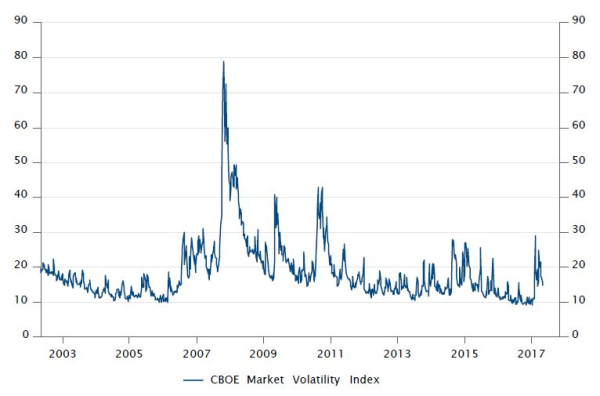

Investors have enjoyed many fruitful years since the 2008 financial crisis, with asset classes having risen steadily in value pretty much across the board as central bank intervention has inflated their prices. There have been relatively few interruptions to their increases over this time, and such was the calm ride that investors enjoyed through the end of 2017, many seemed to have been fooled into thinking that volatility was a thing of the past.

The events of the first quarter of 2018 shattered this perception as concerns about inflation combined with stretched equity valuations led to volatility returning with a vengeance.