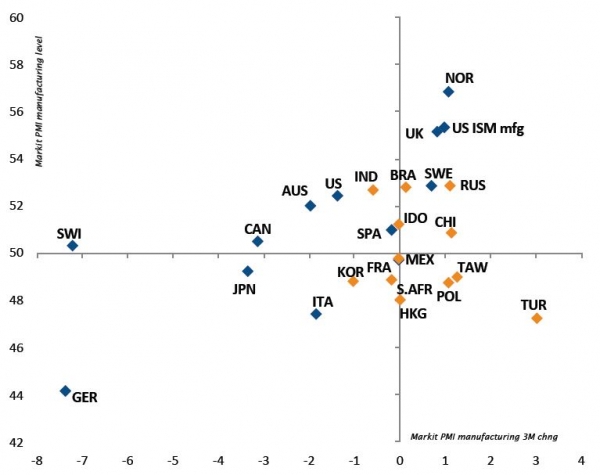

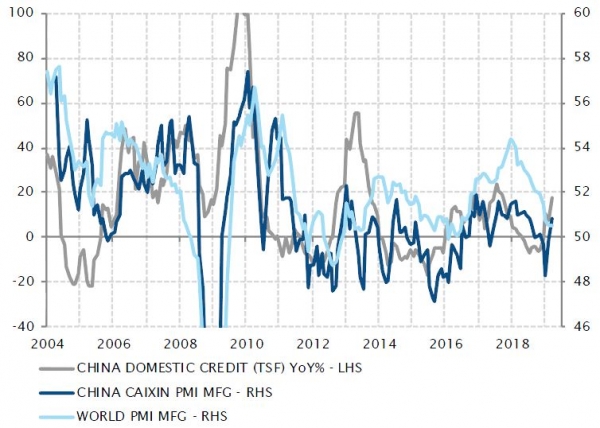

The adage says, ‘sell in May and go away’. But for most investors like us who weren’t brave enough to add at the bottom, the fear of missing out (FOMO) has finally risen, like the White Walkers in Game of Thrones, from beneath the ice-cold bear market sentiment. Markets and asset prices are once again supported by a goldilocks context, which was reinforced by dovish central bank messages, decent growth prospects – evidenced by solid US job creation and signs of improvement in Chinese economic indicators – and still no signs of inflationary pressures following muted US wage growth and lower-than-expected CPI figures in Australia. While we acknowledge this scenario won’t last forever, its end has likely been postponed by a few weeks or months.

It would seem legitimate to follow the crowd, raise our risk stance and add to equities, as the backdrop couldn’t be more favourable. However, it could prove much wiser to resist this move. Overall valuations are no longer attractive enough and upside potential now appears quite limited. With US stocks having regained their losses from the end of last year and reached fresh highs, the exuberance of FOMO is shrinking confidence in the market’s ability to keep climbing. In other words, the more White Walkers are on the ice because it seems rock-solid, the more cracks will start to appear. It also goes without saying, venturing out makes them an easier prey for the fire and fury of dragons – in this case, the bear market’s revenge. As a result, we have preferred to tilt and tweak our equity allocation towards cyclicals and away from defensives rather than significantly adding to it. The main risk of staying cautiously put is we could miss an important upward trend if equity markets enter a bubbling environment.

So, we humbly admit we should have been braver a few months ago, but it is not always easy or obvious to behave like a knight in shining armour. In any case, the bravest aren’t always the ones who survive the longest – both in Game of Thrones and in financial markets.

_Fabrizio Quirighetti