Looking in the rear-view mirror, the main introspection from critics would be that investors have been slightly too cautious too early on risky assets. While our economic backdrop analysis was and still remains globally upbeat, lofty valuation levels on equities, especially in the US, and in the credit space (more precisely in the High Yield segment) has impeded us to be braver so far. Thus, it sounds legitimate wondering if we are not waiting for Godot…

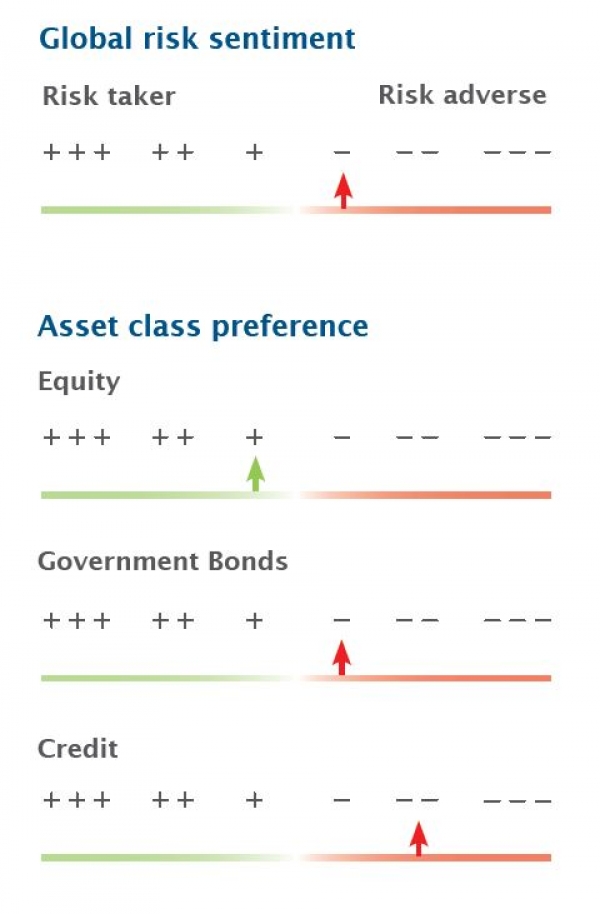

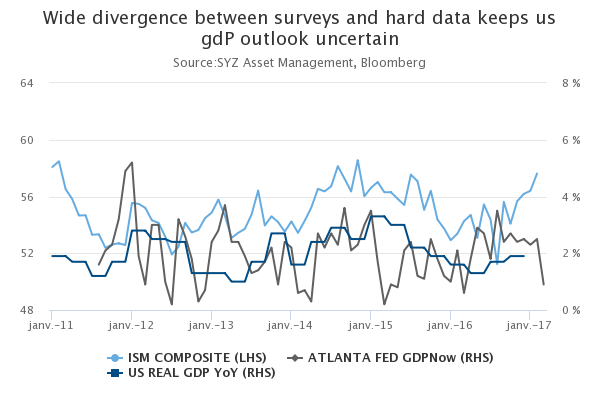

We don’t think so. First of all, we haven’t been too pessimistic, but rather cautiously exposed as our tactical risk stance has remained in "mild" disinclination since January. Indeed, we haven’t been calling for a severe market correction but have kept some dry powder to jump in when valuations become more attractive and/or some uncertainties will be lifted. In the meantime, we continue to strongly believe that there is currently asymmetry between the potential gain in risky assets and their potential drawdown, and given these pricey valuations, risk has been allocated more selectively across and within each asset class. Markets reaction following the Fed’s latest hike and the first disappointment of Trump’s policy (immigration, Obamacare) confirmed our views and positioning. Without any significant shifts in the economic outlook and the asset valuation framework, we haven’t found yet any reasons to modify our stance towards risk and duration.

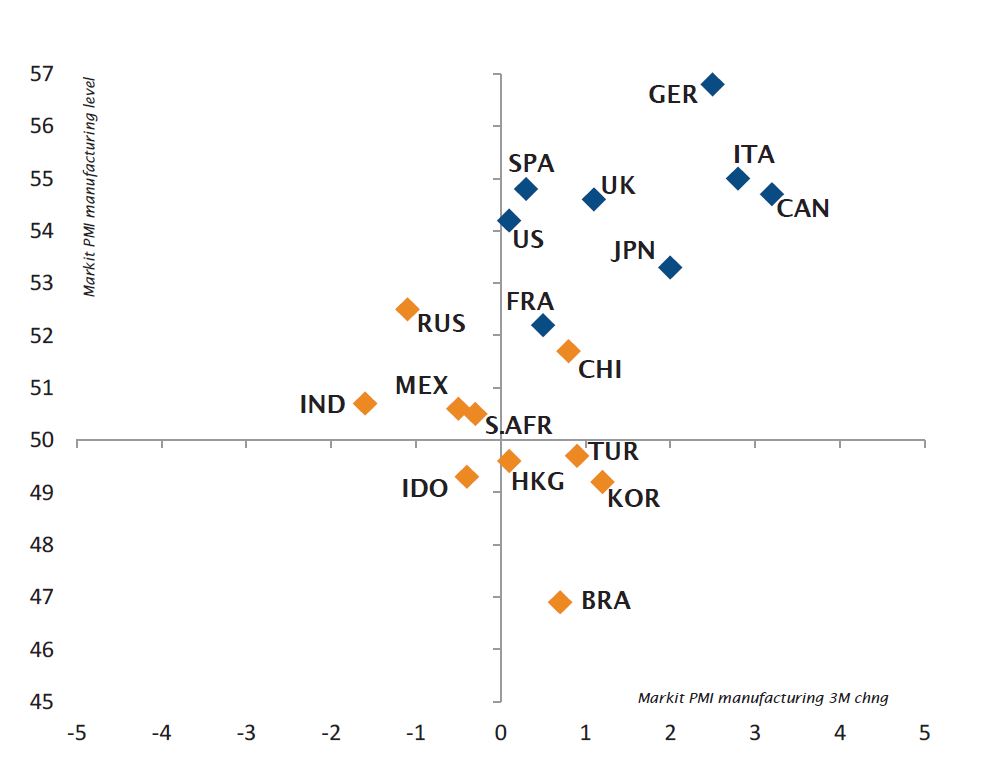

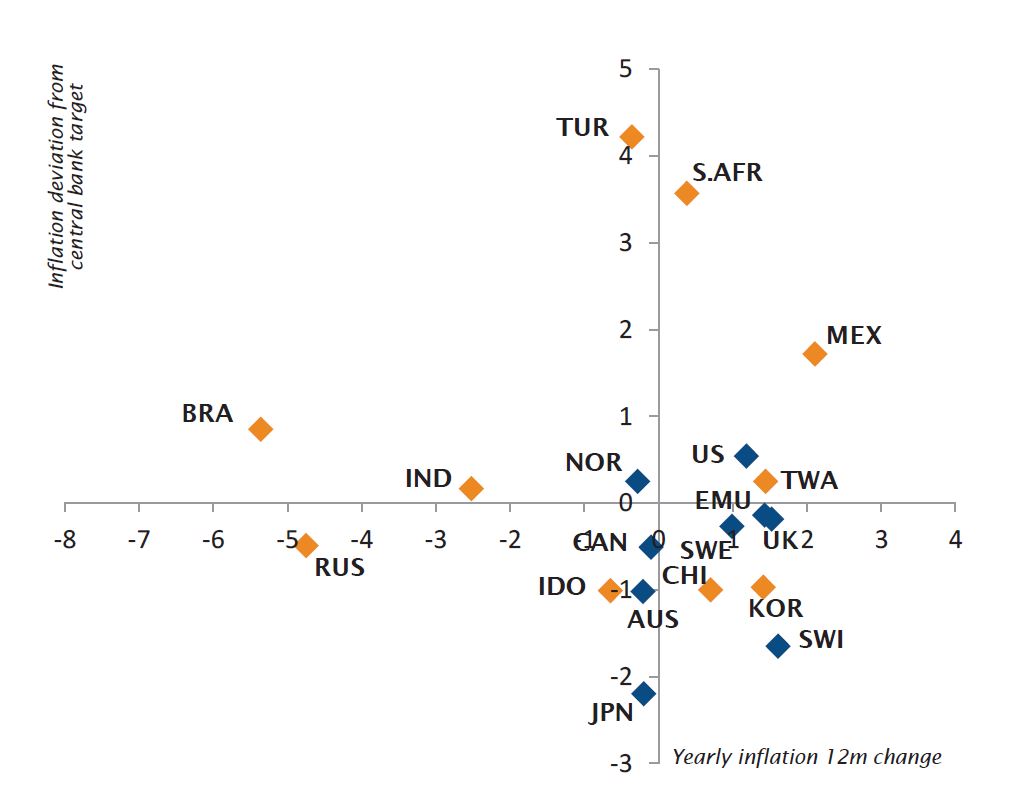

Looking forward, we remain constructive on equities, especially non-US and European equities as they may clearly outperform in the second part of this year when the European political risk premium fades away. For the time being global investors are still distracted by the French elections and Trump’s activity on Twitter, but they will certainly realise at some point that the euro zone’s economic growth is as strong as US and with plenty of catch-up potential. The ECB will sooner rather than later taper and the euro is not (yet) dead. In parallel, the reality check of Trump’s reflationary policy should come below the high expectations already priced in. In this context, our selective favourable stance to some hard and local currency debt should also offer better risk-adjusted returns than US credit for example. And US Treasuries are perhaps less at risk of a major upward repricing in rates than German Bunds or Japanese government bonds.

In this environment of higher Fed fund rates that doesn’t lead to a stronger dollar and a jump in US long term rates, the surprises and thus big changes on markets may now come from other major economic areas or central banks. If we really observe a broad based and synchronised lift in nominal GDP –from last few years depressed levels- the best opportunities lie certainly outside the US equity and credit markets. Godot is really coming.

_Fabrizio Quirighetti