Since its inception in October 2017, the Weinstein case has had global repercussions that we see under the #MeToo banner. What we see less are the consequences of this scandal on the business world that saw a so-called "Weinstein clause" appear in certain M&A contracts. This provides for recovery provisions for a portion of the price of transactions in the event that inappropriate behaviour is discovered within management.

This example is not insignificant: it shows that non-financial considerations emanating from civil society and taken into account by businesses can have a negative impact on the financial results of these businesses. It is clear that a standard for responsible behaviour has not only emerged — it has also taken on greater significance.

Increasingly, analysts are scrutinising the stance of businesses towards social, environmental and governmental issues (the same way they do with their balance sheets and income statement), in search of potential weaknesses that might lead to financial penalties. Their observations are grouped under the theme of "responsible investment", that is to say, investment that incorporates extra-financial factors.

However, since there is no clear consensus on investment taxonomy or philosophy, there are a number of ways to read the subject. Despite the burst of initiatives aimed at establishing a common language for sustainable finance, the problem persists and is visible in several sectors, such as energy. United under key international agreements, governments deemed it urgent to limit global warming. The use of price incentive schemes is one solution. This is the case with the CO2 emissions quota trading scheme, a strategy used within the European Union to encourage industries to reduce their emissions.

Yet, the reality is more complex: take EDF, the French energy giant, for example. The majority of energy it produces is derived from nuclear power (89%) which does not release CO2 emissions, partly protecting it against these measures. The difficulty stems from the controversy surrounding nuclear power, specifically following the Fukushima disaster. Therefore, the degree of responsible investment is set by each client or by each analyst according to their analysis of economic and environmental challenges.

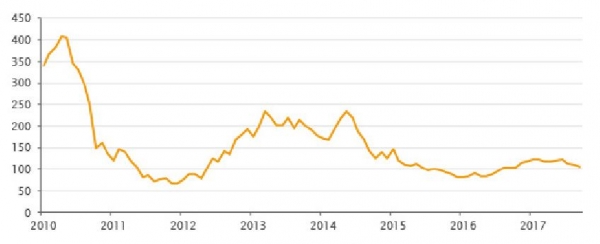

Another crucial factor to consider is the impact of responsible investment on performance. To better understand it, we need to look to the classic law of diminishing returns. When all available capital runs after an idea, the result is an effect opposite to the one sought. Investment becomes less and less productive and the market could reach overcapacity, as shown in the case of solar energy. In 2011, weak demand combined with significant overcapacity caused profits to plunge; as a result, the benchmark, MAC Global Solar Energy Index, lost two thirds of its value. Following this, its performances have been weak in recent years.

Then comes the phenomenon of subsidies, as seen in China in particular, where the government implemented a voluntary programme in this area. Suddenly, in June 2018, the government made the decision to cut subsidies for the majority of solar energy projects, thus triggering a new drop in shares in the sector.

These examples show that one shouldn‘t chase after the responsible investment theme without carefully considering the fundamental characteristics of the businesses. The answer is a pragmatic and non-dogmatic approach. It is possible to create long-term value for investors by integrating these factors in conjunction with traditional management.