In Switzerland, February is usually the time when families head off to the mountains for a week of skiing. This year, we were particularly lucky. There was a profusion of snow and near-perfect weather conditions over the children’s holidays. The warm afternoons were nap-inducing, after a well-deserved meal on a scenic terrace. Who doesn’t dream of a beautiful sunny day skiing in the crisp mountain air? With fresh powdery snow, this may come quite close to paradise. Unfortunately, however, every year, snow avalanches cause many accidents, ruining the lives of such blissful families.

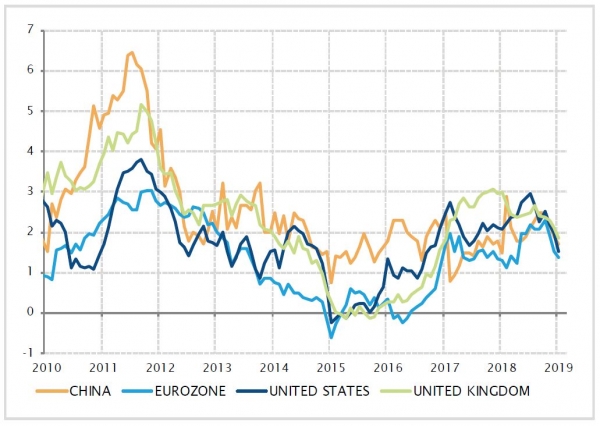

The current market environment is reminiscent of both the good and bad memories associated with skiing. Valuations improved at the end of last year, finally giving investors some fresh powder to ski on. Weather conditions were cleared by the Federal Reserve’s U-turn and reinforced by dovish stances in other developed markets. With no inflationary clouds on the horizon, we enjoyed a smooth ride through financial markets year-to-date. While we may regret not having benefitted more from the last two months of this smooth journey, now is not the time to try and extend the experience. This would only increase the risks and potential difficulties ahead. Avalanche hazards are mounting as the snow crust becomes less stable. In other words, valuations are less appealing because central bank reassurances have led, once again, to exaggerations and crowded trades. How can $8-9trn of government debt with negative yield be justified, if not through financial repression by the central banks?

The current market rally has gone too far too fast. Being aware of the rising avalanche risk, we are keeping a cautiously neutral stance in our portfolios. We took some profits and implemented hedges through options strategies on the equity side, as well as on the fixed income side. Even gold’s appeal now seems tactically less shiny. It’s definitely time for a pause on a sunny terrace.

_Fabrizio Quirighetti