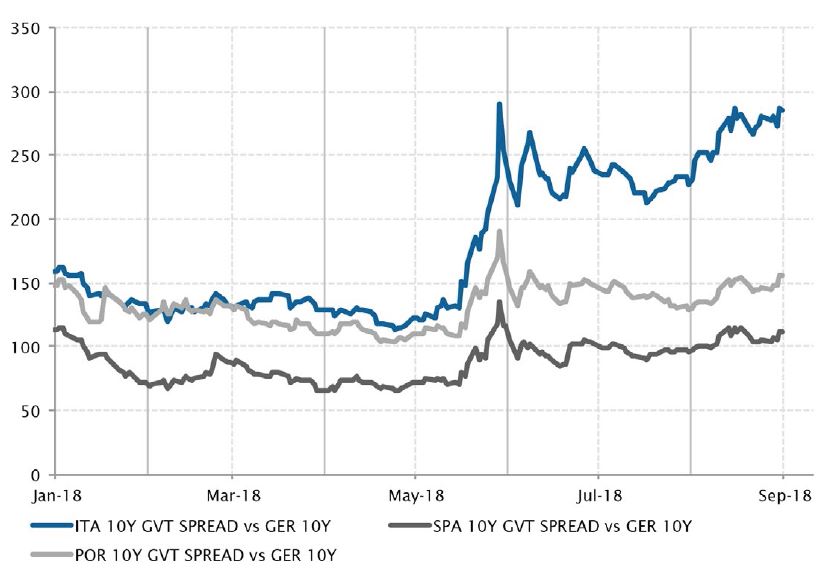

- 6. Fixed income – Italian stress doesn’t spread to Spain and Portugal

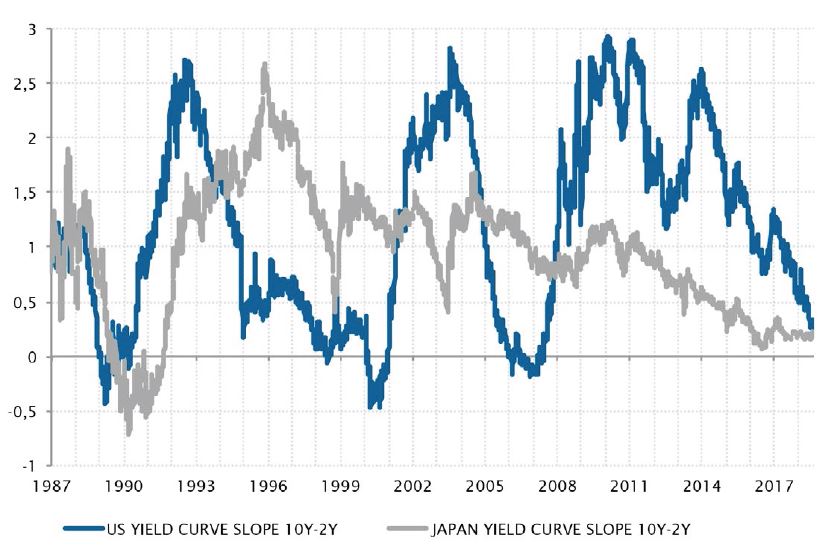

- 7. Fixed income – US yield curve gets flatter than the Japanese one

- 8. Equities – Not all equities are born equal this year

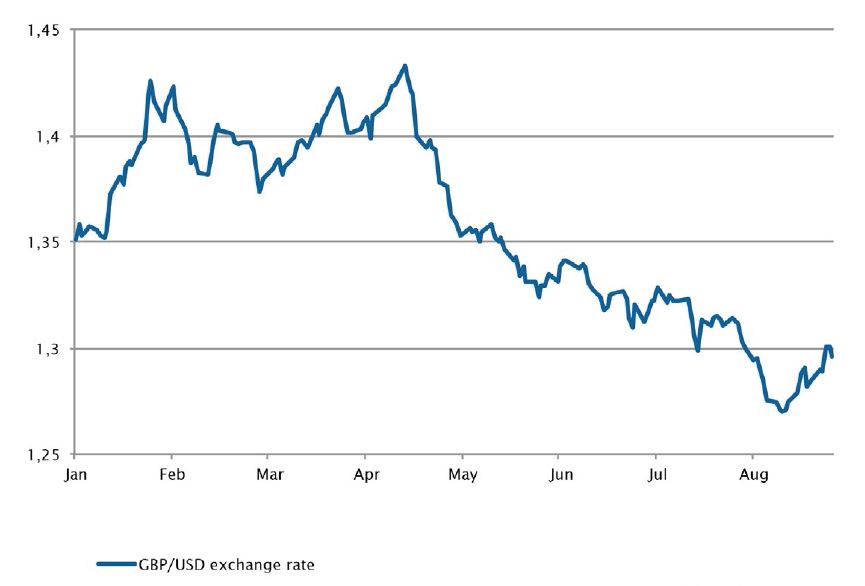

- 9. Forex – GBP under pressure with Brexit negotiations entering final phase

- 10. Forex – Turkish lira crisis intensifies

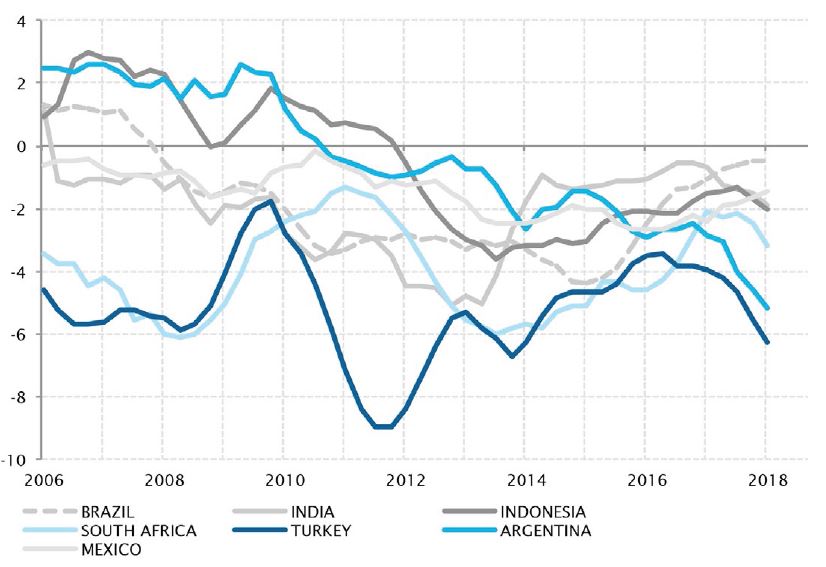

Not an EM crisis, rather a ‘fragile country’ crisis

This summer, financial markets were shaken by an old unpleasant tune. The sharp depreciations of the Turkish lira, the Argentine peso and to a lesser extent the South African rand were reminiscent of previous emerging market crises. With ongoing US-led trade tensions and softening global growth, fears Turkey, Argentina and South Africa were presages of a broader problem weighed on financial markets.

However, investors should keep in mind these three economies share common domestically-engineered fragilities and are not necessarily accurate indicators of the emerging world as a whole, let alone the global economy.

A combination of fiscal profligacy, inflation, excessive reliance on external funding and political instability largely explains the difficulties facing these economies. Global factors such as US dollar strength, higher US dollar rates and rising oil prices are merely additional headwinds further complicating an already unsustainable situation. Proof of this is the fact economies with sounder fundamentals did not experience significant contagion beyond a risk aversion-driven currency pullback.

Turkey and Argentina crisis-prone due to endogeneous fragilities

Sources: Bloomberg, SYZ Asset Management. Data as at: 31 August 2018

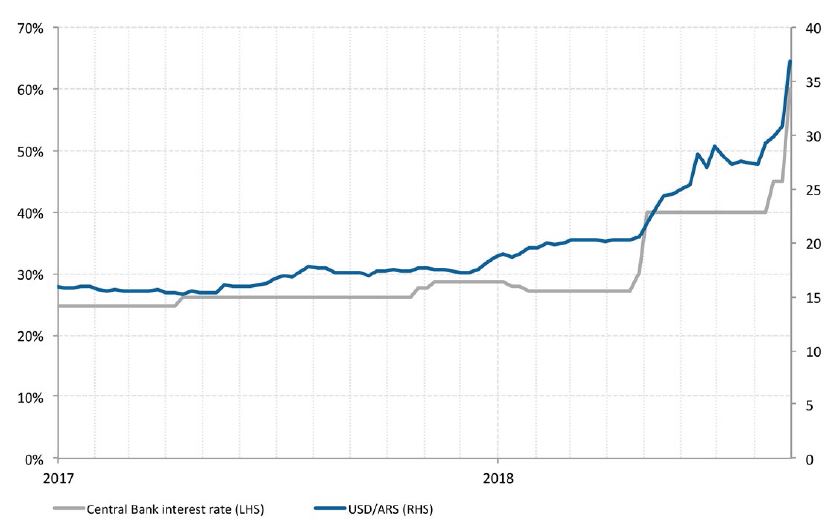

Argentina’s peso hits new low

Sources: Bloomberg, SYZ Asset Management. Data as at: 31 August 2018

Argentina – Crisis of confidence resumes

Following the International Monetary Fund’s $15bn loan to Argentina in June, President Macri’s request to the International Monetary Fund for faster payments from the $50bn line of credit increased pressure on the peso, which plummeted 18% in two days.

The central bank failed to halt the peso sell-off and prevent the currency from reaching a record low, despite hiking its benchmark interest rate to 60% one day after Macri’s announcement. Earlier this month, the central bank had already unexpectedly raised interest rate by 500bps to 45% to stem the currency decline amid risk-off sentiment in EMs caused by Turkey’s crisis. The Argentine peso fell by 26%, posting its largest monthly decline since 2002 – when the country abandoned the fixed exchange rate regime.

Unlike Turkey, Argentina complies with an orthodox monetary policy and has secured financial support from the IMF. However, investors are jittery given the country’s weak fundamentals – a larger fiscal deficit and higher inflation than Turkey.

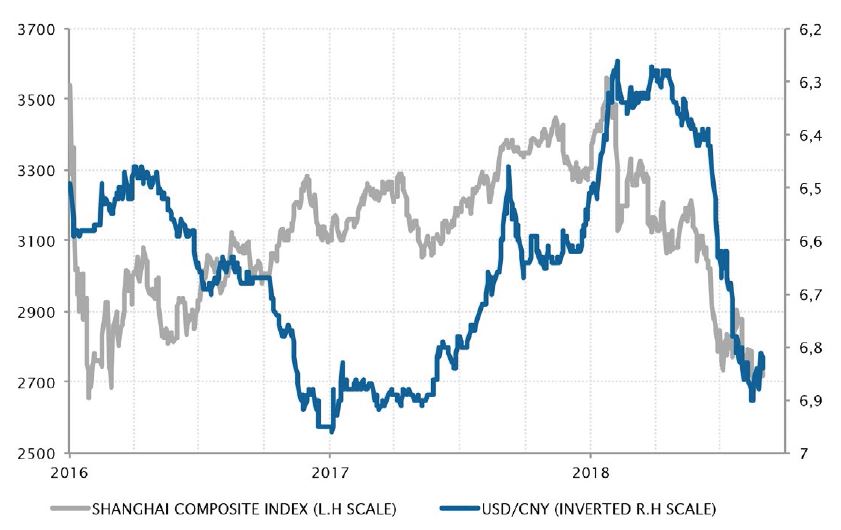

China – Equity markets and currency extend their decline

Chinese equity markets extended their downward trend. They were down 15% year-to-date at the end of August, clearly underperforming the MSCI Emerging Markets Index, which was down 7%, not to mention the MSCI World, up by 5%, and the S&P 500, up 10%.

Headwinds have been piling up for China this year: a slowdown in domestic demand caused by forceful credit tightening at the end of 2017, capital outflows undermining the currency, the imposition of US tariffs on a growing share of Chinese exports and specific US actions targeted at Chinese tech companies.

While trade tensions with the US are unlikely to dissipate anytime soon, the reversal of economic policies undertaken this spring – through monetary policy easing and targeted fiscal stimulus – and the impact of a weaker yuan – back down to its 2016 low – should feed through economic activity in the months ahead and eventually ease off downward pressure on Chinese assets.

Chinese assets have been under heavy pressure this year

Sources: Factset, SYZ Asset Management. Data as at: 31 August 2018

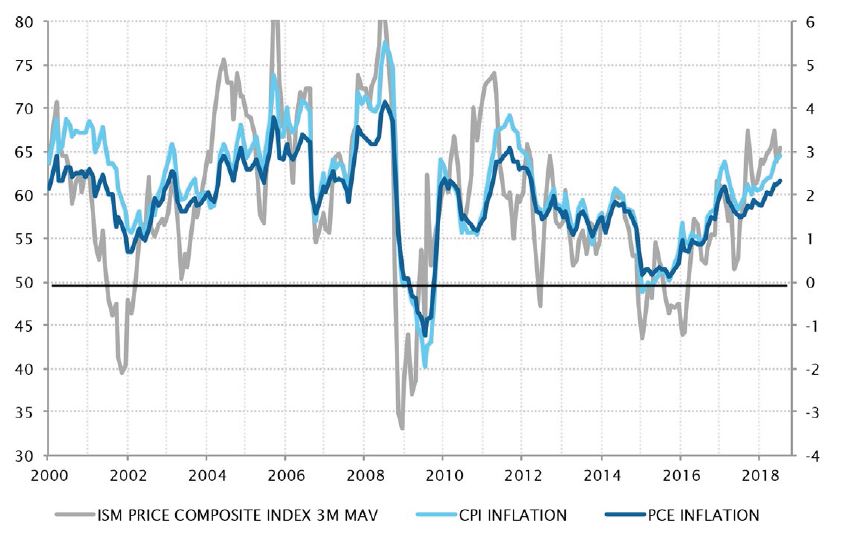

Inflation indicators are all up this year. Can they go higher?

Sources: Factset, SYZ Asset Management. Data as at: 31 August 2018

US – Inflation has finally taken off but can it go higher?

For a long time, waiting for inflation was like Waiting for Godot in the United States. This year, finally, price and wage gauges started trending up, eventually reaching levels in line with the Fed’s mandate.

Consumer price inflation now sits above the Fed’s 2% target, even when excluding the impact of higher energy prices. The cost of employment has also accelerated as labour market tightness is finally translating into upward pressure on wages.

The question now is whether this upward trend will carry on, forcing the Fed to tighten monetary policy more forcefully, or whether current inflationary rates are already the most a booming US economy can generate. Structural downward pressures on inflation in goods and services – coming from technology, production capacities and competition – suggest little scope for runaway inflation acceleration in the future. Recent data also point to a stabilisation at current levels.

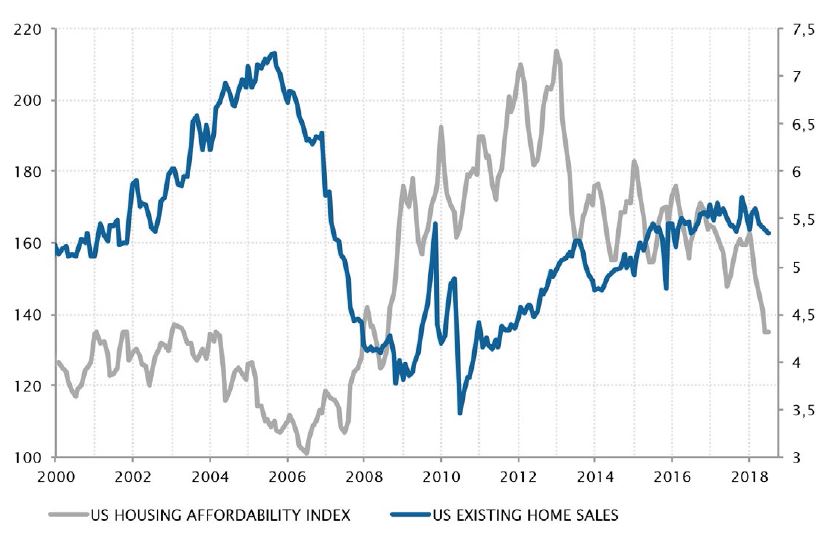

US – Housing markets stalls in 2018

A decade after the real estate-induced recession, home sales have recovered from their trough but remain far from levels reached in the mid-2000s. Mortgage delinquencies have also dropped back down to historical low levels, with no sign of picking up.

Despite a growing economy and low unemployment rate, residential real estate seems to have stalled in 2018 – contributing negatively to GDP growth in the first half of the year. New housing starts dropped during the spring, while existing home sales declined in July to their lowest level since early 2016.

Such developments may be the consequence of the combined steady increase in home prices – up 8% per annum since 2012 – and the rise in mortgage rates since 2016 – with average 30-year fixed rates going from 3.6% to 4.8%. These two elements have led to a drop in housing affordability – down to its lowest level in a decade – and means the housing market is no longer a driver of US growth.

As housing becomes less affordable, sales stall

Sources: Bloomberg, SYZ Asset Management. Data as at: 31 August 2018

Spanish and Portuguese spreads barely affected by Italian tensions in August

Sources: Bloomberg, SYZ Asset Management. Data as at: 31 August 2018

Fixed income – Italian stress doesn’t spread to Spain and Portugal

Italian government bonds were once again in the spotlight in August: 10-year government rates reached their highest level since 2014 and their spread with German counterparts climbed back to May’s five-year high. Fears of fiscal misdemeanour by the new government fuelled investors’ concerns.

Unlike in May, however, there has been very little contagion to other government spreads in the eurozone. Spanish and Portuguese bonds, once highly sensitive to ‘peripheral’ risk, withstood the rise in Italian risk almost without damage.

The improved growth dynamic and debt trajectory in these two economies, a consequence of the structural reforms undertaken at the peak of the sovereign debt crisis, warrant serious consideration from investors. Pro-European governments in the Iberian Peninsula also ensure they will be supported by European institutions and mechanisms in case of market pressure, something Italy cannot take for granted, given the eurosceptic rethoric of its current government.

Fixed income – US yield curve gets flatter than the Japanese one

The flattening of the US yield curve has already been a topic of conversation throughout the year as the Fed has steadily raised short-term rates and long-term rates have failed to decisively break the 3% threshold amid global growth concerns.

Turmoil in Argentina and Turkey led to another flight to quality in August while positive US data further supported the case for Fed monetary policy normalisation. Consequently, the slope of the US yield curve flattened to a new cyclical low. A difference as narrow as 19 bps between the 10-year US treasury rate at 2.84% and the 2-year at 2.65% has not been observed since summer 2007.

Interestingly, this made the US yield curve flatter than the Japanese one – although rates were much higher in absolute terms. Sustained global risk aversion preventing long-term rates from rising, while the Fed keeps hiking, now threaten to cause the dreaded inversion of the yield curve, prophetic of a recession.

The US yield curve got flatter than the Japanese one in August

Sources: Bloomberg, SYZ Asset Management. Data as at: 31 August 2018

High dispersion among equity indices

Sources: Factset, SYZ Asset Management. Data as at: 31 August 2018

Equities – Not all equities are born equal this year

Since February and March, there has been a large and unusual divergence in equity indice performance across the world and across sectors. US equities, especially the tech sector, have posted strong gains, while the rest of the world has struggled. Emerging markets, and more generally value stocks outside the US, have lagged far behind, exhibiting dark red year-to-date performances.

This is not only the result of Trump or trade war concerns, Fed tightening, a stronger dollar and a dimmer economic outlook outside US have also played a major role.

What will happen next? Will the rest of the world catch up, or will the handful of large US companies, where gains have been concentrated, fall off the cliff?

Forex – GBP under pressure with Brexit negotiations entering final phase

After registering losses over many months, the British currency finally rallied on signs a Brexit deal could be achieved. Despite good economic numbers, sterling has so far been under pressure, suffering losses due to uncertainties around Brexit discussions and market anticipation of a ‘no-deal’ outcome. The currency depreciated circa 12% of its value since April, remaining vulnerable to any Brexit news.

Entering the final stage of negotiations, talks between the EU and the UK intensified, as both parties have strong incentives to strike a deal. The mood reversed towards the end of August as Michel Barnier, the EU chief negotiator, said it would be ‘realistic’ to reach a deal with the UK within the next eight weeks.

The announcement immediately generated a positive response in markets, as the news came amid fears a ‘no-deal’ Brexit was on the cards.

The pound bounced back

Sources: Bloomberg, SYZ Asset Management. Data as at: 31 August 2018

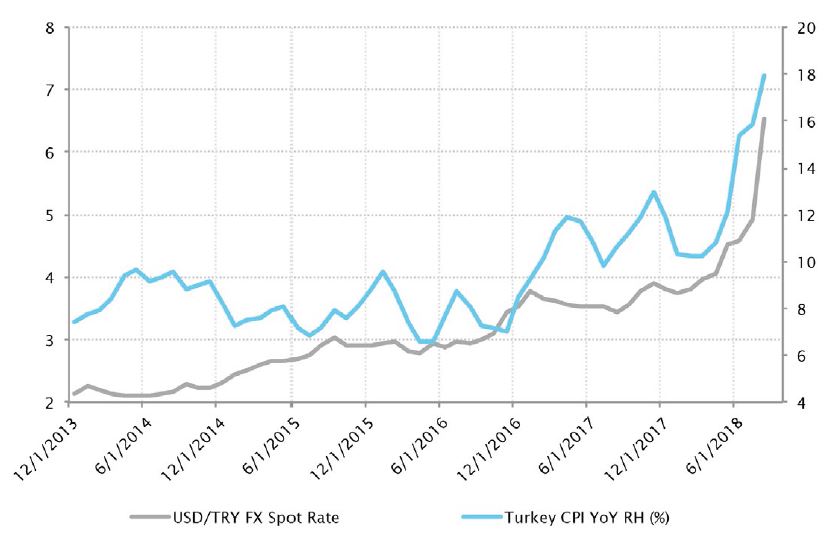

USD/TRY FX Spot Rate and Turkish CPI (YoY in %)

Sources: Bloomberg, SYZ Asset Management. Data as at: 31 August 2018

Forex – Turkish lira crisis intensifies

August was the worst month in a long time for the Turkish currency. The lira dived more than 25% against the US dollar, bringing its year-to-date performance to -41.9%.

All Turkish assets have been under heavy pressure since the US administration implemented sanctions on Turkish ministers in relation to the detainment of an American pastor in Turkey.

This new element came into play as the economy was already experiencing a crisis characterised by unorthodox monetary policy, an autocratic president, high inflation, weak growth, a ballooning current account deficit – which largely needs to be financed by capital inflows – and a large external debt stock – of more than 50% of GDP.

In this fragile context, inflation print for August accelerated to a 15-year high of 17.9% year-over-year, with further risk which could send the next CPI numbers even higher.

Market participants are impatiently waiting for a significant rate hike at the next Central Bank of Turkey meeting.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)