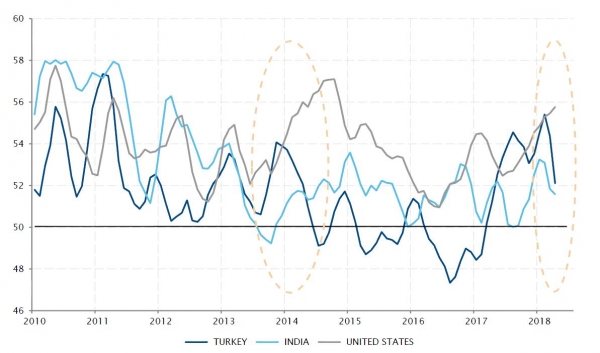

Markets continue to muddle through against an overall supportive economic backdrop, with assets fully or fairly priced. At the margin, there is currently a divergence between the US and the rest of developed markets in terms of growth, inflation and monetary policy dynamics. Consequently, the mix of a stronger greenback and higher US rates is making emerging market central bankers’ lives less easy, as illustrated by recent monetary policy decisions, which either tightened severely or backtracked suddenly from further easing.

We believe that this divergence shouldn’t last for long. Europe and Japan are probably experiencing a mid-cycle slowdown, or rather a temporary pull back after the surprisingly strong growth experienced in 2017, but inflation should start to creep higher in these economies too and the ECB’s narrative may turn less dovish as soon as next month. To some extent, the divergence may even help the ECB to put some indirect pressure to the new Italian government to ensure it continues complying to fiscal discipline.

The stabilisation of asset correlations and asset volatility, as well as lower-than-expected inflation and wage data, is encouraging. Especially as this reduces the evidence that the market is overheating, which is taking pressure off the Federal Reserve to tighten aggressively. Oil at this level shouldn’t be a trouble maker on either the inflation front or on US growth. The temporary uptick in headline inflation won’t impact the Federal Reserve’s outlook, while investment spending on energy-related sectors may compensate to some extent for the drag on consumption. Thus, we believe there is no need to change our preferences on risk and duration, kept respectively in a mild preference and a mild disinclination.

However, a more balanced equity allocation is now required as the global economy is more of an expansion than a recovery phase, inflation is grinding gradually higher and yield curves are flattening on the back of monetary policy normalisation. Furthermore, the relative valuation of defensive versus cyclical assets has generally improved over the last few months. As a result, we are diluting our cyclical bias by starting to build positions in defensive sectors, such as healthcare, and by downgrading both the Eurozone and Japan to a mild disinclination. Their valuations deteriorated recently and they could be penalised further either by their currencies rebounding or by more growth disappointment if we are proved wrong.

_Fabrizio Quirighetti