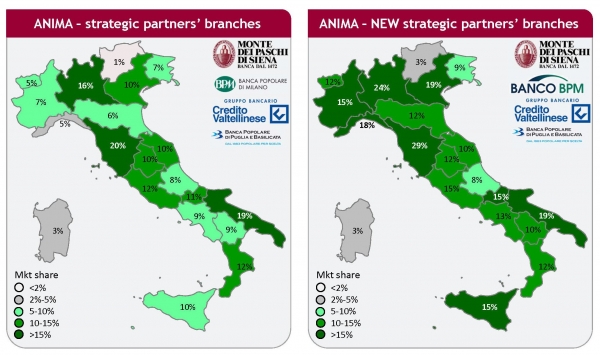

The onset of the financial crisis, and the subsequent double dip recession triggered a collapse in credit quality as excessive leverage and weak profitability among Italian corporates and SMEs caused bank loans to sour. Non-performing loans (NPLs) began to rise forcing banks to crystallise losses, cut dividends and raise capital. However, this was no different to other banking systems across Europe, particularly in Southern Europe. Why then was the Italian banking crisis so severe? The situation in Italy was exacerbated by the unique structure of its system. More than half of the sector consists of mutual or cooperative banks that have strong ties to the local communities in which they operate.

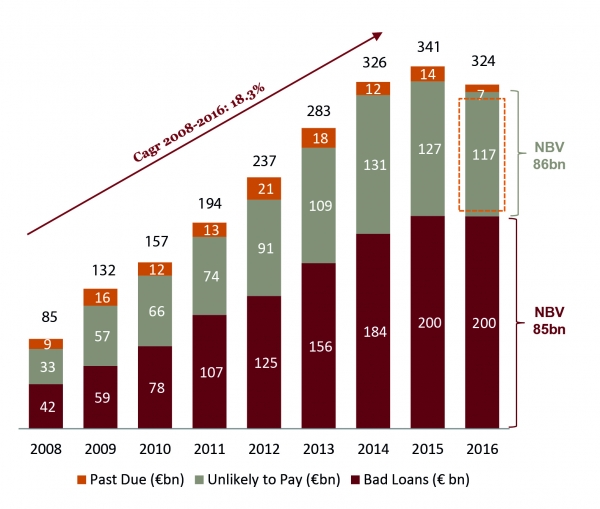

This strong connection with clients, coupled with poor underwriting, led to a sharp ramp up in lending prior to the financial crisis. The subsequent losses in these portfolios were compounded by excessive red-tape and a weak and inefficient judicial system that made it difficult to collect loans or seize the collateral underpinning those portfolios. As a result, the deterioration in loan portfolios was particularly acute in Italy with the stock of NPLs more than tripling to cEUR340bn in 2015.

The NPL crisis peaked last year, as fears began to mount that the rising losses could trigger a spate of bank failures including Monte Dei Paschi (MPS) and maybe even the banking giant, Unicredit. With confidence in the sector crumbling, liquidity pressures spiked as depositors fled the weakest banks for fear they could also lose money if their bank failed. As a number of banks edged towards failure, share prices plummeted to deeply distressed levels.