European equities crashed out of favor with investors in the last year with the longest run of persistent outflows in a decade. For 2018, net outflows from active European equities funds totaled €44 billion with another €14 billion in the first two months of this year. (Source: Broadridge, for Europe-domiciled funds).

Cinderella before the ball

Tuesday, 04/23/2019European equities are trading at five-year valuation lows due to growth fears and record fund outflows. However, lost among the macro headlines is the fact that Europe is home to many of the world’s leading businesses. Yes growth has slowed but it has not fallen off a cliff. We take the viewpoint that market uncertainty and unease represent a window of opportunity to purchase the best companies that most see as wearing “rags” rather than “ball gowns”.

“We view the negative international sentiment for European equities as overdone, representing an excellent contrarian buying opportunity.”

Investors fleeing European equities

Growth scare overblown

European market participants were battered by disappointing economic news in 2018 with a deterioration in the macro picture especially pronounced recently. They shared worries about a general global slowdown and US-China trade wars but also region specific problems like the “Yellow Jacket” protests in France and UK and Italy political uncertainty.

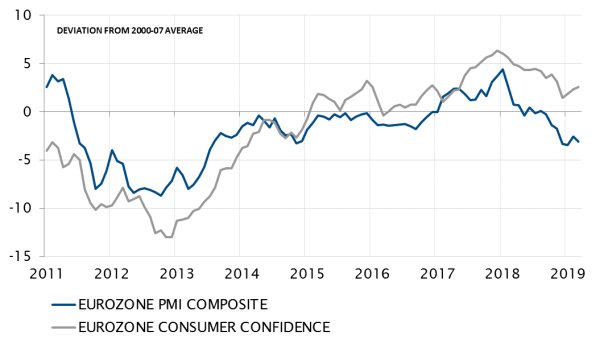

However, our Chief Economist believes that domestic demand drivers remain supportive of a 2019 GDP growth of about 1.5% for the Euro area. Declining unemployment (six-year lows), rising real income, positive consumer confidence and very accommodative financing conditions all point to a stabilisation. The latest prints for PMI and Consumer Confidence (March 2019) indicate a rebound from 2018 year end lows. Growth may have slowed, but it has not fallen off a cliff.

Historically low valuations

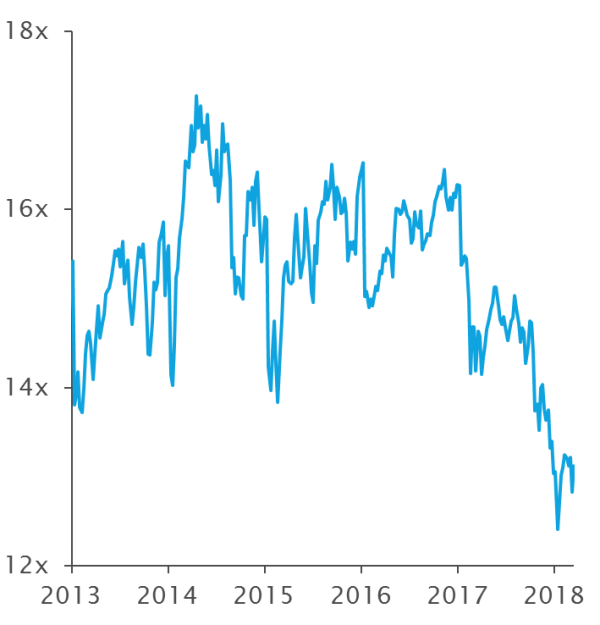

Even after the rally year-to-date, investors can access European equities at five-year low valuations following the market drawdown in 2018.

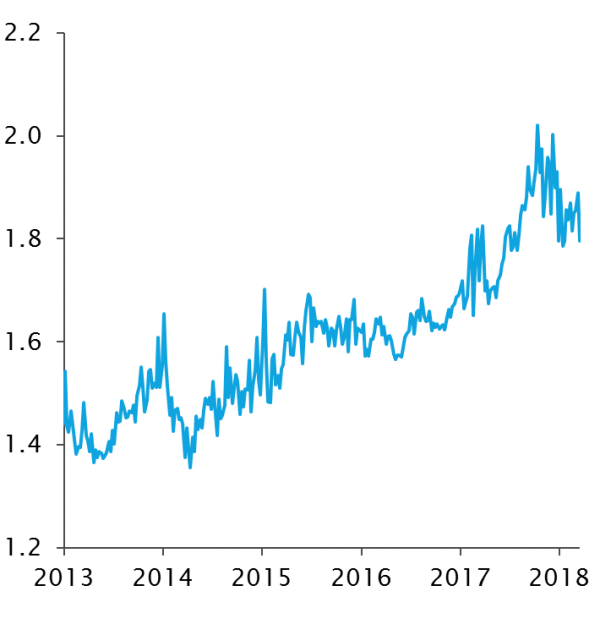

European equity valuations are especially attractive compared to U.S. equities on measures such as price to book. Currently US stocks are trading at a P/B of 1.3x more than European stocks (3.0x compared to 1.7x).

Cinderella before the ball

We view the negative international sentiment for European equities as an excellent contrarian buying opportunity; the growth scare has led to an unwarranted discount. Lost among the macro headlines is the fact that Europe is home to many of the world’s leading businesses. While they may not generate fervor like Amazon or Apple, companies within our portfolios like Louis Vuitton Moët Hennessey, ASML and Prudential are world-class companies in their own right.

Our managers’ expertise is in identifying high-quality companies and to purchase them at attractive valuations to deliver strong returns in the medium to long term. They are bottoms-up stock pickers but they use to their advantage fear or negative sentiment in the market. Though more economically sensitive sectors and stocks are currently unloved, they are the ones that, when chosen correctly, have the ability to outperform the most in an eventual rebound.

Thus the investment team is investigating areas of the market such as the energy, auto and tech hardware sectors whose valuations imply we are in a mild recession. Yet the US economy is performing well, the eurozone continues to expand (albeit more slowly than at the start of 2018) and China is injecting stimulus.

However we can not deny there is market uncertainty and unease. But we believe that our managers’ selective stock-picking approach is optimal in such conditions. This means that the best companies may be purchased when everyone else sees rags while our managers know that they will be transformed into ball gowns.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)