With the return of volatility in all asset classes, the impact on global equities is quick and clearly negative (outflows) but likely temporary. While most market worries roll-over from the first quarter to the second quarter of 2018, the current lateral consolidation could also persist for the time being, but probably miss the necessary ingredients to turn into a full-fledged downturn as the year progresses. Presently global PMIs and credit conditions remain healthy and these economic strengths coupled with excellent fundamentals of global equities, should further the late-stage equities bull-run. In a longer term though, we would like to flag the bulging corporate credit situation in the US as a potential risk to the markets. As a defining factor for this specific risk, the speed and aggressiveness of the FED in its rates hike will be closely monitored.

Global Equities: Technology, Trump and Emerging Markets

Wednesday, 05/02/2018While most market worries roll-over from the first quarter to the second quarter of 2018, the current lateral consolidation could also persist for the time being, but probably miss the necessary ingredients to turn into a full-fledged downturn as the year progresses.

“The current correction could persist for the time being, but probably miss the necessary ingredients to last for the rest of the year as Global PMIs and credit conditions remain healthy and when coupled with excellent fundamentals of global equities, should further the late-stage equities bull-run.”

- Latest worries for the market include: The reversal of momentum in Tech, Trump’s Trade Wars fears, and the investment implications for Emerging Markets. These are in addition to an apparent end of easy monetary policies in the west.

- While the mood is cautious, the current correction in Global Equities (& other asset classes) isn’t a ‘game over’ for the bull-run.

- Global economic conditions remain healthy (PMIs, Credit situations etc.) and Global Equities continue to feature excellent fundamentals.

Run-down of first quarter of the year

Recent waves of volatility in global equities have been triggered by reversal of trends, sector rotations, and fear of trade wars. In addition the FED-factor has come into play, at least at the earlier part of the first quarter, when in early-February rising inflation numbers gave way to US rate concerns. As the FED factor gradually faded in March, Trump’s protectionary stance and the Tech’s reversal of momentum took over as the major worries for the markets. This resulted in the VIX reaching its 2.5 years highs, and most global indices closing the quarter in negative territory. For indices like MSCI ACWI and S&P500, first three months were the first negative quarter finished since 3Q2015.

What does the second quarter hold for global equity investors?

It is only natural to say that the mood is cautious, when the latest correction has extended into many asset classes, and when the VIX only slightly recedes while persisting at uncomfortably high levels. Looking ahead into the second quarter and the year ahead, the 3 latest questions (in addition to much discussed monetary policy normalization in the West) that a global equities investor faces are the following:

- What to do of Tech?

- How to best position on the face of Trump’s protectionist agenda?

- What are the investment implications of the above for the EMs?

Let’s tackle the 3 one-by-one, beginning with What to do of Tech?

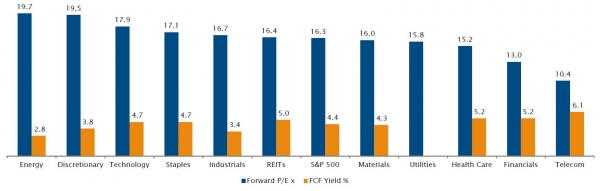

Global tech has been a high-flyer in the current bull market and unlike previous high points in history for the sector, this time it has been supported by higher profitability and EPS growth.

In the latest series of events, the US internet mega caps come under fire with the Facebook debacle over users’ personal data and Amazon’s twitter bashing by Trump. One might ask, if this is the beginning of the end? We opine with an opposing position to Tech-bears, and argue that the longer term uptrend should persist in the presence of strong performance catalysts including; excellent growth in the top line, solid monopoly-like businesses, and cheap valuations. It remains hard to imagine any credible reasons why in the foreseeable future, comprehensive ecosystems like those of Alphabet, Facebook and Alibaba should lose their scale and global leadership and discontinue a profitable user-base growth. Admittedly the operating expenses for social networks might go up in higher spending on better users’ data protection, and thus a slightly negative impact at the bottom-line levels. But this is largely priced in. Moreover these companies have developed a long term advantage with the possession of data in large amounts - which despite higher regulatory focus - is instrumental in their strategies of cross-selling across various assets they control, and allows targeted advertisement campaigns to their client global marketers. Once the dust on the Facebook story completely settles down, and the industry embraces new regulatory environment, the sector should be set to continue its growth path. Companies like Facebook and Alphabet are examples of likely beneficiaries.

Not to miss other growth pockets within the Tech sector, an appropriate global tech exposure will be a balanced mix of both ‘new tech’ or the internet and cloud, and the ‘old tech’ or the hardware side. While internet software has been the leader in revenue growth in 2017, and with increasing profitability; it has seen promising earnings revisions for 2018, similar is the performance of the hardware side. An exposure to the semis, the smartphone OEMs and their suppliers has returned quite decently over various time horizons. Though Taiwan Semi’s latest numbers temporarily cloud the sky somewhat.

On the question of what is the best global equities positioning given Trump’s protectionist trumpet, one may argue that so far these topical trade wars are less action and more rhetoric. So far the protectionist measures taken by the Trump administration have been merely symbolic. Consider the fact that the latest tariffs by the US on Chinese imports concern less than 3% of China’s exports, or lets’ say not large enough to trigger a serious retaliatory action from China or other trade counterparties like Europe. Therefore currently topical trade wars are in fact overblown fears of something that has little probability of materializing; especially given their counter-productive nature in today’s interconnected global markets. On the other hand, investors tend to forget that many countries are still opening their markets, and trade barriers are still largely coming down. Even China – despite the recent measured retaliatory response – has announced reduced tariffs on several products, and is not likely missing any opportunities of open up to other Asian markets. Finally, there is a key geo-political aspect to consider for global political leaders, US wouldn’t like to decay its relations with China, the only country that allows it to maintain any diplomatic window with North Korea.

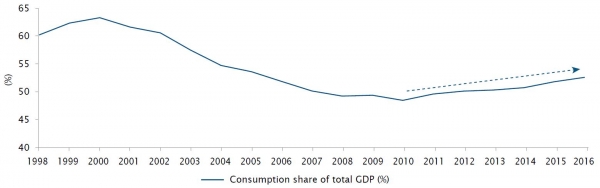

Finally, what are the investment implications of the Tech fallout and Trump’s agenda for the Global Emerging Markets? A large part of the outperformance delivered by emerging markets (vs. developed) in the past year, can be explained by the improving political environment in countries like Brazil, commodities’ return into fashion, the Tech sector outperformance (notably China and South Korea), and a weak USD materializing into contained inflation and high GDP growth. Since Emerging markets like China have been a key beneficiary of lower trade barriers and exports represent a large portion of their GDP, recent rhetoric of protectionism poses risks for continued EM GDP growth. However, since any serious global trade protectionists’ measures remain missing, all weaknesses on fears of trade wars are excellent buying opportunities into EM Equities. Our preference is for the Asian region, that maintains relatively high domestic saving ratios, is home to growth-oriented Tech (e.g. MSCI China is over 40% Tech), and boosts countries like China, Thailand and Indonesia that are quickly moving up the value added curve and narrowing the quality gap with developed peers. One specific pocket of potential high growth is the Chinese consumer sector. With private consumption in China accounting for less than 40% (vs. 60% global average), the current trend points at the figure moving up to at least 50% in the next decade and if the current growth in GDP is also maintained, we are speaking about a significant (high single digits) local consumption growth in the country. Haier Group (consumer electronics / white goods), and Anta Sports (sporting goods) are typical examples of businesses ready to capitalize the opportunity.

A potential risk to the continued bull-run in Global Equities however emanates from the US corporate debt. A low-for-longer interest rates environment has led to high levels of leverage accumulation – and across the whole spectrum of sectors including telecommunications, mining, oil and gas and capital goods manufacturing. According to an independent source, c.35% of US corporate are sitting on net-debt-to-EBITDA multiples of 5x or more. This when viewed in combination of a rising rates environment, could cause the markets to be jittery if the FED is found to be more aggressive and swift in rates hikes, than expected by the markets. We would therefore keep a close watch on FED’s rates decisions as well as both corporate and government bonds yields, and their respective key threshold levels.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)