The threat of new variants and the lack of vaccines in several large emerging economies is sadly keeping the pandemic’s risks alive for the second half of the year. Still, global economic growth is on a positive trend for the coming months.

Summer is finally here in Europe, and with it comes a sense of return to normality in our daily lives

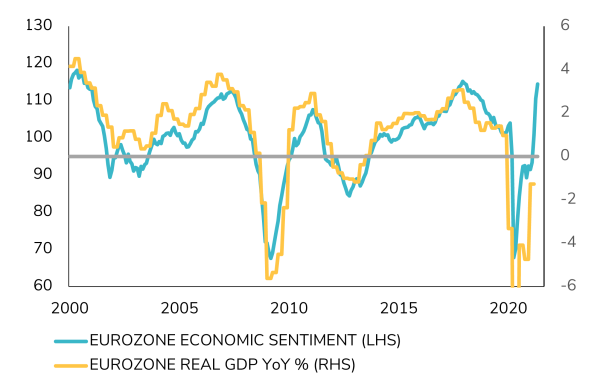

Tuesday, 07/06/2021Shops have reopened, restaurant terraces are crowded, office spaces filling and traffic jams back as Covid-related restrictions ease after the vaccine rollouts. As a result, economic activity is picking up across the continent, and remains strongest in the United States.

Among developed economies the US continues to lead the recovery. So much so that the debate has shifted from lingering pandemic-related risks to concerns of possible overheating and excessive inflation. It is still too early to see this shift in Europe, but we expect that a strong recovery over the next three months will trigger the same debate on this side of the Atlantic. The discussion is influencing central banks and governments, as well as moving market sentiment, as we move toward the post-crisis era.

With growing evidence of recovering economic activity, it is logical that attention turns to discussing when the huge central bank and government support provided over the past year will be phased out. The timing must strike a delicate balance. Any premature or disorderly removal of support risks derailing a recovery that still largely depends on it.

The most recent meeting of the US Federal Reserve highlights the challenge facing policymakers around the globe. They must adjust monetary and fiscal policy to meet the demands of an improving economic environment without undermining growth.

In acknowledging the improving situation of the US economy, the Fed has advanced expectations of monetary policy normalization, in other words the timing for tapering its injections of liquidity and hiking short term interest rates. However, the intention remains to keep financing conditions highly supportive for an extended period, in order to fully heal the pandemic’s deep economic scars.

The transition from a ‘crisis policy’ to ‘recovery and normalization’ can generate uncertainty on the timing and extent of the process, its short and long-term impact on growth , inflation and financial markets. The US central bank will closely monitor financial conditions to avoid repeating the experience of December 2018, when high yield companies lacked access to financing, and ultimately led to a policy u-turn beginning January 2019.

For now, the very supportive mix of monetary and fiscal policy is firmly in place across developed economies. The reflation at play since the end of last year will extend and continue to fuel equity indices’ advance in the coming months. The environment should also continue to favor cyclical segments of the equity market, at both the sectorial and geographical level.

Our allocation to equities, consistent with these themes since the beginning of the year, does not yet therefore need adjustments. We maintain an elevated exposure to equities in general, with a tactical tilt toward cyclical sectors and markets, in order to offer the best return prospects for the months ahead. Conversely, the fixed income allocation in general warrants some caution, especially on long-term bonds that are prone to further upward pressures on interest rates.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)