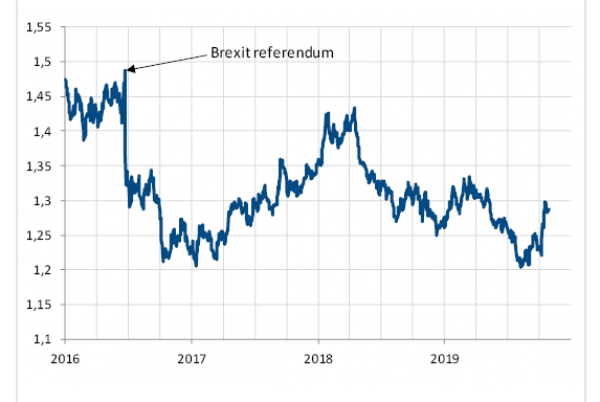

Let’s be clear: we are not naïve enough to believe that the Brexit chapter is now closed nor that political stability and harmony will be back in the UK parliament. The only thing we venture to say is that with a no-deal Brexit on October 31 out of the way and a deal and extension agreed to with the EU, the Brexit issue no longer poses the potential systemic risk it did before. With general elections in sight, it is now essentially a domestic British political issue that will certainly continue to generate noise and have implications for long-term economic prospects in the UK, but that does not threaten to abruptly shut long-established trade relationships and supply chains between the Island and the Continent.

The US/China rivalry is likely to last even longer than the Brexit saga and, here again, it would be foolish to take the resumption of negotiations for the beginning of the end of the trade war. However, this is a significant step as, at the minimum, it reverses the tariffs/retaliations spiral of the summer. Nobody can tell how successful, how comprehensive and how sustainable those negotiations will prove to be. But, factually, the US administration has suspended some tariff hikes already, China has raised its imports of US agricultural products, and both parties now agree on moving forward step by step rather than attempting to solve all wide-ranging issues at once. Objectively, this is better than where we stood in early September.

In the meantime, the global economic environment hasn’t changed much, with the household consumption and service sector activity sustaining low-but-positive GDP growth against the ongoing slowdown in industrial activity. Risk remains tilted to the downside as long as industrial activity doesn’t pick up. However, the mere fact that the tail risks of a no-deal Brexit and trade war escalations have been significantly diminished warrants a more constructive view toward risky assets for the end of the year. Especially in a context where central banks maintain or accentuate their accommodative monetary policies and support the relative value of equity markets.

Our monthly view on asset allocation (November 2019)

Monday, 11/11/2019Brexit twists and turns on the one hand and Twitter-format US/China trade negotiations on the other have both become such regular features in our investment landscape that it has become difficult to disentangle meaningful developments from postures and noise. We believe that events in October fall under the former category, and that two significant downside risks have been cleared for the months ahead.

Beyond the noise

Economic backdrop in a nutshell and global economic review

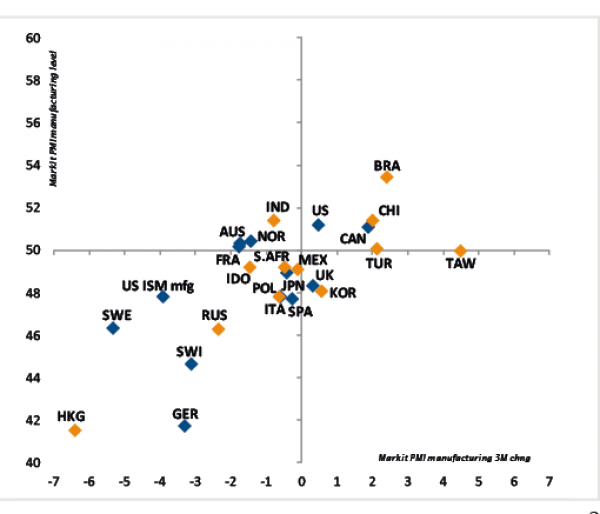

More of the same again! The global economic environment hasn’t changed last month beyond Brexit and trade-related political developments. Household consumption and activity in the service sector continue to generally expand, and still support positive GDP growth. On the other hand, most industrial indicators continue to describe weak or contracting activity in the sector, even if some tentative signs of stabilization or rebound are visible in some areas, especially in Emerging markets.

The dissipation of short-term risks around Brexit and the US/China trade war could help alleviate downward pressure on business investment in the months ahead.

In this context, our central scenario remains that of constructive global growth stabilization and gradual, mild pickup next year, supported by low interest rates and accommodative monetary policies, including in a growing number of emerging economies. Risks of a further slowdown remain however non-negligible as long as industrial activity indicators do not pick up durably from their current low levels. Nevertheless, the dissipation of short-term high-impact risks around Brexit and the US/China trade war could help to alleviate downward pressure on business investment in the months ahead, reducing the “extreme left tail” of the distribution of potential outcomes and therefore the level of uncertainties.

Growth

GDP growth is still positive across the board, but business cycle dynamics are slowing down in the US, “core” European countries and the UK. The trend has generally stabilized in Asia.

Inflation

Inflation rates are generally low in absolute terms, slowing down and below the central bank’s target across most developed and emerging economies. Stable energy prices currently do not present a risk for those of goods and services. And market-based medium-term inflation expectations remain at uncomfortably low levels for central banks.

Monetary policy stance

Given the current inflation and growth context, no wonder most central banks are more or less aggressively leaning toward a dovish and accommodative stance. Mr. Draghi delivered a large package in September before handing over the helm of the ECB to Ms. Lagarde. The Fed is widely expected to cut its key rate again in October. And several EM central banks are in the midst of a rate cut cycle. A broad-based easing trend at play.

Developed economies

The sharp decline in the ISM manufacturing index of September, complemented by a weaker-than-expected ISM for the service sector, serves as a reminder that the slowing trend of the US economic growth was still at play. However, even if employment growth has also slowed down, “Hard data” such as retail sales are still pointing to resilient final demand. Easier monetary policy and possibly receding risks of tariff escalation could support sentiment in the months ahead and bolster the resilience of US economic growth.

In Europe, “core” economies of the Eurozone (Germany & France) continue to exhibit slowing business cycle dynamics, along with neighboring Switzerland and Scandinavian countries. However, more resilient domestic demand helps to stabilize growth in Italy and Spain. The UK economy has continued to slow down amid Brexit uncertainties.

Before the planned VAT rate increase, the Japanese economy stabilized throughout the summer. The impact of this VAT hike on consumer spending will be visible and measurable in the coming months.

Emerging economies

Economic growth appears to have stabilized across the emerging world, with the notable exception of Hong Kong which is dealing with the impact of the lasting social unrests.

_Adrien Pichoud

Asset valuation & investment strategy group review

Risk and duration

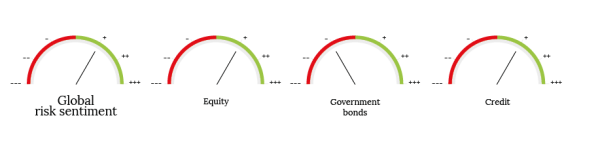

Risk preference was raised a notch to “mild preference”.

On the one hand, the trigger for this movement was the latest rather positive developments on the US-China trade war and Brexit fronts, in the context of still resilient domestic consumption in the developed world and accommodative monetary policies.

On the other hand, the view is not that these issues will both be solved smoothly in the short run. Neither has there been any material change in terms of global growth that would improve the overall scenario. The assessment is, rather, that those developments significantly lower the chances of a worst case scenario.

In an environment where (1) global growth remains positive, (2) monetary policies are very accommodative and (3) rates remain low, the conditions might meet the standards for supporting an appetite for risky assets. More specifically, they might be good enough for fuelling catch-up demands for assets and markets that had so far been battered as a result of those specific risks.

The duration scoring remained at “mild disinclination” due to a lack of inflation and dovish central banks. In an environment of low inflation and accommodative central banks, duration can still provide a useful hedge for portfolios against a slightly less likely but still real risk of a negative macro outcome, even at current expensive bond valuation levels.

The risk stance has been increased a notch to “mild preference” on the back of the latest positive developments regarding Brexit and improvements in the trade war conflict, thus significantly lowering the likelihood of a worst case scenario.

Equity markets

The direct consequence of the increased risk appetite was that we continued to reduce the implicit defensive bias in the equity allocation.

Given extreme levels of relative valuations between defensive and cyclical markets and sectors, we sought to reduce our defensive bias to avoid being caught wrong-footed were there a temporary reversal or a correction in relative performance triggered by reduced fears of declining global growth.

Therefore, we raised the preference for UK equities to “mild preference,” and kept the exposure to the British pound open with a midcap bias since those companies could benefit most from the dissipation of a no-deal Brexit short-term risk.

We maintained a “mild preference” scoring for Eurozone equities but within this bloc, we retained a preference for Germany for its cyclicality related to its sectorial composition.

We also lowered the preference for the more defensive Japanese market (to “mild disinclination”).

In terms of sectors, we identified financials, in the US and in UK/Europe, as potential beneficiaries of an improvement in market sentiment from the still quite polarized gap between defensive and cyclical sectors.

Bond markets

In the wake of the increase in risk appetite, we raised the preference a notch for high yield and emerging markets debt (hard currency) to “mild preference” and emerging markets debt (local currency) to “mild disinclination”.

We kept a “mild preference” scoring for investment grade credit and inflation linked government bonds, while nominal government bonds are still scored at “mild disinclination.” The latter are clearly expensive from a valuation perspective but continue to provide a decorrelation effect in a balanced portfolio.

Italian government bonds remain the favoured European sovereign bonds market, in the context of ECB monetary policy easing and still positive relative value.

US (and Canadian) government bonds are the other sovereign bonds market of choice as they offer the highest potential for portfolio protection in the event of a recession scenario that would imply Fed rate cuts.

We raised the preference for credit denominated in British pounds to “mild preference” as it is in the cheap camp from a valuation perspective and Brexit developments are favourable from a tactical standpoint.

We still favour European credit over that of the US, mainly on valuation grounds and due to the expected support to be provided by the ECB.

In the local debt bucket we upgraded Mexico to “mild preference” as the Mexican peso is cheap coupled with attractive interest rate levels and a downward path for inflation. We downgraded Turkey to “strong disinclination” because of renewed geopolitical tensions, prospects of possible US sanctions and downward pressures on the Turkish lira.

Forex

Following the latest rather positive Brexit developments, we reckon that the heavy downside pressure that dragged the British pound to a clearly undervalued level has abated and now warrants a convergence more towards its fair value. The GBP is therefore now scored two notches higher compared to the previous month (at “mild preference”).

Gold remains the preferred alternative currency for the diversification it brings into a portfolio and (scored at “mild preference”).

The US dollar is still favoured to the euro despite the greenback’s higher valuation but it offers a better growth outlook and especially a still positive yield differential.

Finally, the Japanese yen is ranked at “mild preference” for its characteristic as a diversifier in a risk-off environment.

_Maurice Harari

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)