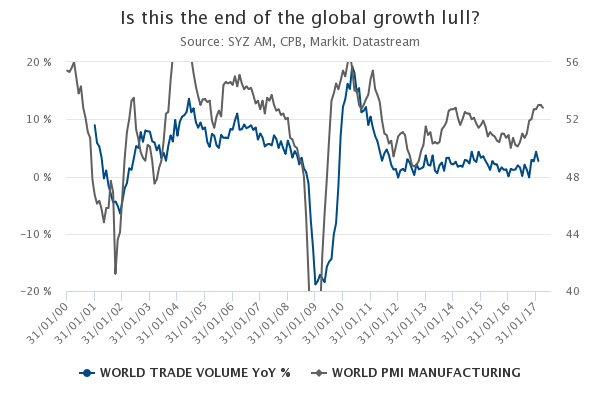

Is this the end of the global growth lull?

Since the summer of 2016, the global economy has experienced a broad-based acceleration. The rebound in energy prices, stabilisation in China, resilient growth in Europe and the end of the rapid US dollar appreciation have been trends helping to engineer a clear improvement in cyclical momentum and world trade.

However, this trend already appears to be fading away. It is not that a sharp slowdown is around the corner, as growth drivers remain supportive in most economies, it is just that the potential for further acceleration appears fairly limited – especially with weakening commodity prices, fading optimism around US fiscal reforms and the negative impact of tighter financial conditions on debt-sensitive economies, such as the US or China.

Early indicators of global momentum have stopped improving in April and the global economy appears unlikely to depart from the 3.5% annual growth rate that has become the norm in the post-2009 area.

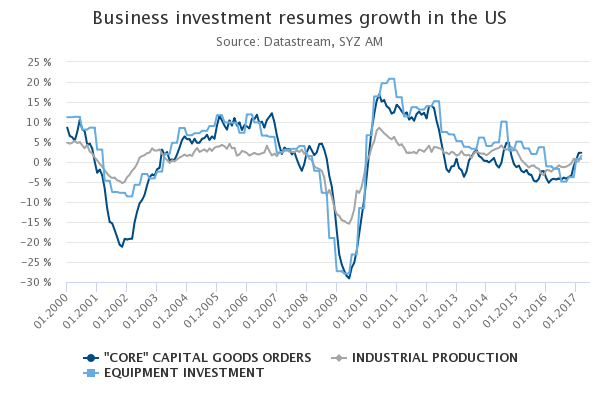

US - Business investment resumes growth

Business investment is finally rising in the US. Having suffered from falling energy prices, US dollar strength and concerns around the political growth outlook, capex has finally improved in the first quarter.

This is an encouraging sign for the cyclical dynamic of the US economy. It dissipates growth downside risks born a year ago and counterbalances the weak overall Q1 GDP data, as positive investment dynamic suggests a growth catch up to come in Q2.

Can therefore growth surprise on the upside? Part of the answer lies in the hands of the US Congress and its ability to rapidly adopt large tax cut packages. But structural factors strongly limit upside risks and the likelihood of any significant positive surprise. Potential US growth stands at 1.8%; industrial capacity utilisation rates stand at their lowest level outside recession periods. Such context clearly limits the potential for a surge in business investment and rather suggests only mild positive growth going forward.

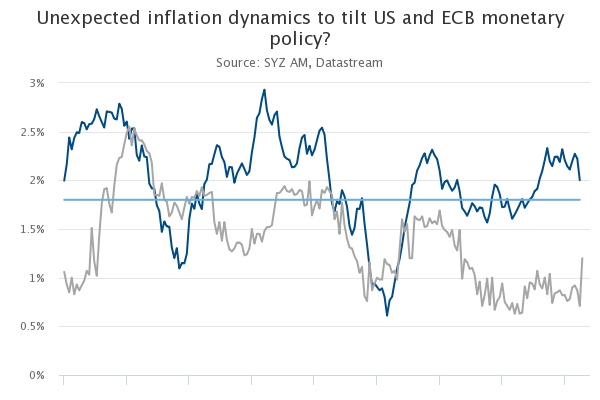

US vs Eurozone inflation and the implications for central banks

Not so long ago, deflation was hovering above the Eurozone and the US. Falling oil prices had pushed headline inflation rates into negative territory and even "core" inflation (excluding the volatile energy and food components) was below central bank targets of 2%.

Things have changed remarkably recently in the US, with the US Fed being able to hike rates twice, with more expected in response to continued improvements in the job market. On the other side of the pond, the ECB has refrained from significantly withdrawing monetary policy support. However, both the Fed and the ECB’s expected paths may be altered in the second half of 2017. The surprising acceleration in "core" inflation in April may push the ECB to consider policy normalisation earlier than expected, on the back of solid economic growth. On the other hand, the lack of inflation acceleration in the US might force the Fed to be more gradual than expected in its rate increase cycle.

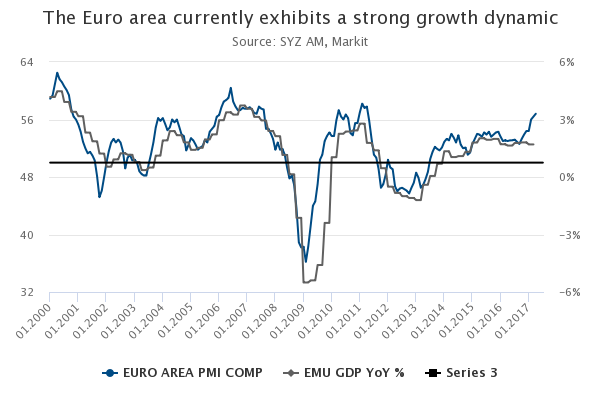

Eurozone - The current global growth bright spots

The Eurozone recorded faster GDP growth compared to the US last year and has managed to replicate this in Q1 2017. What has happened to the ‘depressed’ and ‘hopeless’ Europe of the previous years?

Fundamentals have not changed: potential growth is still higher in the US than in Old Europe. It is just a matter of economic cycle difference: the US growth cycle is in its eighth year and faces gradually tighter financing conditions. In contrast, the European growth cycle is only four years old, with a very accommodative central bank.

On top of this, the intensity of political risk, which has plagued confidence since 2010, is clearly diminishing. This combination explains why Europe is currently able to grow significantly above its long term potential, with leading indicators sending encouraging signals for the second half of the year. The Euro area is currently the global economy’s bright spot. A spectacular reversal of fortunes!

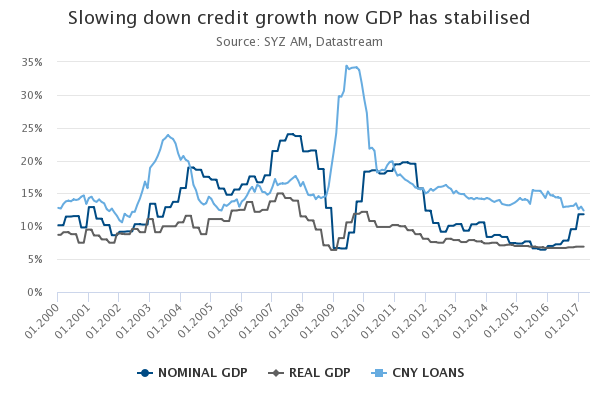

China - Is it time now to slow down credit growth

China’s GDP was up 6.9% year-on-year in Q1, a slight acceleration on last year’s 6.7% rate. On top of this, price trends have reversed and pushed away deflationary concerns, with nominal GDP growth accelerating sharply. A cocktail of fiscal stimulus and weaker currency has helped to engineer this growth stabilisation.

However, it has also been supported by accommodative monetary conditions and continuously rising indebtedness, with credit growth persistently and significantly above GDP growth during the past five years.

Chinese authorities are apparently now willing to cool down the pace of credit expansion. Restraints on liquidity have pushed money market rates sharply up, with the Shibor 3-month rate jumping from 2.8% to 4.3% within six months. This significant tightening in financing conditions is (finally) weighting on credit growth, down to its slowest pace in 15 years. Such a dynamic might be a headwind for China’s growth in the short run, but it is certainly a healthy development in a longer term perspective.

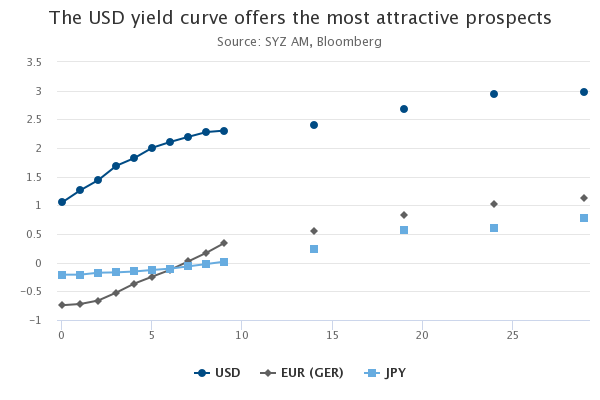

Fixed Income – The attractiveness of the USD yield curve

In the current economic and financial environment, sovereign bonds are often dismissed by investors due to low yields. Government bonds are often viewed as offering low return prospects and large downside risks should rate move upwards.

However, investors forget the return of a bond is not necessarily equal to its yield, as long as it is not held to maturity. Yield curves with a positive slope allow the generation of additional returns thanks to roll-down and have helped, for instance, Japanese insurers to generate hefty returns over the past two decades despite very low JPY rates.

If offered the choice, USD bonds are today the most attractive among the main developed markets. EUR and JPY curves have been kept low by central bank interventions, amid low domestic growth and inflation. This might change. On the contrary, the USD curve already incorporates higher US growth and inflation prospects, with a central bank already in tightening mode. In addition, if risk aversion were to arise, USD rates have the largest potential for protecting diversified portfolios.

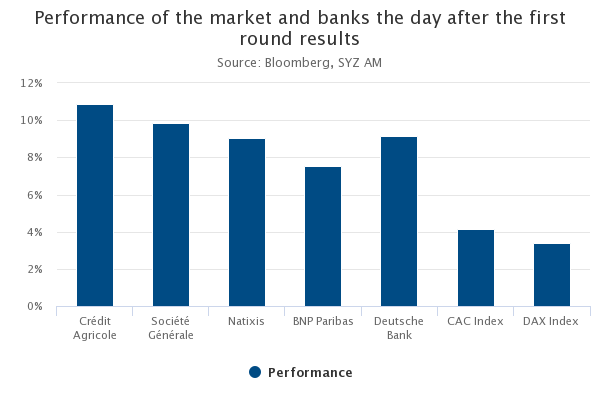

Stock market - European banks are “En Marche!”

After several weeks of political uncertainty and market volatility due to the French presidential election, the relief was palpable following the results of the first round. European indices jumped, led by banks soaring between 7.5% and 10% on 24 April.

While the most feared scenario was a second round with Mélenchon against Le Pen, a duel between Macron and Le Pen, in contrast, was largely viewed as market friendly. Indeed, a victory for Le Pen or Mélenchon, both Eurosceptic and anti-bank, would have jeopardised France’s position in the international business scene, with French banks in the crosshairs.

With Macron an ex-banker and strongly pro-EU, the result has reassured financial markets and French banks in particular. Market risks, as well as political uncertainties, in Europe are now expected to ease due to the high probability of Macron becoming the next president of France.

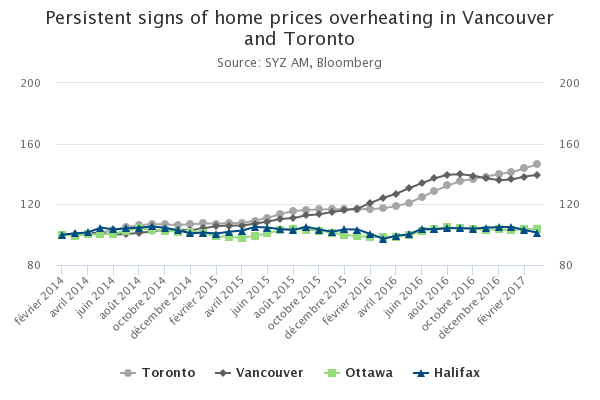

Real estate – Is Canada heading toward a real estate crisis?

The fall of Canadian alternative lender Home Capital Group in April has returned the spotlight on the country’s ‘bubble-like’ real estate problem. Although this company is not systemic for the country, the problems of Home Capital Group have dragged down a number of lenders. Moody’s has recently noted that Canada is vulnerable to a real estate crisis.

Despite a number of warnings and a tightening of mortgage issuance conditions, Vancouver and Toronto have not managed to cool down the rise in prices. Toronto, for example, continues to witness constant home price increases, as illustrated by the latest year-on-year print of +25%.

According the various sources, the bubble is fed by foreigners, as well as a high level of speculative behaviour. In an attempt to cool down prices, the government introduced a 15% foreign-buyer tax in August last year, but there is still evidence of overvaluation.

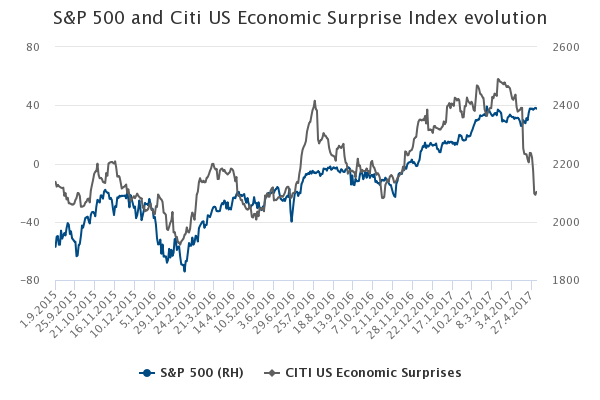

Economy – US economic data surprising on the downside

The US Citi Economic Surprise (CESI) index recently collapsed to levels not seen since the end of last year in the aftermath of Donald Trump’s election. The CESI is built to track the performance of economic forecasts, by measuring data surprises relative to market expectations. Recently, US economic data has surprised to the downside and this index has been breaking the relationship with the US equity market (S&P 500).

For example, the US first quarter GDP growth disappointed at an annualised quarter-on-quarter rise of 0.7%, versus consensus of 1%. Last quarter’s GDP rise was 2.1%. Consumer spending also eased and tax cuts in the US have yet to arrive. Moreover, there is a wide gap between confidence surveys (soft data) and economic data (hard data) since the beginning of the year.

In this context, the S&P 500 continued to return positive performances of 0.9% last month and 6.5% year-to-date.

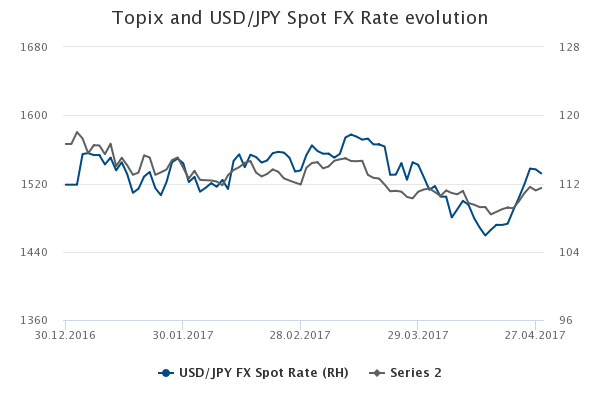

FX – Yen: from risk off to risk on

Since the beginning of the year, the Japanese currency played its role of safe haven currency. Year-to-date, the JPY has appreciated against most developed currencies: +4.6% vs USD, +2.5% vs CHF and +1.3% vs EUR.

More recently, while the result of the first round of the French election on the 23rd of April was widely expected by market participants, the confirmation of Emmanuel Macron and Marine Le Pen entering the second round reduced political tail risks in a meaningful way. At the same time, the Fed meeting increased the probability for a June rate hike close to 100%, while a stronger employment report followed a few days later. This weighed on the JPY, which has great sensitivity to the US economy.

In this context, the JPY lost its safe haven appeal towards the end of the month and closed April flattish against the Greenback.

Finally, the Japanese equity market (Topix) bounced back late on the weakening of the FX rate.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)