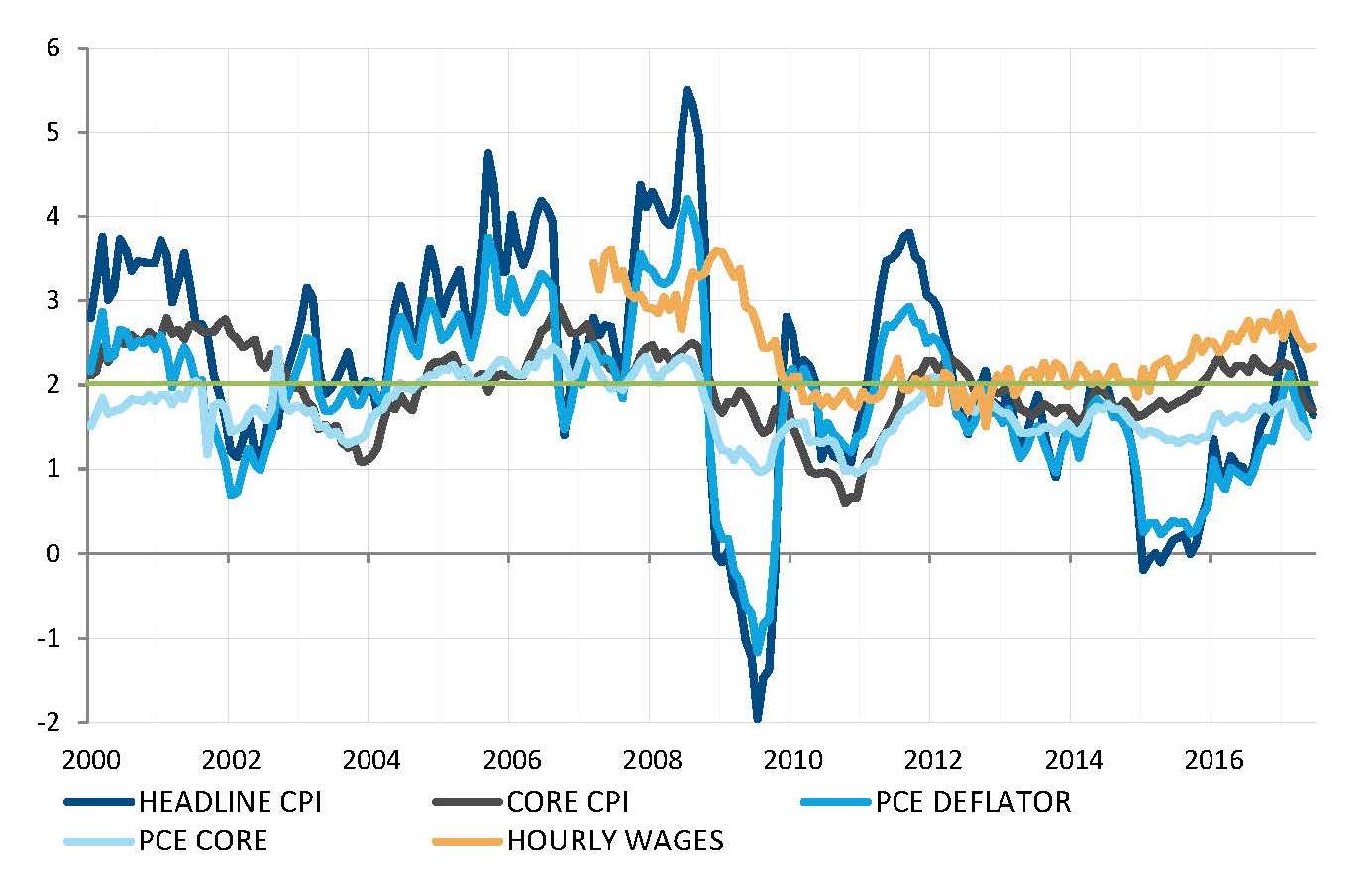

United States - The missing inflation

The lack of visible inflationary pressure in the US economy is an increasingly frustrating puzzle for the Federal Reserve. With the unemployment rate below 5% for a year and job creation still close to 200k per month, economic theory would suggest that upward pressure on wages and prices would start to appear. Such expectations have indeed supported the Fed’s decision to raise rates and to prepare for a gradual reduction of its balance sheet.

But since March, all US inflation measures have in fact fallen below the medium-term target of 2%. While the Fed initially sounded confident that this scenario might be transitory, the persistence of inflation weakness has apparently shaken its confidence. During her semi-annual testimony to Congress, Janet Yellen mentioned uncertainty about when and how much inflation will respond to tightening.

The missing inflation is complicating the scheduled policy normalisation process as it weighs on long-term rates, leads to a flattening of the yield curve and instils doubt about the validity of monetary policy tightening.

Inflation is unexpectedly slowing to below the Fed’s target

Source: Factset, SYZ Asset Management. Data as of: 28 July 2017

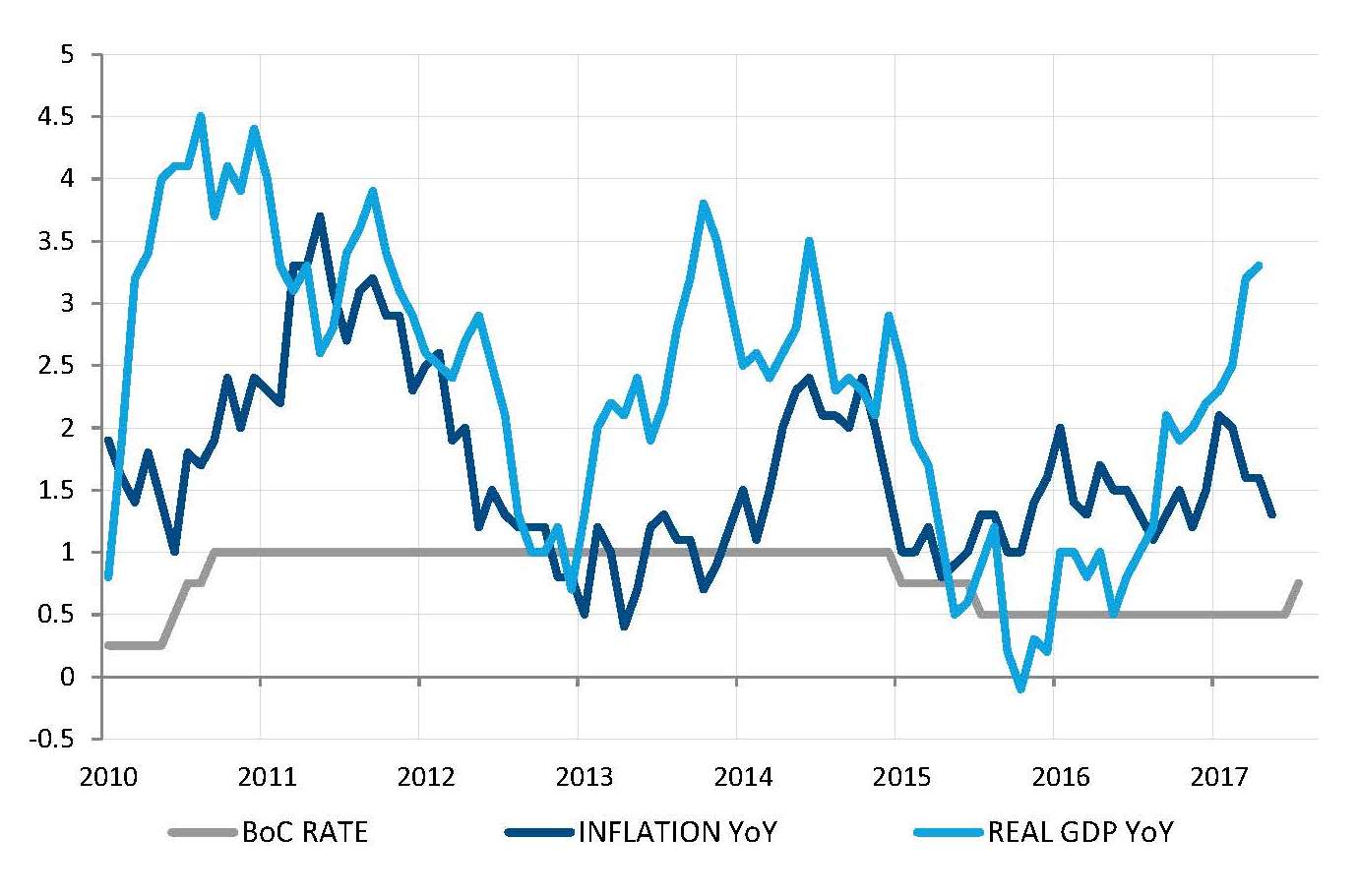

The BoC raised rates amid accelerating growth and slowing inflation

Source: Bloomberg, SYZ Asset Management. Data as of: 28 July 2017

The Canadian rate hike, sign of rising central bankers’ confidence

The past few weeks have raised the question of whether central bankers could be subject to "herd behaviour". Only a few month ago, the Fed appeared quite lonely in its attempt to normalise monetary policy. Then, in a matter of weeks, monetary policy normalisation has become the new normal, with several central banks (especially in Europe) using a less dovish tone (albeit still far from hawkish).

The Bank of Canada has been the fastest to embrace this new dynamic, hiking its key rate by 25bps in July. One month ago, the market price-implied probability of such a move was only around 10%. This decision relies on an improving economic environment as GDP growth has rapidly rebounded after the oil-driven slowdown of 2015. Still, as in the US, inflation is not following and has even slowed recently. However, such softness is judged to be temporary.

Solid GDP growth might indeed warrant such (very mild) monetary policy tightening. And inflation might finally accelerate, although the CAD appreciation after the rate hike will become a headwind. But one cannot help wondering if the BoC decision would have been taken without this recent chorus of confident central bankers.

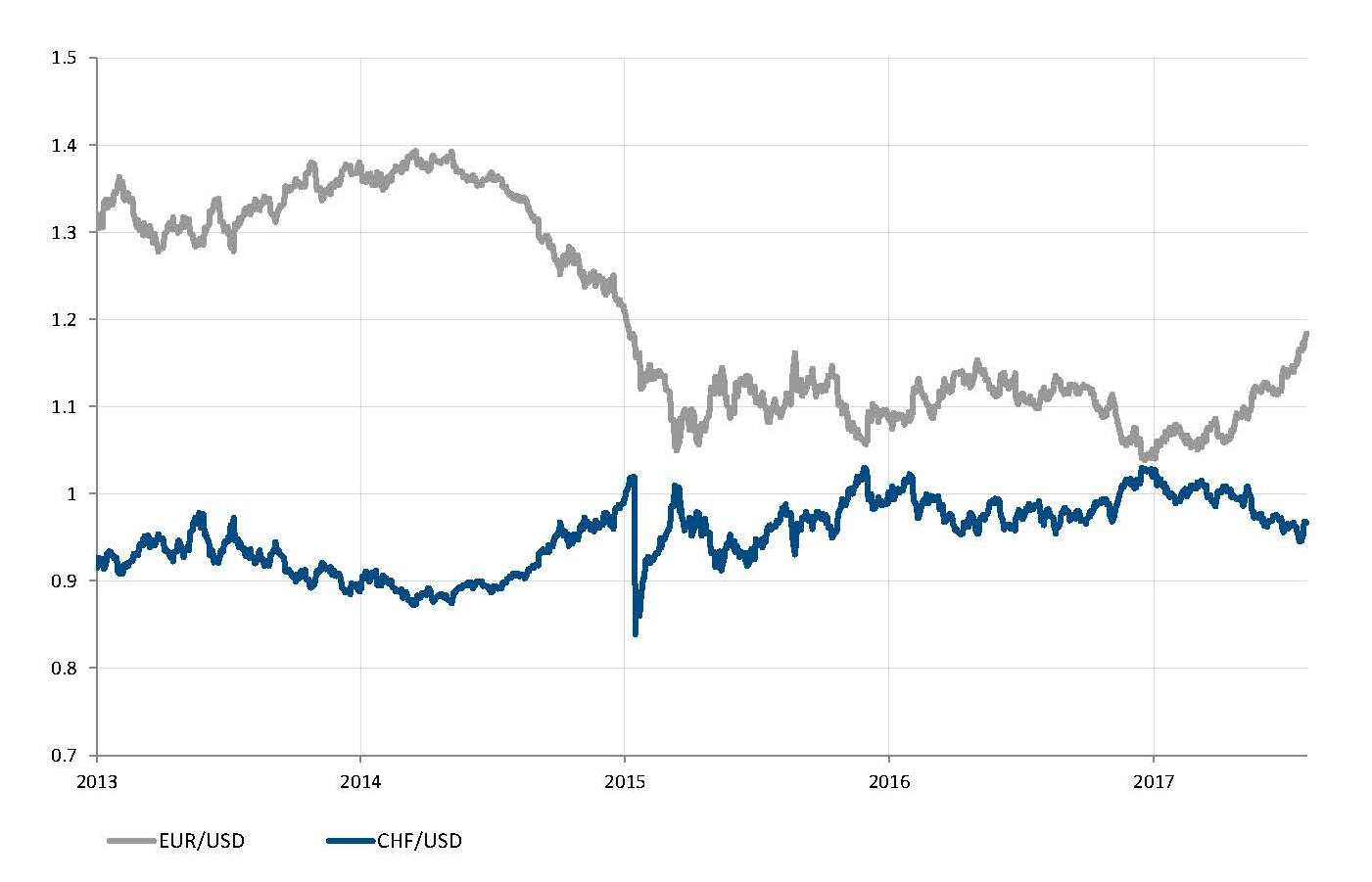

The euro is getting stronger

The euro remained in high demand in July as it jumped against the dollar, from 1.14 to 1.18 on the back of a supportive mix of factors. First, the euro is still undervalued according to PPP metrics, while the euro area runs a current account surplus. With political uncertainties fading away since the French presidential election and economic growth making a surprising comeback, investors are now looking for hints of ECB monetary policy normalisation going forward. The apparently hawkish tone of Mario Draghi’s speech in Sintra at the very end of June has given more fuel to the recent and rapid euro ascent.

But it’s not only a strong euro story as, at the same time, the US dollar has been hit by somewhat disappointing economic growth, the markets’ continuous backpedalling concerning US target and long-term rates and the poor (Sharpe) ratio of Trump’s political action vs. gesticulation. Expectations about Trump’s impact on growth, rates and inflation deflated further last month.

Euro rapid ascent? USD highway to hell? Or both?

Source: Bloomberg, SYZ Asset Management. Data as of: 28 July 2017

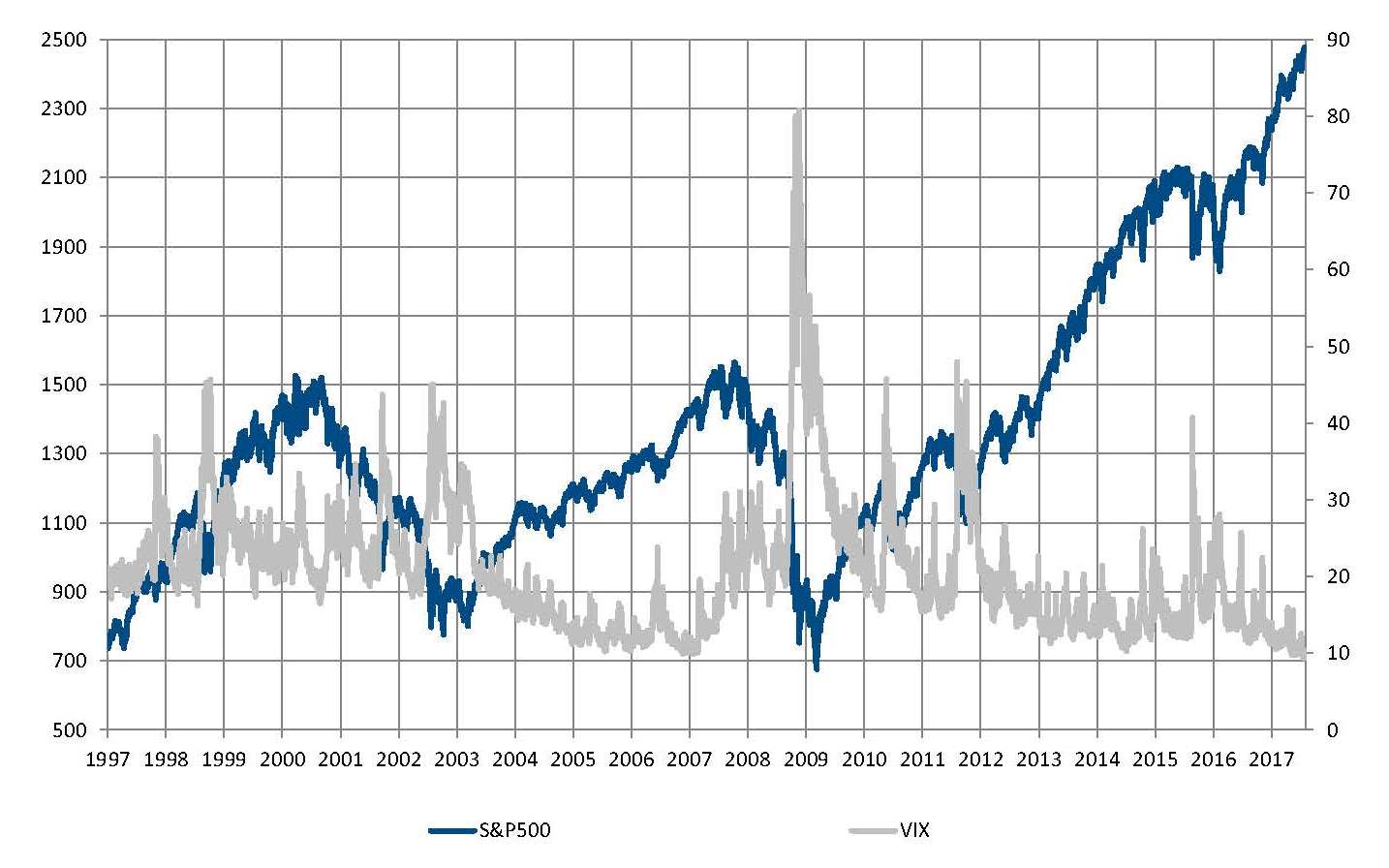

US equity indices defy gravity

Source: Bloomberg, SYZ Asset Management. Data as of: 28 July 2017

US equities reached new highs

US equity indices reached new highs in July. The NASDAQ briefly broke 6400, while the S&P500 is now close to 2500 and the Dow Jones is almost at 22000. The largest and most representative index, the S&P500, has risen in nine of the past 10 months. US equities have been supported by a goldilocks (i.e. not too hot, not too cold) economic environment characterised by steadily unspectacular economic growth, a lack of inflation and still extremely loose monetary policy. Add to that a weaker dollar, plus a good set of second quarter earnings results, and there are some good reasons why US equities markets are currently priced for perfection.

However, as usual, there is a growing "vertigo" malaise about these heights, especially given the high degree of complacency in the markets. Indeed, despite geopolitical threats and the US political mess, the VIX index (the gauge of volatility) broke new lows last month. It seems that the TINA refrain (There Is No Alternative to equities) is now playing continuously in investors’ ears. Further illustration of the placidity of the markets is that S&P500 experienced only four days with a drop of more than 1% since the beginning of 2017. This is only 3% of trading sessions, compared to a long time average of 24%.

Fixed Income - Real yields are creeping higher in Germany and in the United States

Recently, political risk has faded away and attention is again turning to central banks. In the US, the Fed could probably announce a reduction of the size of its balance sheet after this summer, while the ECB could start the tapering process and the BoE is less and less comfortable with the inflation overshoot driven by the sharp depreciation of the British Pound.

The most recent round of speeches by the central bankers was one of the main drivers for the volatility occurring in the bond market. Now, real yields edging higher are driven by inflation that is heading lower (since the one year inflation regime is swinging between reflation and disinflation). It seems unlikely that downside pressure will drive nominal yields back to this year’s lows.

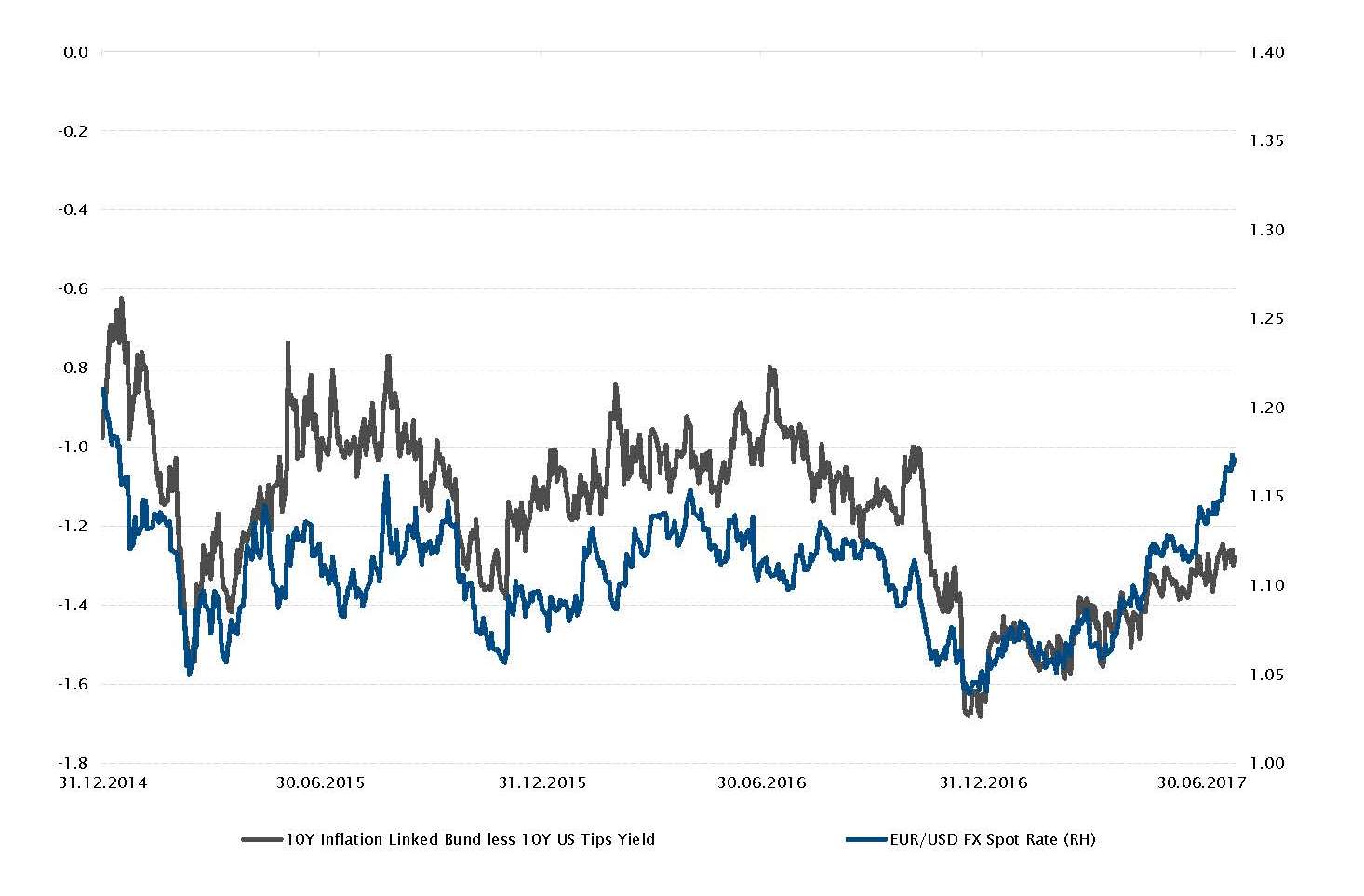

At the same time, the differential in real yields between Europe and the United States is boosting the euro against the Greenback.

In this context, German Bunds and US Treasuries saw their nominal yields increasing by +17bps (real rates +15bps) and +11bps (real rates +13bps) respectively since the end of May while the EUR appreciated +3.8% against the Greenback.

10Y Inflation Linked Bund less 10Y US Tips Yield and EUR/USD FX Spot rate evolution

Source: Bloomberg, SYZ Asset Management. Data as of: 01 August 2017

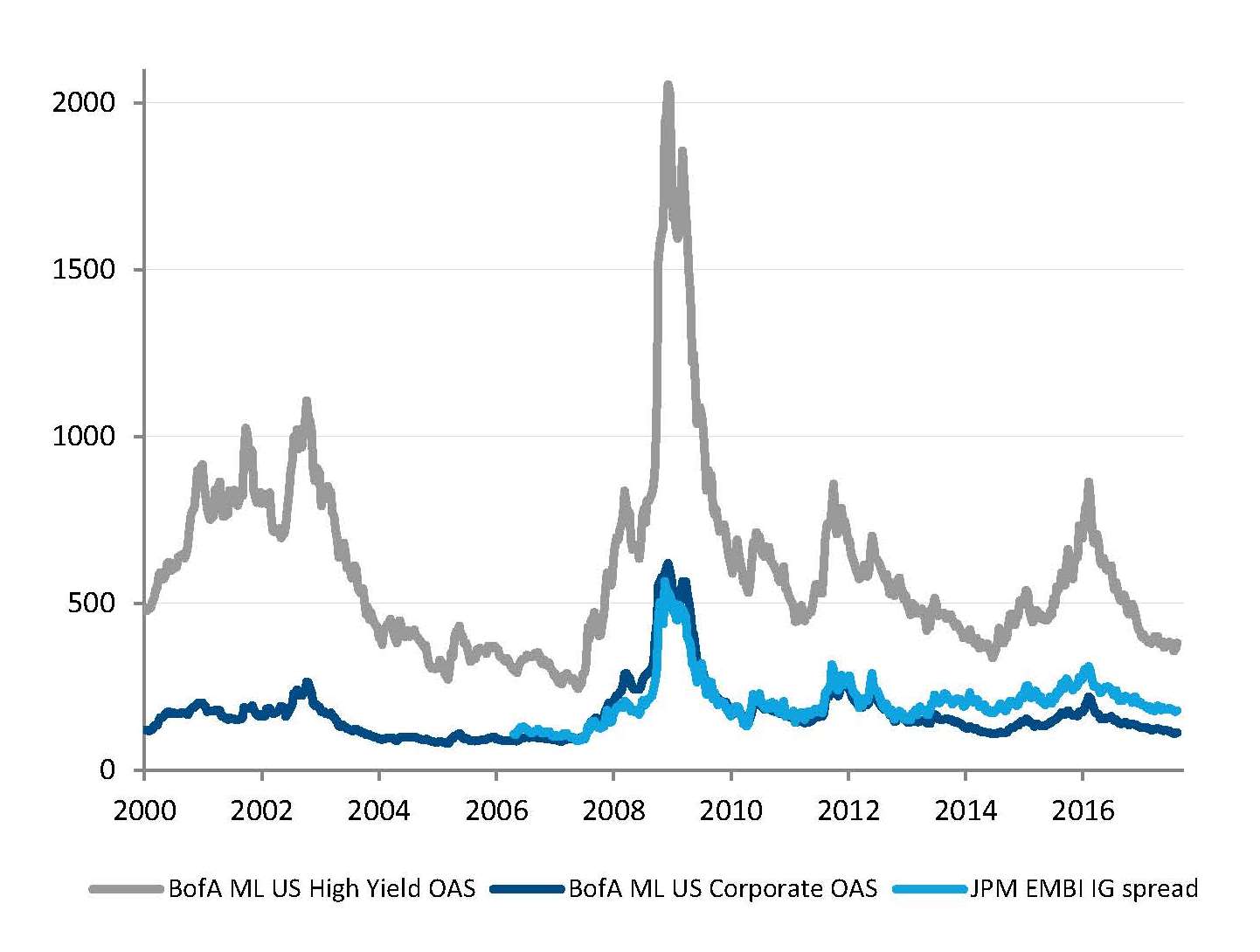

Tight and tighter

Source: Factset, SYZ Asset Management. Data as of: 28 July 2017

Credit spreads continue to tighten

High Yield, EM debt and Investment Grade credit spreads tightened further in July. For the same goldilocks’ reasons that equities continue to fly high, spreads are getting slimmer. While there is certainly a limit to the compression, it’s difficult to see what could trigger a significant reversal of this trend. Certainly a recession, a shock on rates or inflation, or sudden liquidity evaporation, which may eventually happen if imbalances and capital misallocation continue to balloon.

So, as weird as it is seems, this phenomenon of overall tight spreads could last much longer than we think. Just look at what happened back in 2005-2006 in the credit markets or in Japan over the last 30 years on rates and spreads. As long as central bankers continue to act as "dumb and dumber" by chasing inflation with their current monetary weapons, credit spreads may just get slim and slimmer.

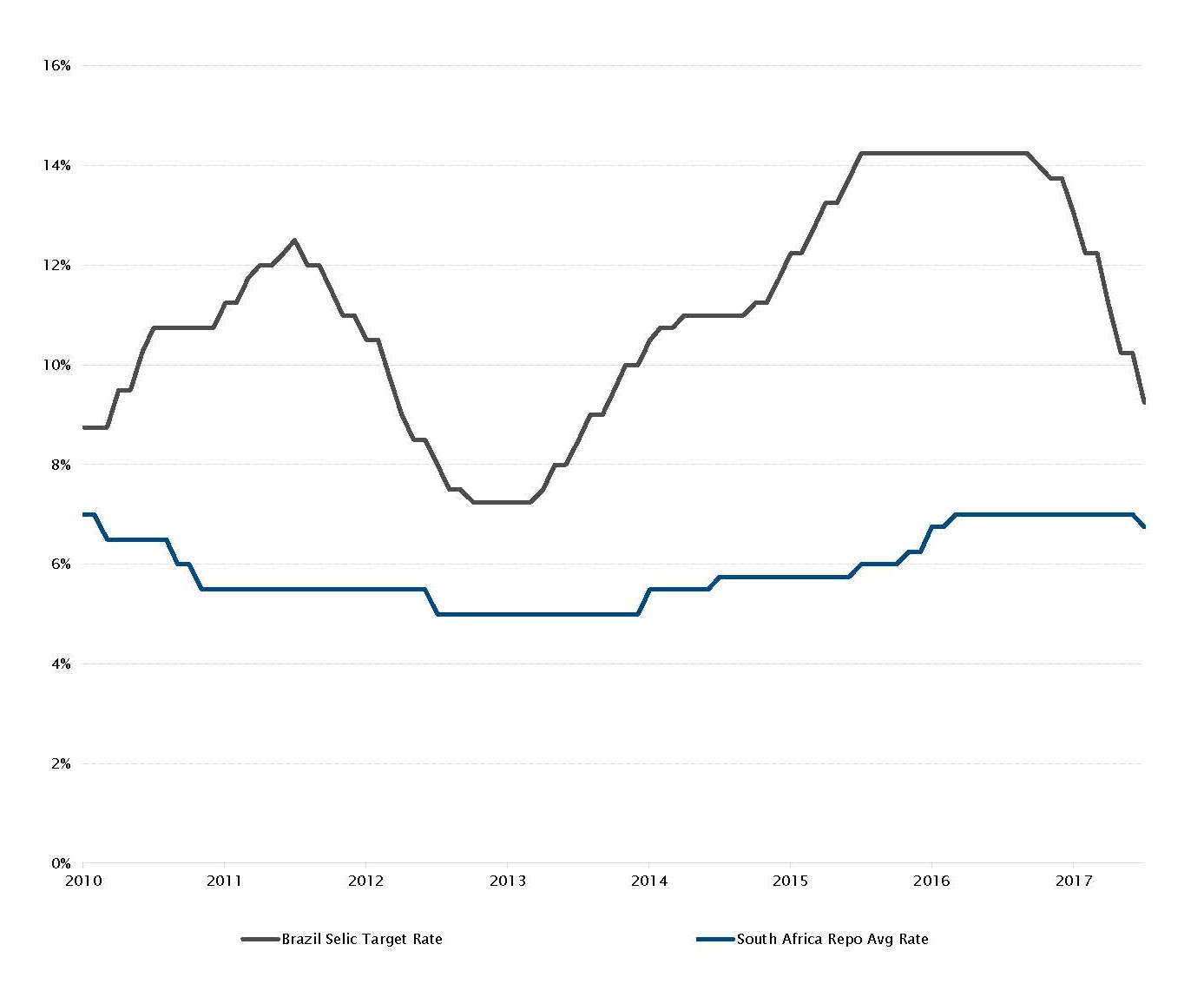

Central banks in emerging markets are cutting interest rates

While the central banks are struggling to normalise their monetary policy in developed markets due to downward pressures on inflation, emerging markets’ central banks are cutting rates for the same reason. It is worth noting that in the past emerging countries were facing issue to lessen (too) high inflation, which meant having high levels of real interest rates. The current downward trend on the inflation front is allowing several EM central banks to lower rates now.

In South Africa, the SARB surprised the market by cutting its rate (-25bps) to 6.75% for the first time in five years. While South Africa faces severe political and economic turmoil (the country was in recession in Q1), the risk on the inflation outlook is now more or less balanced. In Brazil, inflation continues to fall and the drop in July numbers opened the door for another rate cut (-100bp to 9.25%) by the COPOM.

Other central banks (in Peru or Colombia) also lowered their benchmark rate during the month and the consensus expects a rate cut in India at the August RBI meeting.

The COPOM and the SARB cut interest rates

Source: Bloomberg, SYZ Asset Management. Data as of: 31 July 2017

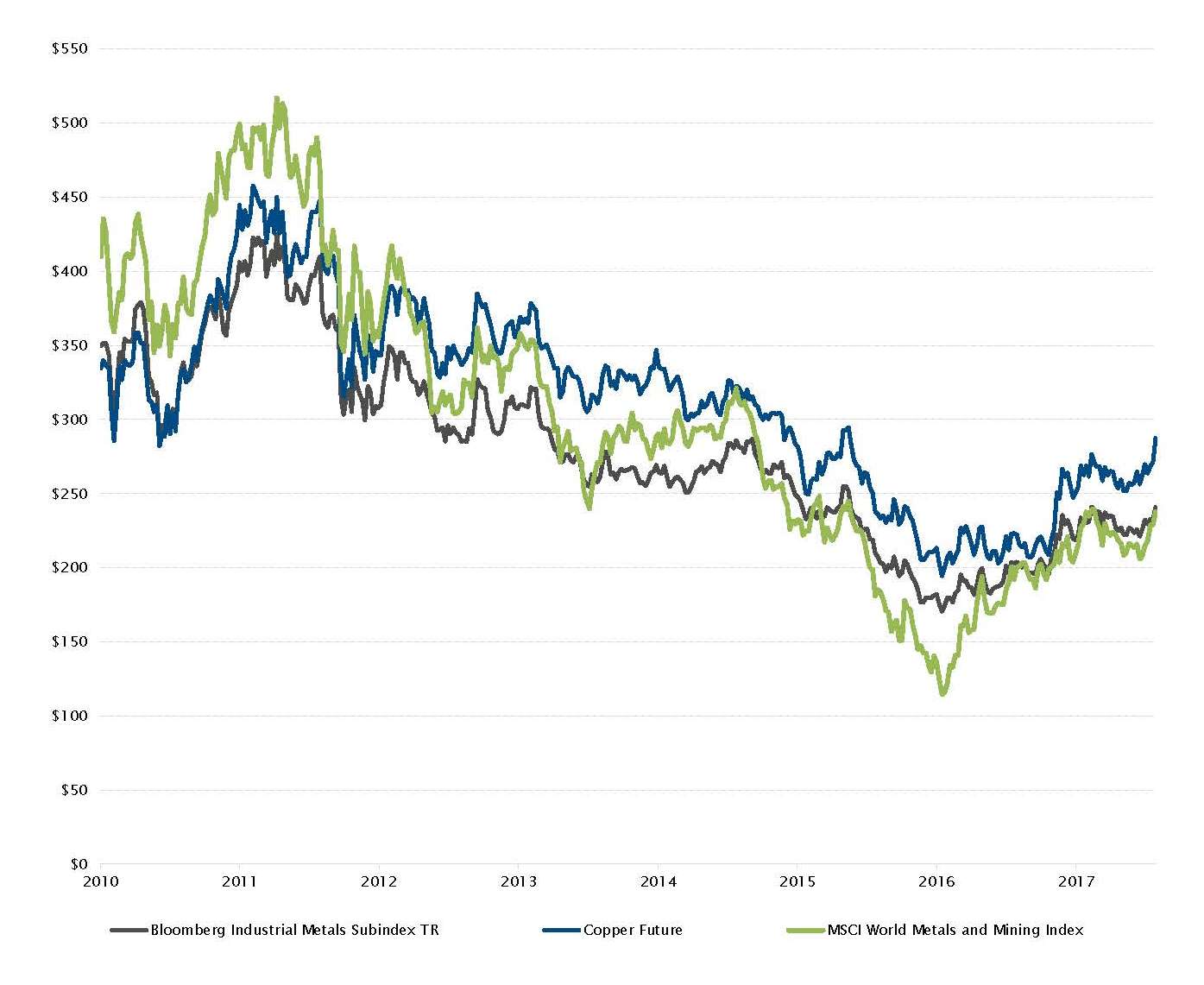

The rally in copper and other industrial metals

Source: Bloomberg, SYZ Asset Management. Data as of: 28 July 2017

Copper - The supply and demand dynamic is driving price increase

Industrial metals performed strongly in July on the back of sustained demand, lower supply and a weaker dollar. Copper was among the best performing assets in the commodities space. It reached its highest level in more than two years, increasing by +7% over the month.

The demand was supported by global economic activity, with the manufacturing PMI remaining in expansion territory, and positive newsflow from China, which accounts for around half of the global consumption of refined copper. In addition, there was some speculation about a potential Chinese ban on scrap copper imports - a source of swing supply for China - which added upward pressure to prices.

On the supply side, labour disputes among the largest copper producers and weather disruptions in Chile and Peru weighed on production. The sector has also reduced its capital expenditure leading to lower production than last year.

The positive momentum on the overall industrial metals complex is driving the price recovery on metals and mining related equities.

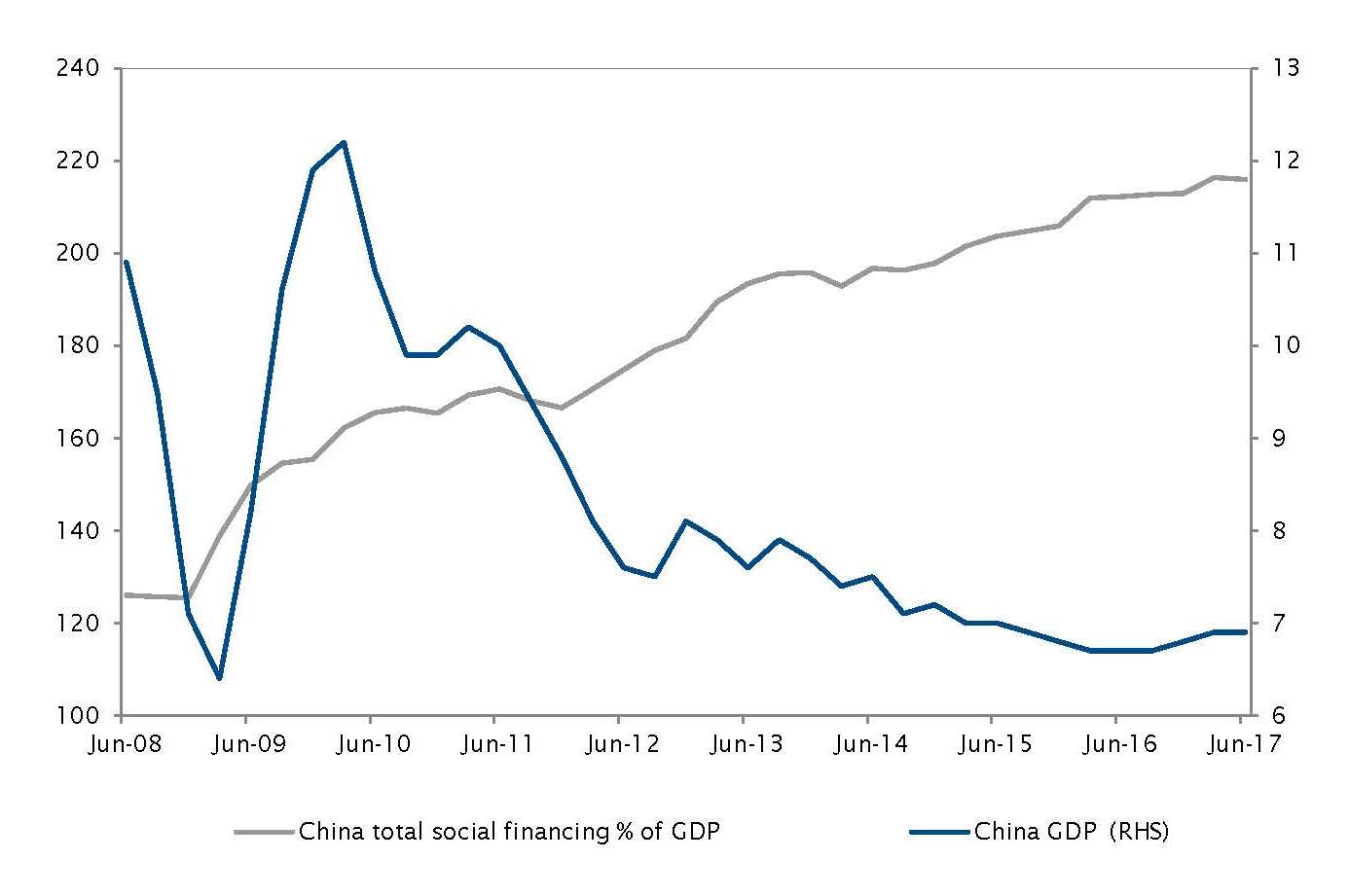

China - Robust GDP growth but still higher leverage

On a positive note, the Chinese economy proved to be resilient as the second quarter GDP figure came out at 6.9% while industrial output rose 7.6%, both higher than market expectations. The economy grew faster in the second quarter, mainly due to large public investments as well as a boost in consumer spending and a strong global demand for Chinese products.

However, the last positive GDP result does not mean the worries on China have eased. The main risk the country is facing remains its excessive debt level, which is still growing as illustrated by the total social financing indicator, a broad measure of credit and liquidity.

Although the government took measures to slowdown the bank credit expansion, the Chinese’s economic growth still relies heavily on credit. If the country wants to maintain a GDP at 6.5% or higher, it will be difficult at the same time to taper credit growth and reduce leverage.

Solid economic growth coupled with growing debt levels

Source: Bloomberg, SYZ Asset Management. Data as of: 28 July 2017

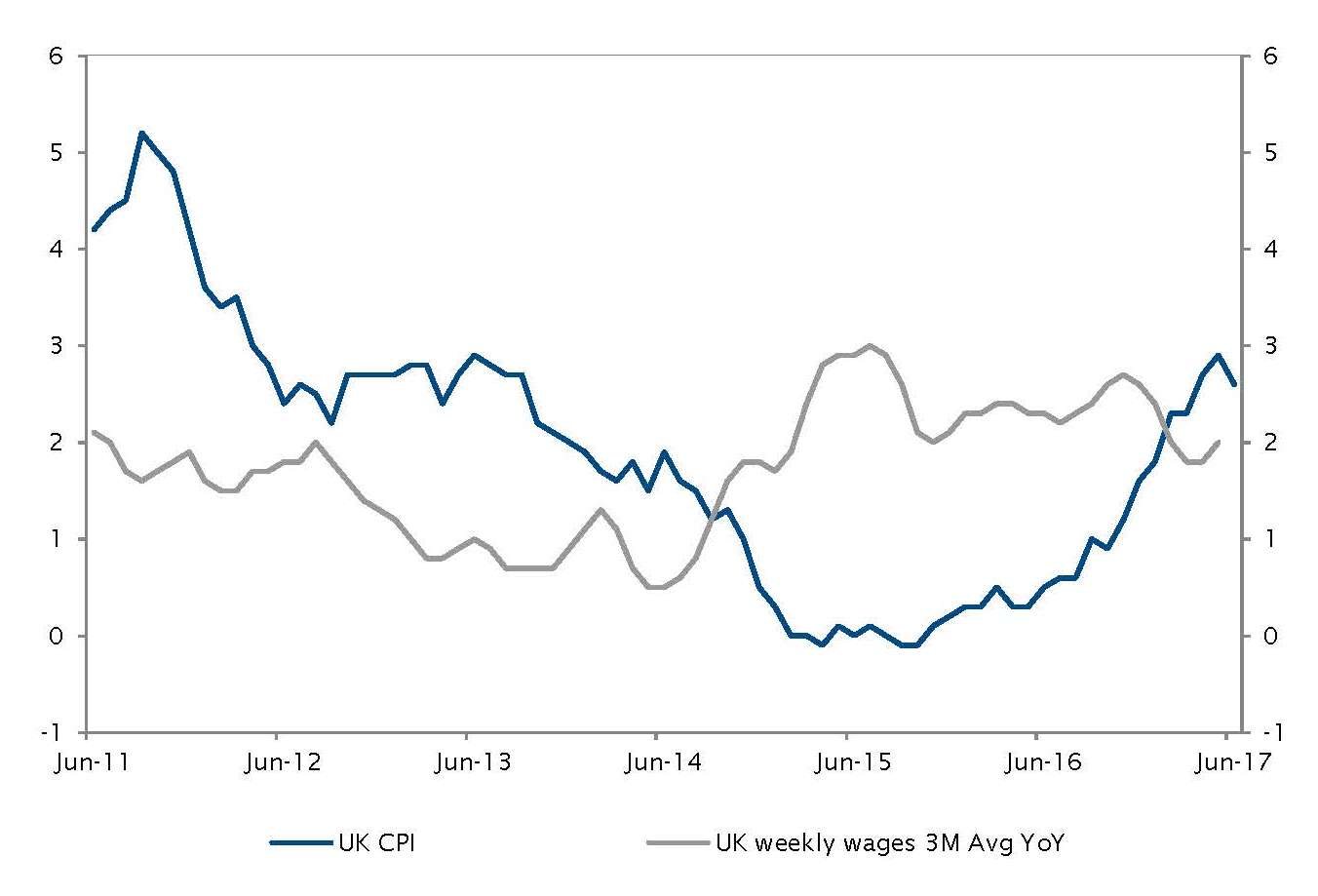

UK inflation slowdown and wages growth under pressure

Source: Bloomberg, SYZ Asset Management. Data as of: 28 July 2017

UK inflation - Less pressure on the BoE to hike interest rates

The UK, which has been under pressure to raise rates as price growth was getting somehow out of control as of late, received a sign of respite as of late. Inflation data came out softer than expected as the inflation rate was 2.6% while it was forecast at 2.9%. It seems that the prolonged talks of Brexit and the triggering of Article 50 have had an impact on prices across the country.

The housing market seems to have cooled off as home-price inflation have slowed to 3.7% from 7% in 2016 according to PWC. London prices are set for a bigger decline, although the capital has been subject to severe housing inflation for several years.

Although lower inflation in the context of Brexit is good news for the BoE, the Bank should continue to monitor its economy carefully as pay growth has recently fallen below price growth, which preludes a potential slowdown.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)