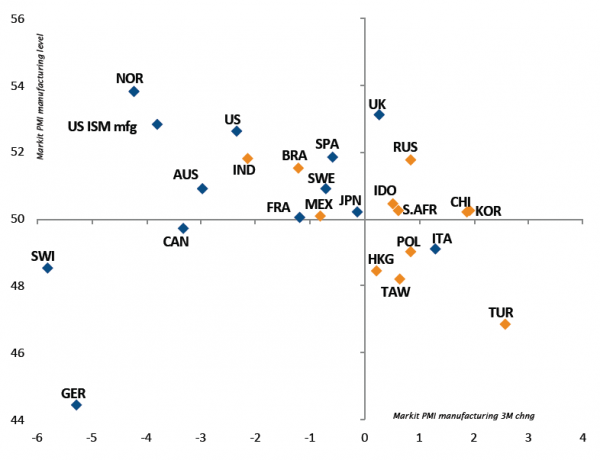

Let’s get straight to the point – disappointments and concerns are mounting. First, economic growth momentum remains weak. While our scenario from the beginning of the year anticipated a more clear-cut rebound by now, tentative signs of a pickup in Chinese or European activity have been dashed by the most recent news flow.

Second, thanks to President Trump’s tweets, trade war headaches are back. Tariffs per se should not push the economy into a recession. However, related uncertainties are counterproductive, limiting the odds of a quick and sharp improvement in the business cycle. The deterioration of sentiment will act as drag and source of volatility on risk-on assets, especially equity markets.

Strong year-to-date returns were made on the back of a more accommodative US monetary policy, as well as expectations of improving growth and a resolution to the tariff situation. But it is difficult to get excited by the sustainability of a market rally that consists of expanding valuations in a slowing earnings environment. In other words, markets have likely run ahead of themselves.

Fortunately, the lack of any inflationary pressures and the Federal Reserve’s U-turn at the beginning of the year, combined with easy-for-longer monetary policies across developed markets, are providing some support and liquidity, especially to fixed income markets.

As a result, it seemed quite obvious for us to reduce beta and volatility, taking some profits on the most cyclical part of the equity allocation, especially after strong year-to-date gains. However, we are keeping some carry in the fixed income space, particularly in emerging market hard currency debt. As the saying goes, a bird in the hand is better than two in the bush.

_Fabrizio Quirighetti