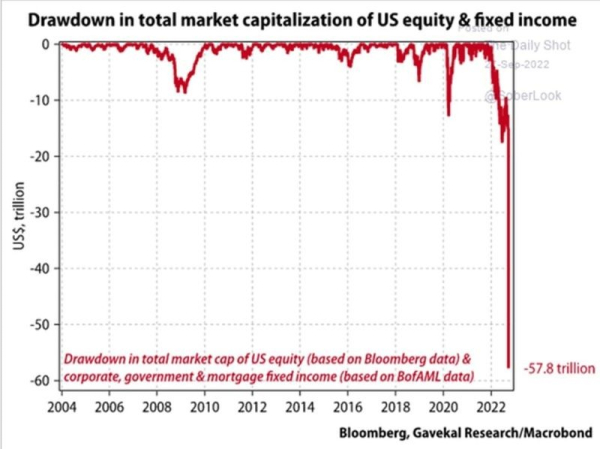

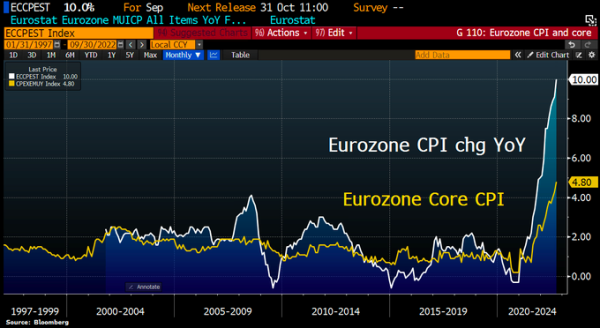

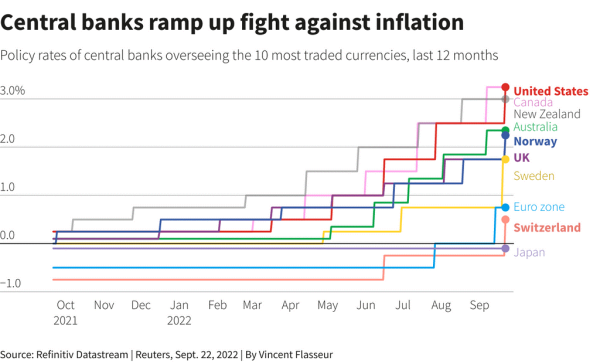

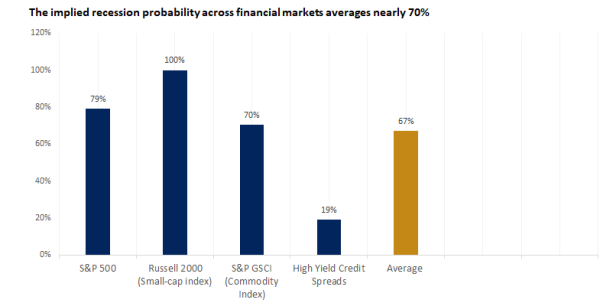

The third quarter was a very volatile quarter for financial markets with an astonishingly wide set of declines across all the major asset classes. Indeed, after a dismal first half of the year, the vast majority of asset classes recorded a negative performance during Q3, as investors grew increasingly concerned about a looming recession due to a combination of hawkish central banks, major disruptions to Europe’s energy supply and looming sovereign debt crisis in the UK and potentially in Italy.

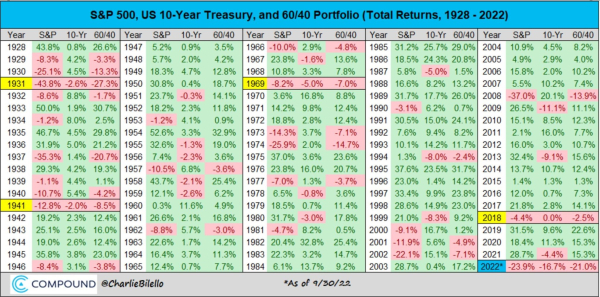

In spite of a strong performance in July, the major equity indices all lost ground due to a decline which accelerated towards the end of the quarter. For both the S&P 500 (-4.9%) and Europe’s STOXX 600 (-4.2%), this is the first time since the Great Financial Crisis that they’ve lost ground for 3 consecutive quarters, with their year-to-day losses standing at -23.9% and -18.0%, respectively.

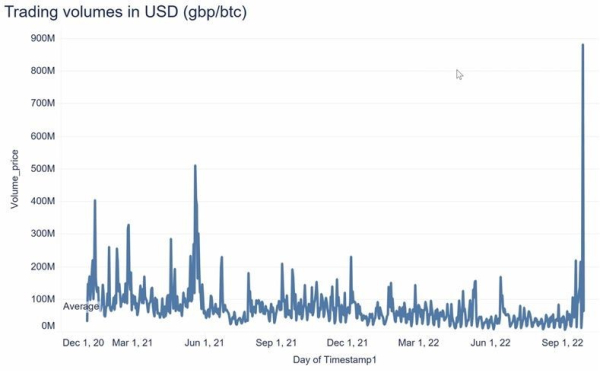

Due to persistent inflation and central banks that were more hawkish than expected, sovereign bonds had another poor quarterly performance. Gilts (-14.0%) were the worst affected given the market turmoil in the UK, although both US Treasuries (-4.4%) and European sovereigns (-5.1%) still lost significant ground. Combined with the losses over Q1 and Q2, that brings the year-to-date decline for US Treasuries to -13.4%, and for European sovereigns to -16.7%.

On the credit side, every single credit index we follow lost ground, across each of USD, EUR and GBP – and this for the 3rd consecutive quarter. GBP credit was by far the worst performer, with Investment Grade non-financial down -12.7% over the quarter, compared with -3.2% for EUR and -5.1% for USD.

After a strong first half of the year, there were broad-based declines across different commodity groups in Q3. Both Brent crude (-23.4%) and WTI (-24.8%) saw their worst quarterly performances since Q1 2020 (Covid lockdown). On a monthly basis, Brent Crude has now declined for four consecutive months for the first time since 2017. Both precious and industrial metals also struggled over Q3, with copper (-8.1%) and gold (-8.1%) losing ground as well.