Different reasons may explain the muted reaction on financial markets, such as the ECB backstop on government debt and the fact that this result was largely anticipated, but left most investors surprised by the mild market behavior. So, what else could have played a role?

While it was clear that a ‘no’ vote meant a rejection for the Italian government and its leader, it is less clear for most watching the markets to establish what this vote did not mean. We believe this is where the benign market reaction stands from.

First, differently from Brexit, it did not mean a vote against Europe: while it is true that some of the ‘no’ supporters are also against the EU, most of them have never claimed they want to leave the Union, hence why most of the voters only voted against the government or rejected a badly written reform.

Secondly, this vote does not, and will not, imply Italy will hold anytime soon a new general poll, since the current framework will make it impossible to form a common majority on both chambers. This also means that the odds of a populist government lead by five stars remain low, since they will never accept any alliance and do not have a voting share large enough to do it themselves.

Last, but not least, this is only partially a vote against the establishment, like the Trump election, since Renzi and most of his government are quite new on the Italian political field, and most of the old establishment representatives lead the ‘no’ campaign.

So, what now? Italian president Mattarella, the only one with the power of calling for new elections, already asked Renzi to remain in place until the approval of the financial stability act, and will certainly ask the parliament to support a new government strong enough to guide the country through the economic and international agenda while a new electoral law will be written. While a new government should be formed soon, the full process will take time to get to its end.

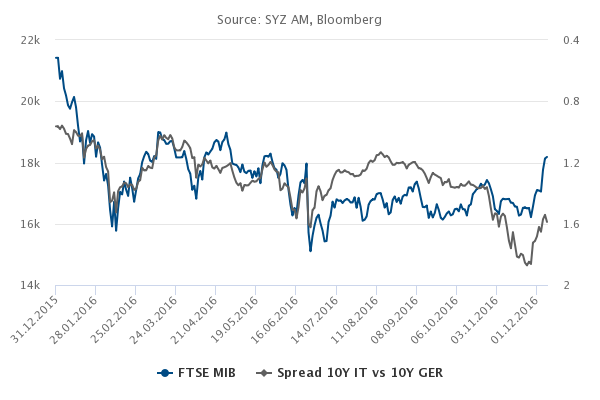

Finally, looking to the markets, while we are not bearish on the medium-term outlook for the country, we see some uncertainties remaining in place suggesting volatility will remain high from the potential stop to the reforms’ agenda to the banking sector issues. In light of this, we reduced our exposure to Italian companies but remained overweight in the region focusing on the highest quality names like Intesa, Generali and ENI in order to benefit from the good risk-reward profile they offer.