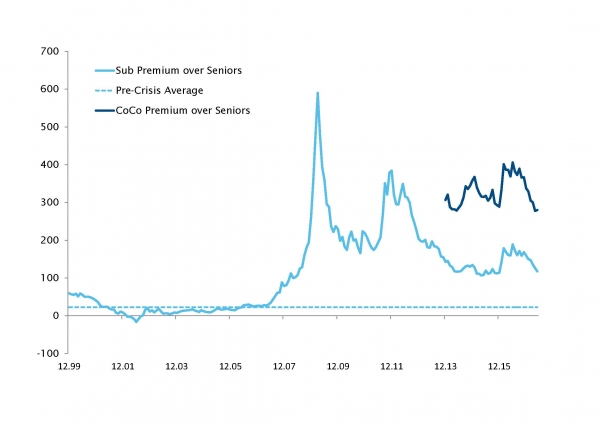

European subordinated bonds have proved to be one of the best-performing fixed income assets of 2017. In our view the strong run experienced so far – supported by strong data - is far from over and further gains will be available to investors. On both an absolute valuation and relative to other fixed income assets basis, there are compelling reasons to expect that subordinated debt will extend its attractive 1H 2017 performance going forward.

Take first the relative performance argument. By analyzing total returns for a set of fixed income indices and their moves from December 2015 (hence including market drawdown of January-February 2016), we can see that, notwithstanding the recent outperformance, subordinated bonds indices have barely caught-up with European high yield but lag way behind US high yield.