2017 was finally a good year for the hedge fund industry after three difficult ones. Our two strategies performed above target in 2017. The uncorrelated strategy, which has zero beta with the equity market, was up more than 4.5%, while the multi-strategy was up more than 6% with a beta below 0.30.

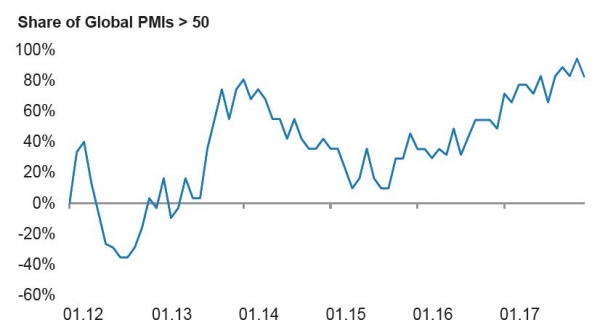

The main difference with previous years is an improvement in the environment for alpha generation. Whether it be Equity Market Neutral or Arbitrage strategies, most managed to make good money. While the first style profited from a decrease of the intra-stock correlation not seen since pre-2008, the second gained from volatility in the bond market. We expected it should help Macro Discretionary managers, too. Unfortunately, those who stayed away from equities and emerging markets struggled as they were on the wrong side of the trade all year, e.g. long USD and short US government bonds. The improvement of the other economies and a weak inflation outlook completely subverted the great expectations for these trades.

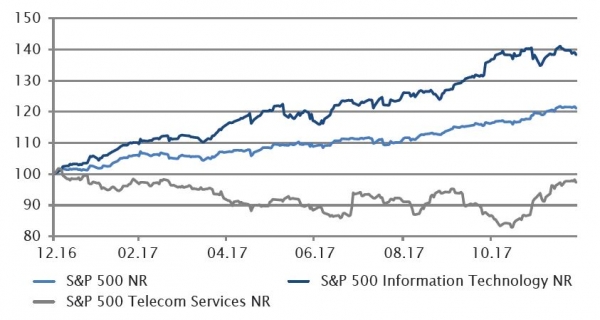

Thanks to the rally of risky assets, it was not a surprise the biggest winners were the beta bias strategies like Technology Equity Long/Short and Emerging Market strategies. The largest gains came from China Equity Long/Short managers.

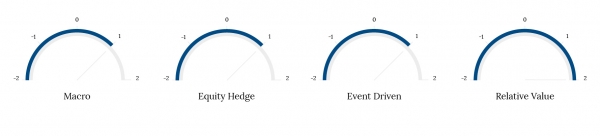

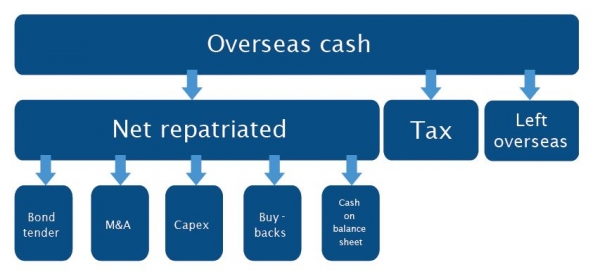

In 2018, we should expect to see an improvement for the hedge fund industry as market normalisation will continue. Federal Reserve tightening and tapering in Europe should profit rates trading and increase opportunities in the equity markets. In addition to equity dispersion, US tax cuts, which will increase corporate activity and give opportunities to stock pickers, should benefit the equity strategies, namely Long/Short Equity and Event-Driven. At the end of this document, you can read our conviction on machine learning.