The Fed moves ahead and tempts its peers

In June, the Federal Reserve raised USD short term rates for the third time in six months. It seems to be engaged now in a tightening cycle, especially as it also signaled its readiness to begin unwinding its USD 4.5 trillion balance sheet, possibly before year end.

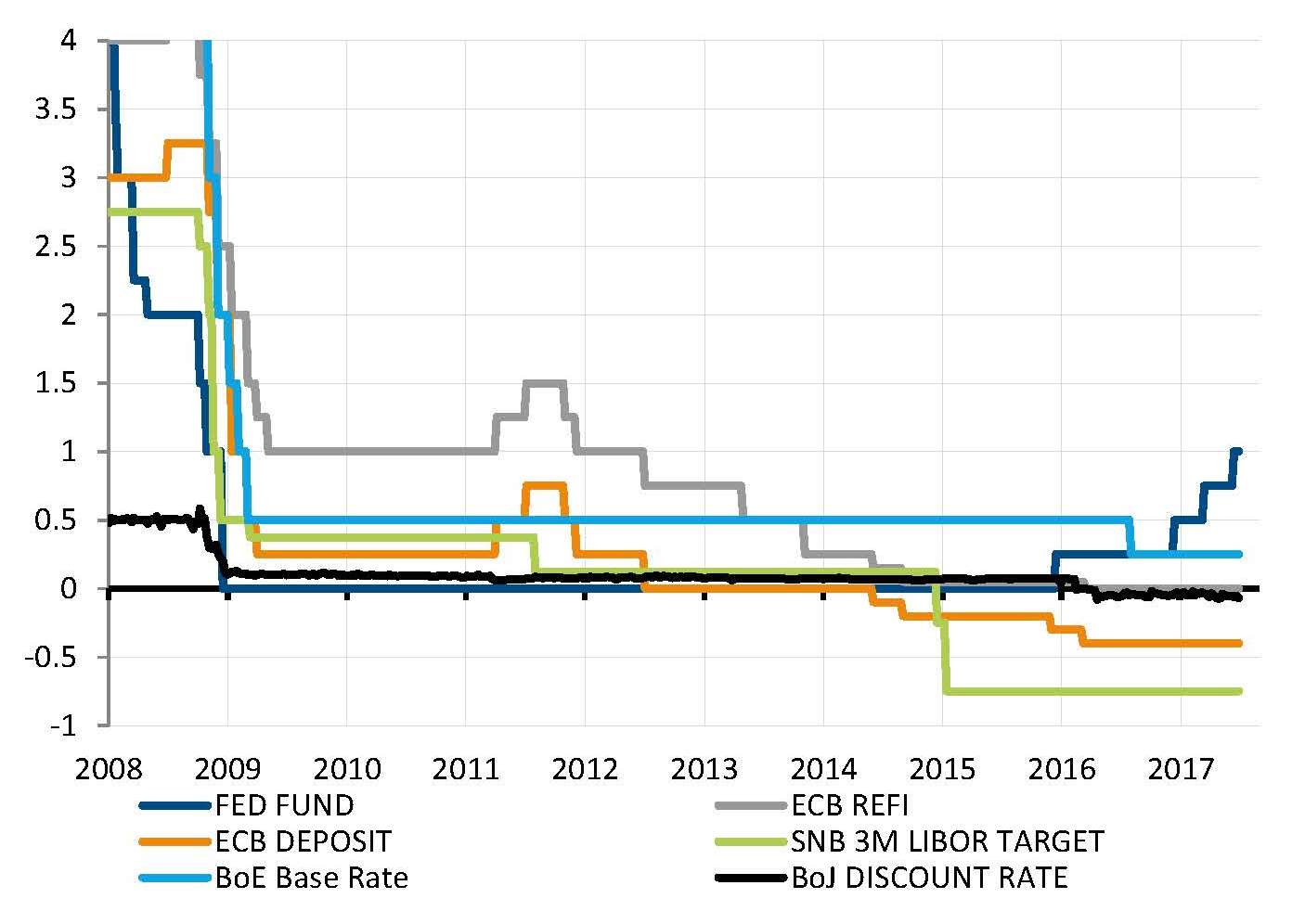

Within developed economies, the US is clearly ahead of the pack for monetary policy normalisation. Other large developed economies are still stuck with rock-bottom short-term interest rates. However, positive economic growth and reduced deflationary risks are prompting other central bankers to contemplate normalisation of their policy too. In June, the ECB and M. Draghi inflected their forward guidance, triggering a knee-jerking reaction of rates and FX markets, and M. Carney opened the door to a BoE rate hike in 2017.

While the economic context can justify this evolution in central banks’ stance, the fact that the Fed is now moving ahead is also certainly a factor providing room for manoeuvre to other central bankers.

The Fed’s move makes monetary policy normalisation “easier” for everybody

Source: Bloomberg, SYZ Asset Management. Data as of: July 2017

Restored balance between investment and consumption drivers

Source: Factset, SYZ Asset Management. Data as of: July 2017

United States - A late cycle but relatively balanced economy

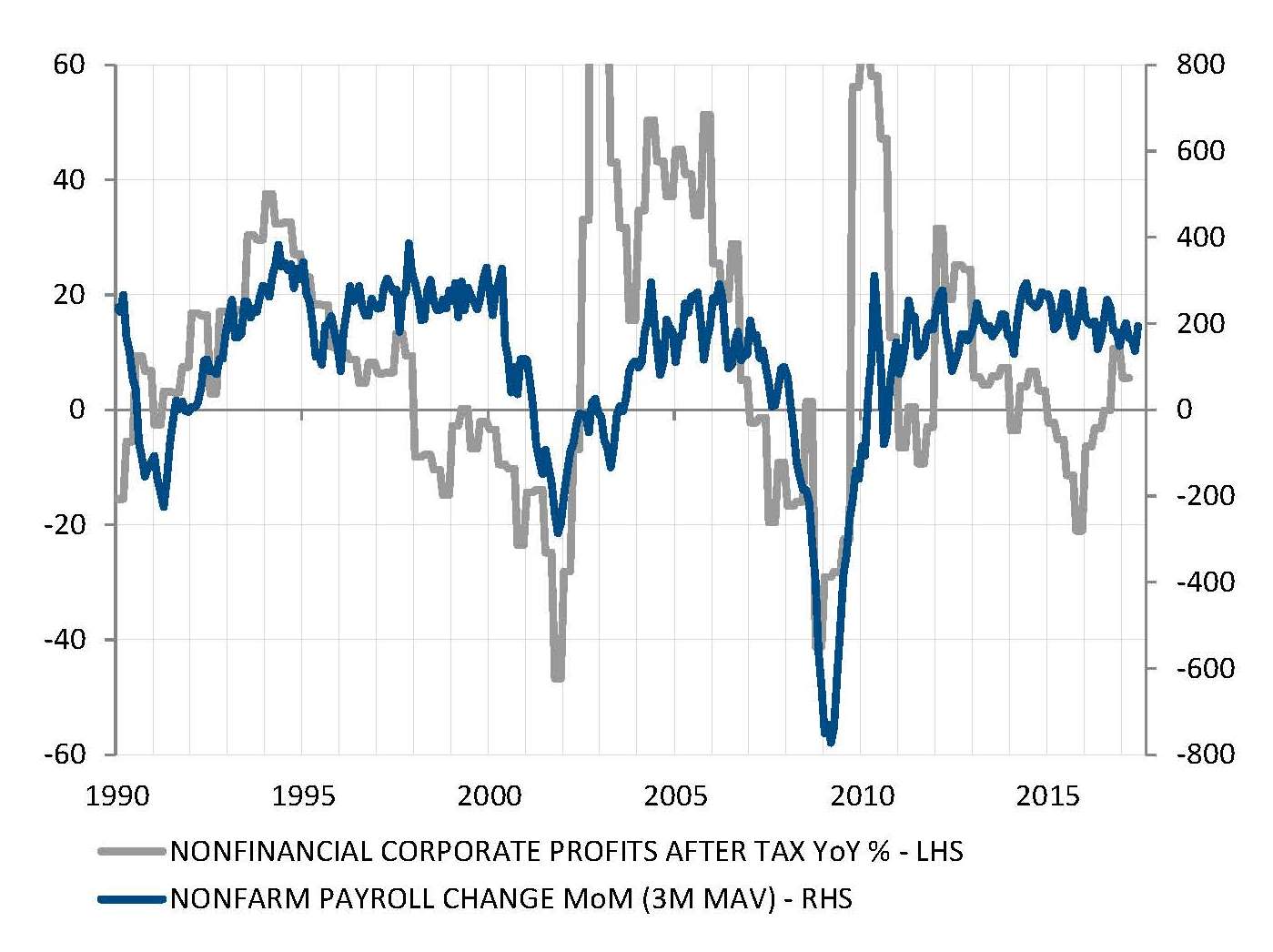

The performance of the US economy during the first half of 2017 has been disappointing compared to the post-Trump wave of optimism. The lack of concrete announcement on the fiscal front has left GDP growth around the 2% average growth rate characterising this eight-year expansion cycle.

However, a rebalancing of growth has been at play. After two years of consumption pre-eminence among growth drivers, business investment has resumed to contribute to GDP expansion. The drag on corporate profits of falling oil prices and rapid USD appreciation has dissipated and allowed for business spending recovery. This is at a time when consumption is losing strength with less buoyant job growth, subdued wage growth and slower credit distribution.

In fact, the pace of US expansion may be disappointing at this advanced stage of the business cycle, but the restored balance between household consumption and business spending suggests that the expansion can run further if not hit by market shock (for example on interest rates and on oil prices).

Eurozone - Confidence at its highest

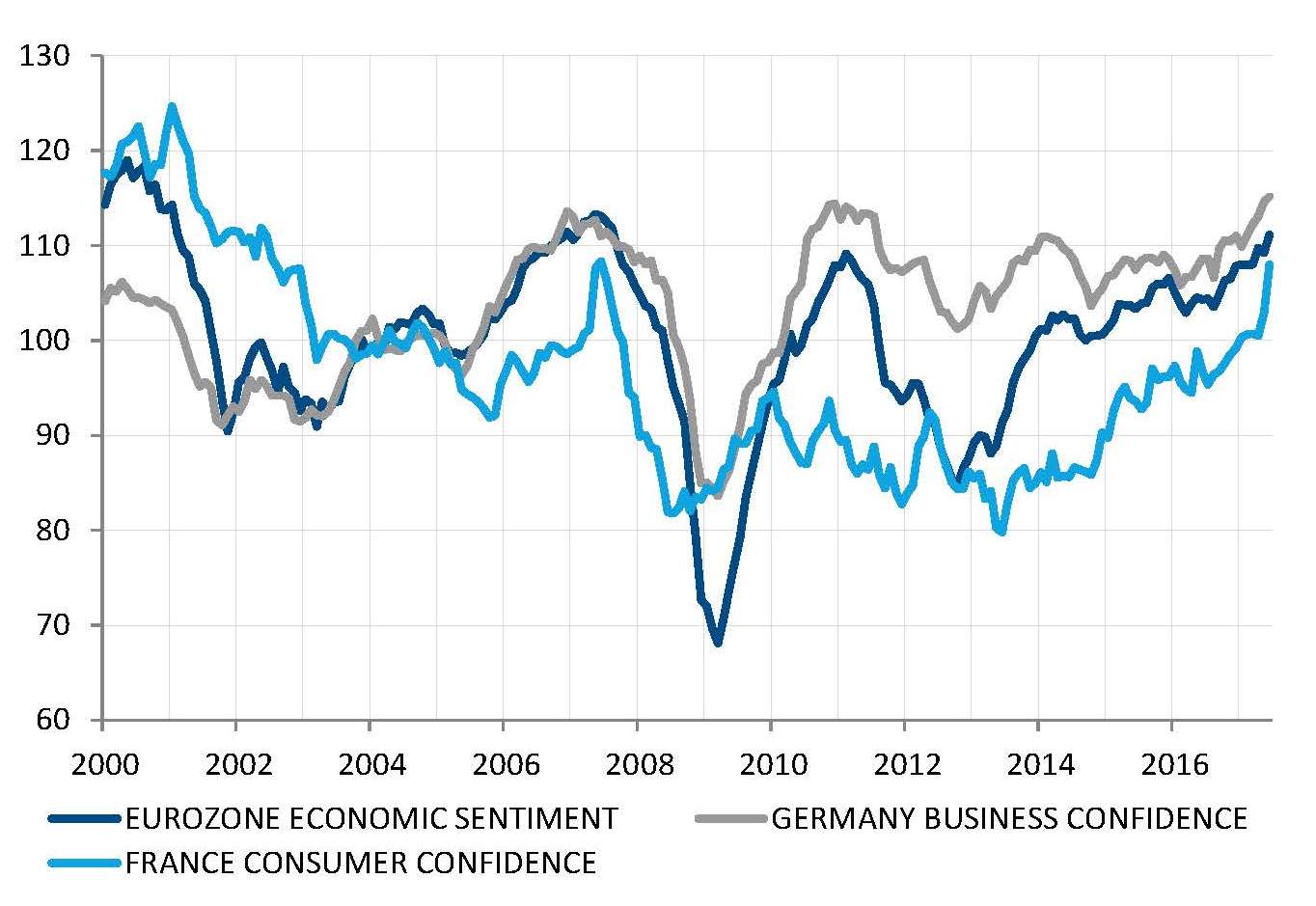

The Eurozone may currently experience a sort of state of grace. This includes broad based positive economic growth and declining unemployment rates, no immediate threat of political turmoil after the electoral sequence in Italy, Netherlands and France, plus supportive monetary policy and firm global demand as solid tailwinds.

Such positive picture in absolute terms is probably made even brighter by the contrast with only a few years back, when the Eurozone was the weak link and main risk of an otherwise well oriented global economy.

All various confidence surveys across the monetary union are reflecting this unexpected return of long-lost optimism among businesses and households. In June, the Eurozone-wide Economic Sentiment Index and the French Consumer Confidence Index rose to decade-highs. And the German ifo Business Confidence Index simply reached a new all-time high, which means optimism is back in Continental Europe.

Confidence surges in Europe, among businesses and households

Source: Factset, SYZ Asset Management. Data as of: July 2017

Theresa May’s lost gamble has weighted on the GBP

Source: Bloomberg, SYZ Asset Management. Data as of: July 2017

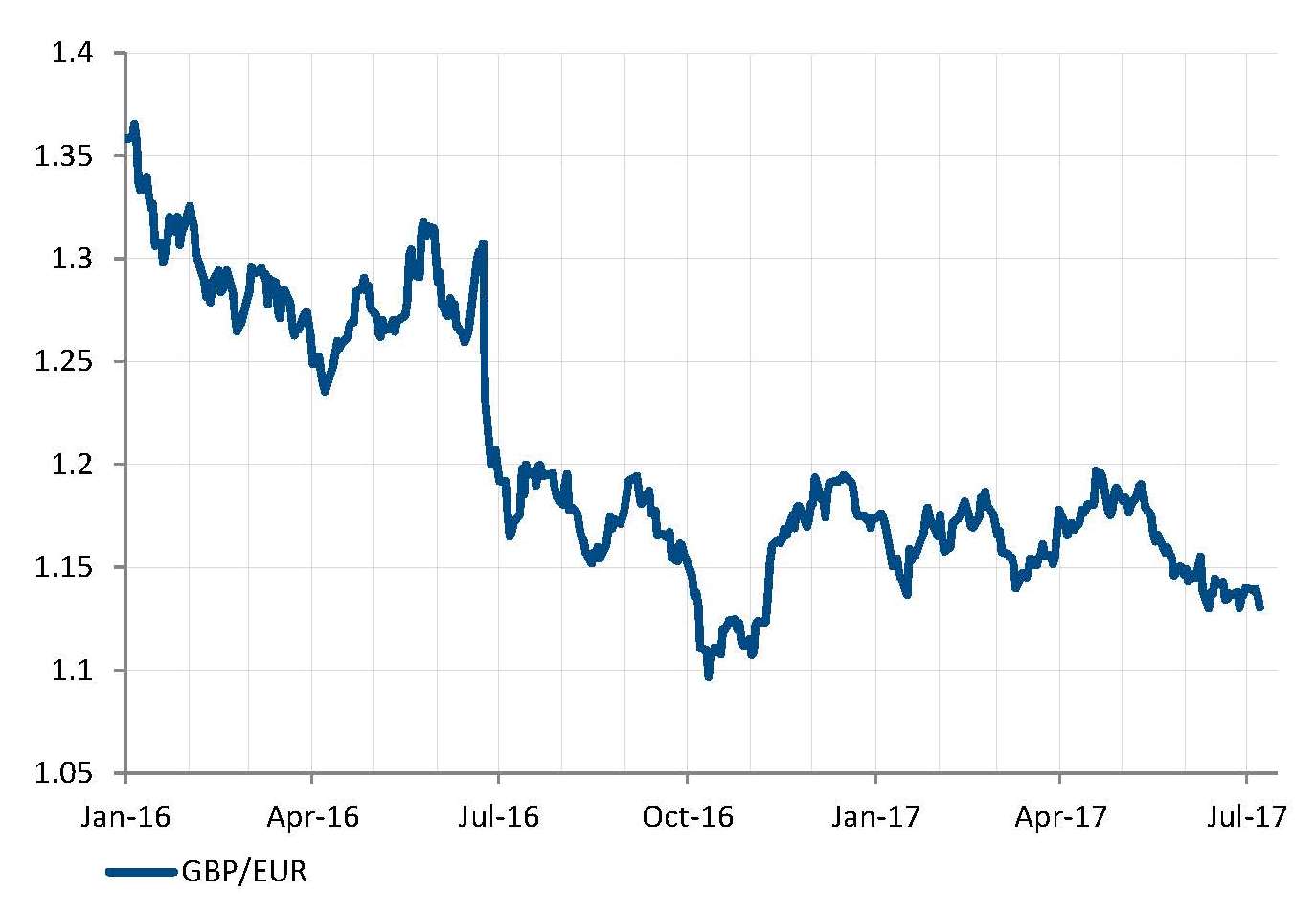

UK - A sad irony for the start of Brexit negotiations

There is a fair bit of irony in the recent developments on each side of the Channel. While Continental Europe is getting back onto its feet, the UK is recording slowing economic growth and is plunged into the throes of political turmoil.

Right at the time when Brexit negotiations are formally starting, the roles seem indeed to have been suddenly inverted. The successful UK, previously buoyed by a flexible and liberal economy, has become a country with weak political leadership and an inclination for more regulation, taxes and protectionism. On the other side of the table, a once cacophonous group of countries, plagued with weak economic growth, hopeless perspectives and recurring political crisis is finding itself, at long last, in a positive economic dynamic, with most political clouds out of the way and one of its core members just having elected a pro-reform, liberal and openly European president to the surprise of most.

This couldn’t have gone unnoticed by the FX market, where GBP has fallen back toward its low against

the EUR.

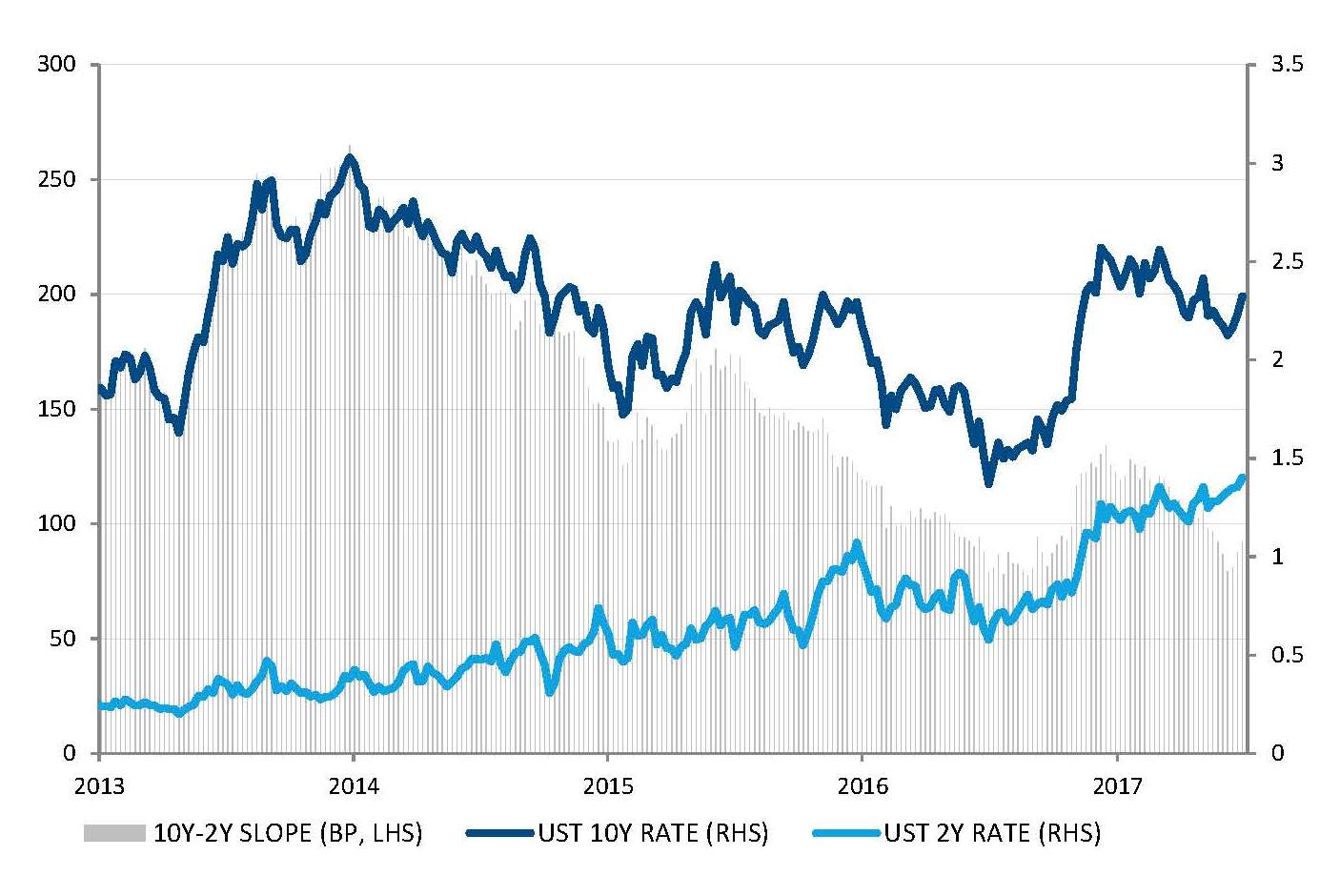

Rates - A flatter US curve driven by short term rates

Since 2013 and the first hints of Fed policy normalisation (the famous "Bernanke tapper tantrum"), US long term rates have recorded volatility within a 1.5%/3% range but have not exhibited a sustained upward trend. They have been capped by the lack of domestic inflationary and growth pressures, and by a global environment of (very) low interest rates.

However, a mild and gradual normalisation of the Fed’s monetary policy has still happened in the meantime, with the phasing out of QE and then four rate hikes. Short term interest rates have trended up, with the US 2-year rate reaching its highest level since 2008.

Such flattening of the yield curve reflects a disconnect between market-based low growth and inflation expectations and a central bank now willing to normalise its stance before the business cycle’s exhaustion. While such flattening used to be a good predictor of recession in the past, it may however not have the same predictive power currently, at least if global factors weighting on US rates remain in place.

A yield curve flattening caused by rising short term rates

Source: Bloomberg, SYZ Asset Management. Data as of: July 2017

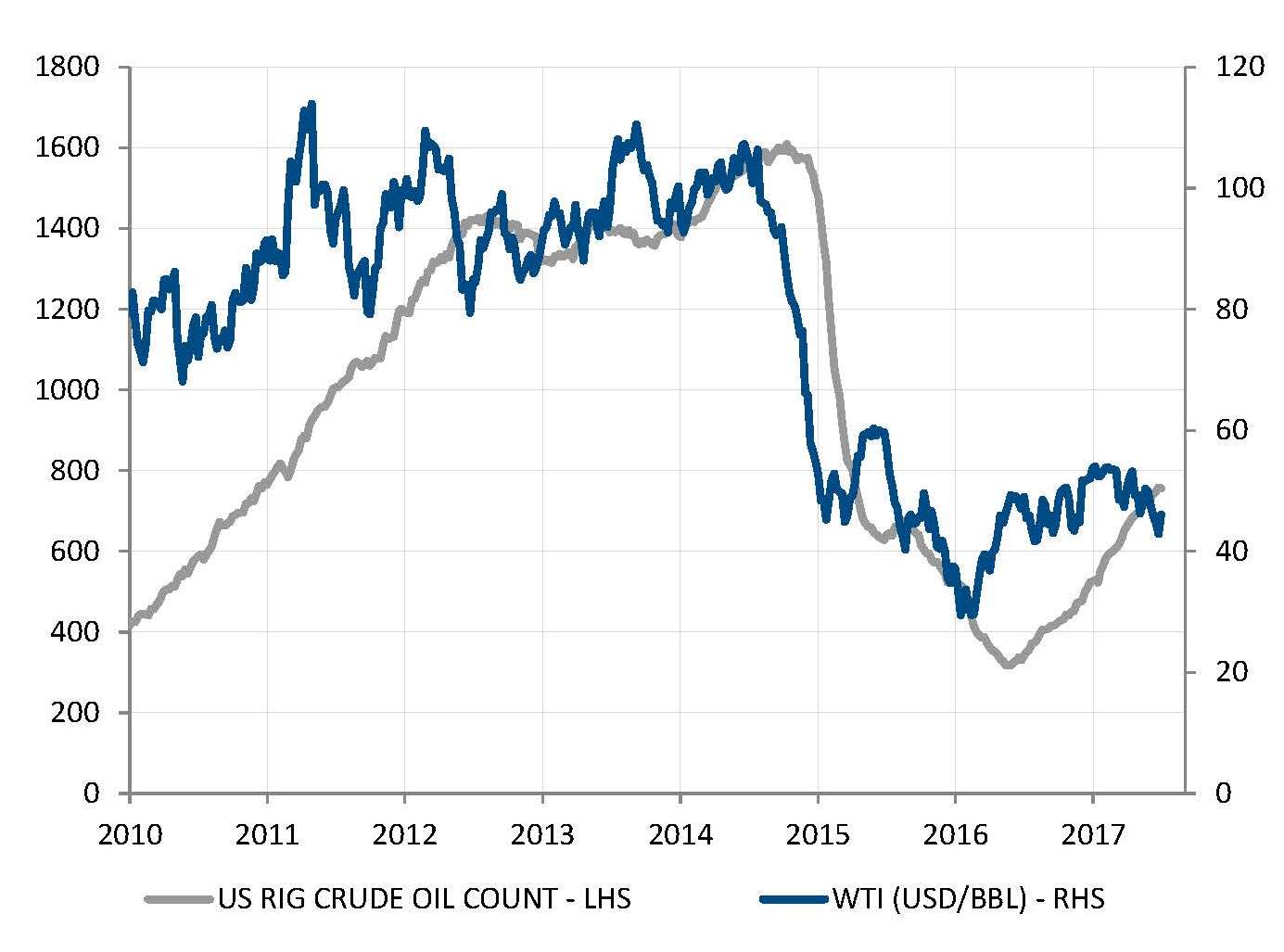

The US shale oil industry caps oil prices

Source: Bloomberg, Baker Hughes. Data as of: July 2017

Oil - US shale producers cap the price of oil

Oil prices have been pretty volatile in the past four months, experiencing three declines of more than 10% each time followed by sharp rebounds. Still, they have trended down amid this volatility, with US oil prices falling to their lowest level in 10 months in June.

The volatility has been fuelled by an alternation of hopes and disappointments on OPEC production control. Despite OPEC’s stated efforts, crude oil inventories remain close to record highs in the US.

The reason for this lack of impact is yet to be found in the US, where crude oil production is almost back at its peak of 2015. The shale oil industry has digested the 2015 shock and is increasing again the number of rigs in operation. Technological progress allows those rigs to be more efficient, for example, to produce more per rig and at a lower cost, with greater flexibility, such context caps oil prices in the medium term, even if volatility is likely to continue to prevail.

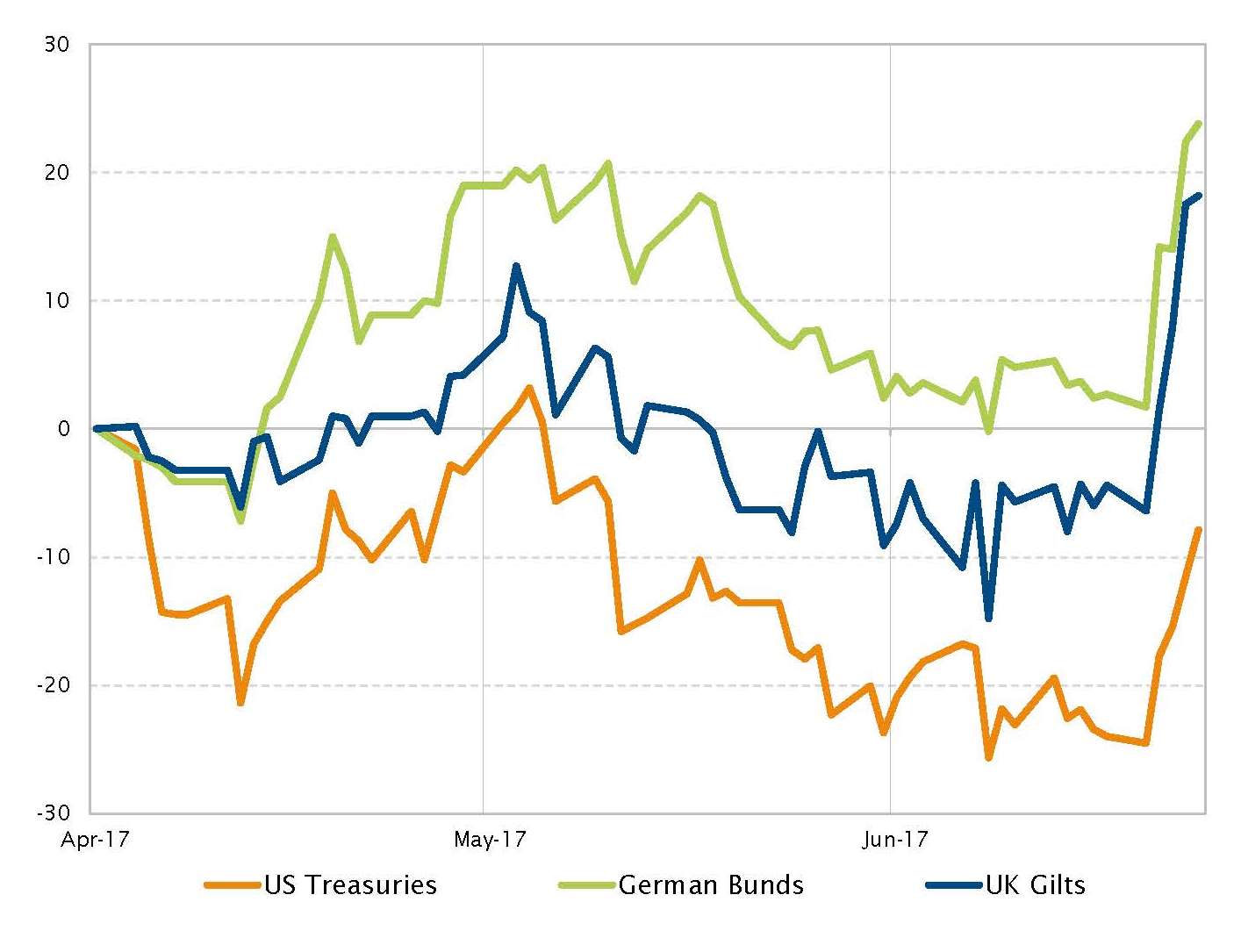

Fixed Income - Sharp pullback of main developed sovereign interest rates

In June, developed market interest rates were under pressure following some hawkish central banke’ comments during the last week of the month, with equity markets following in the same direction. ECB and BoE statements turned more hawkish, triggering a selloff in bonds, a stronger EUR and a fall in European equity markets. In the US, the Fed could begin shrinking its balance sheet in a gradual manner starting in the third quarter. In Europe, a confident speech from Mario Draghi on the growth and inflation outlook and the ability of the ECB to normalise its monetary policy also triggered this upward movements in rates. In the UK, the BoE have signaled that it could potentially hike rates this year to manage the current inflation overshoot.

In this context, UK Gilts, German Bunds and US Treasuries saw their yields increasing respectively to +22bps, +17bps and +10bps.

Change in 10-year sovereign bond yields since April 2017 (in basis points)

Source: Bloomberg, SYZ Asset Management. Data as of: July 2017

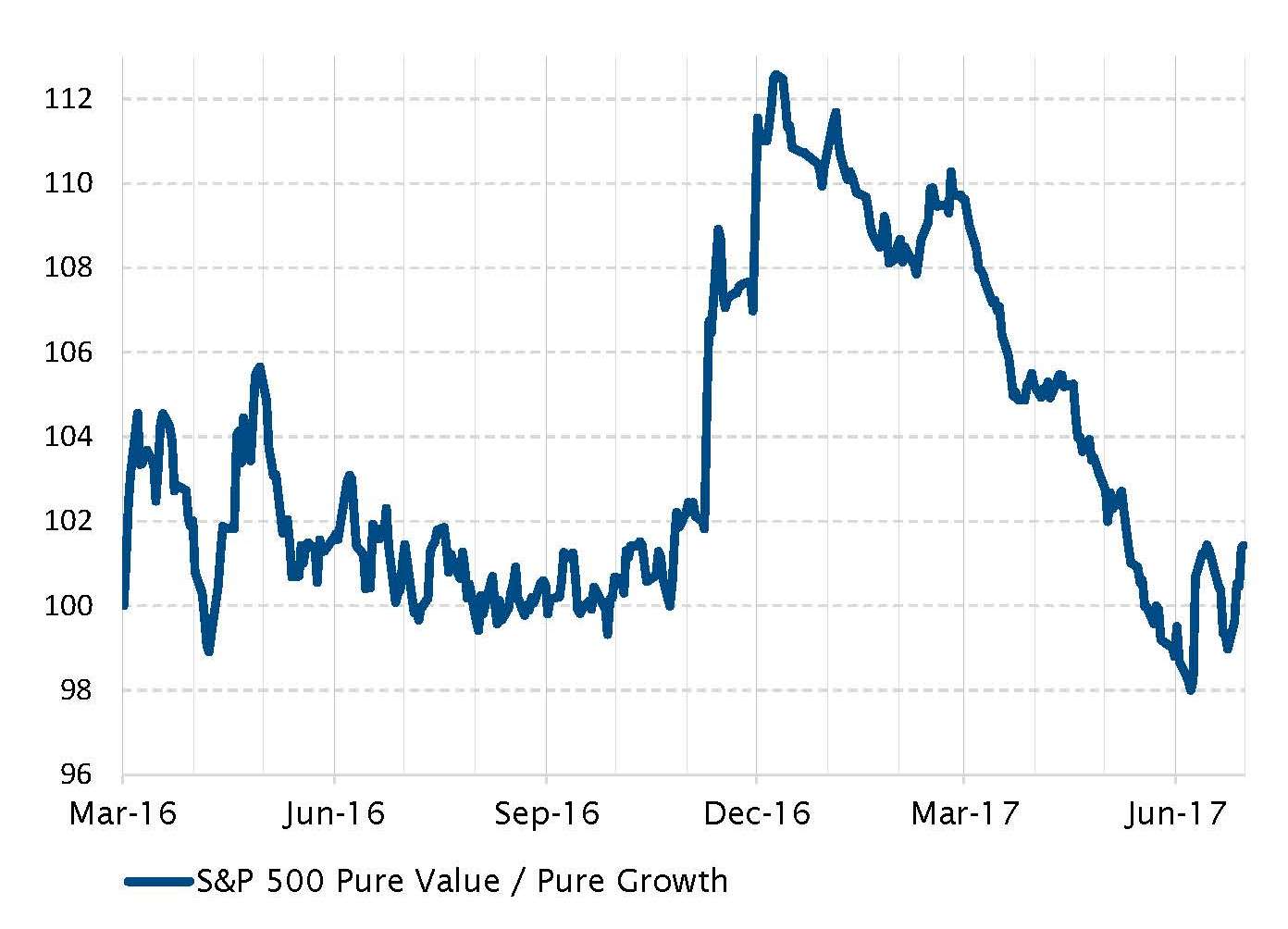

S&P 500 Pure Value/Pure Growth (March 2016 = 100)

Source: Bloomberg, SYZ Asset Management. Data as of: July 2017

Equity - Style reversal in the United States after Trump’s election

Last year after the US election in November, the US equity market rally has been characterised by some style rotation between first value and then growth stocks. Value outperformed in the post-election period by circa 15% before this outperformance was erased in favour of growth until the end of May.

Value index is biased with financials (34% of the S&P Pure Value Index) and growth index is over represented with technology (31% of the S&P Pure Growth Index). These two strong overweights were leading the rally: financials from November 2016 to January 2017 and technology afterwards.

Growing expectations of "general" monetary policy normalisation in developed markets (ECB, BoE, BoC and RBA) triggered during the last few days of the month a sell-off in bond markets and reversed many trends on financial markets. In this context, US equities closed the month flattish with the noticeable outperformance of small caps and financials and the negative performance of technology and European markets.

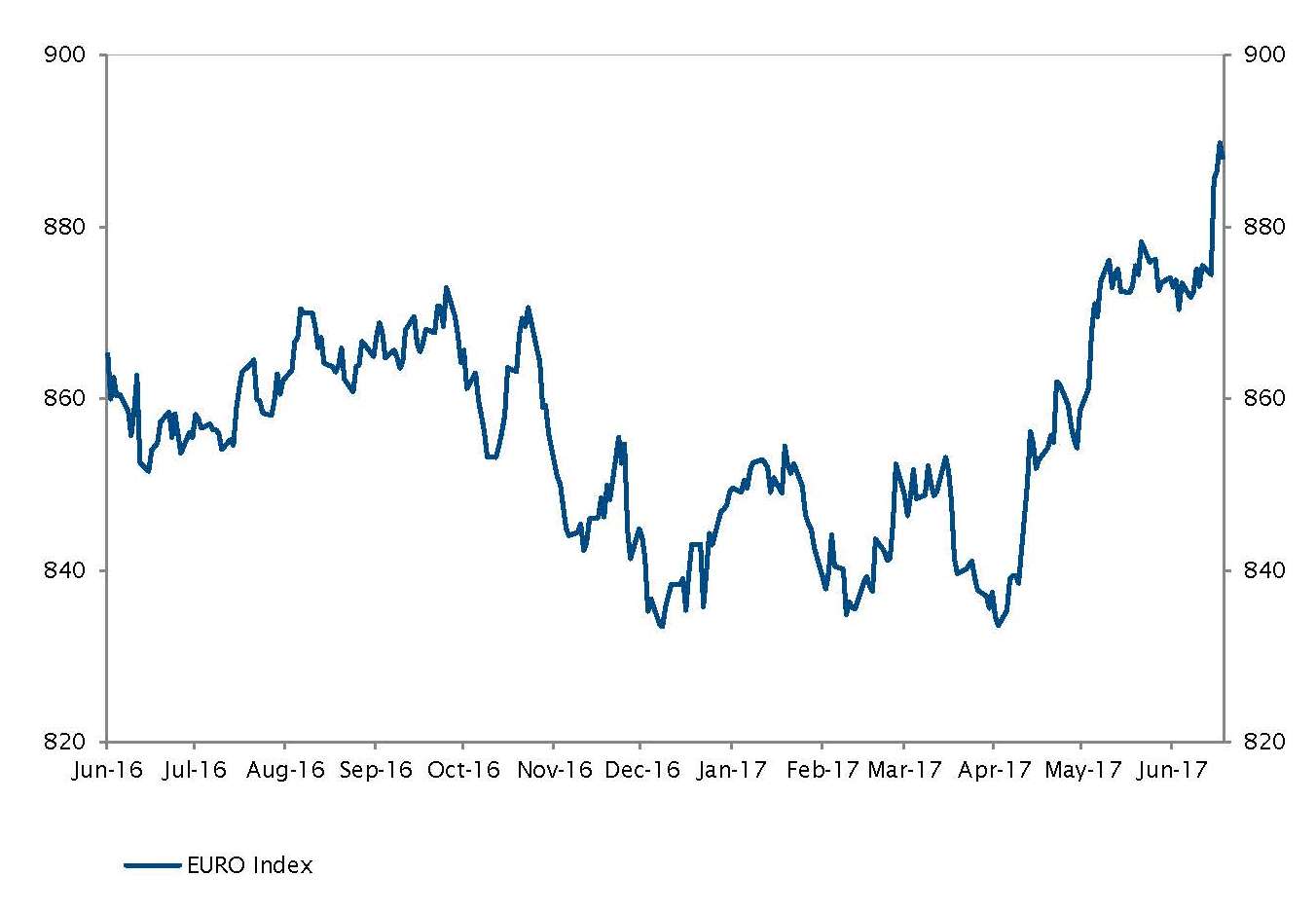

Euro - Communication issue between ECB and markets

The euro surged during the last week of June as investors misjudged a speech from Draghi. The message was intended to recognise the current strengthening of the Eurozone economy and that the threat of deflation was gone while reflationary forces were at play. Draghi stated that an unwinding of the asset purchase program might be possible. That was enough for markets to interpret it as a signal that the ECB was planning a slowdown or a stop of its quantitative easing program. In reaction, the Eurozone bond prices fell while the euro surged by more than 1.5% as illustrated by the euro index.

ECB officials reversed the hawkish interpretation the next day and the situation calmed down. What this episode shows is that the ECB must be cautious on how it communicates, in order to avoid adding stress and unwarranted tightening of financial conditions.

The euro surged following Draghi comments

Source: Bloomberg, SYZ Asset Management. Data as of: July 2017

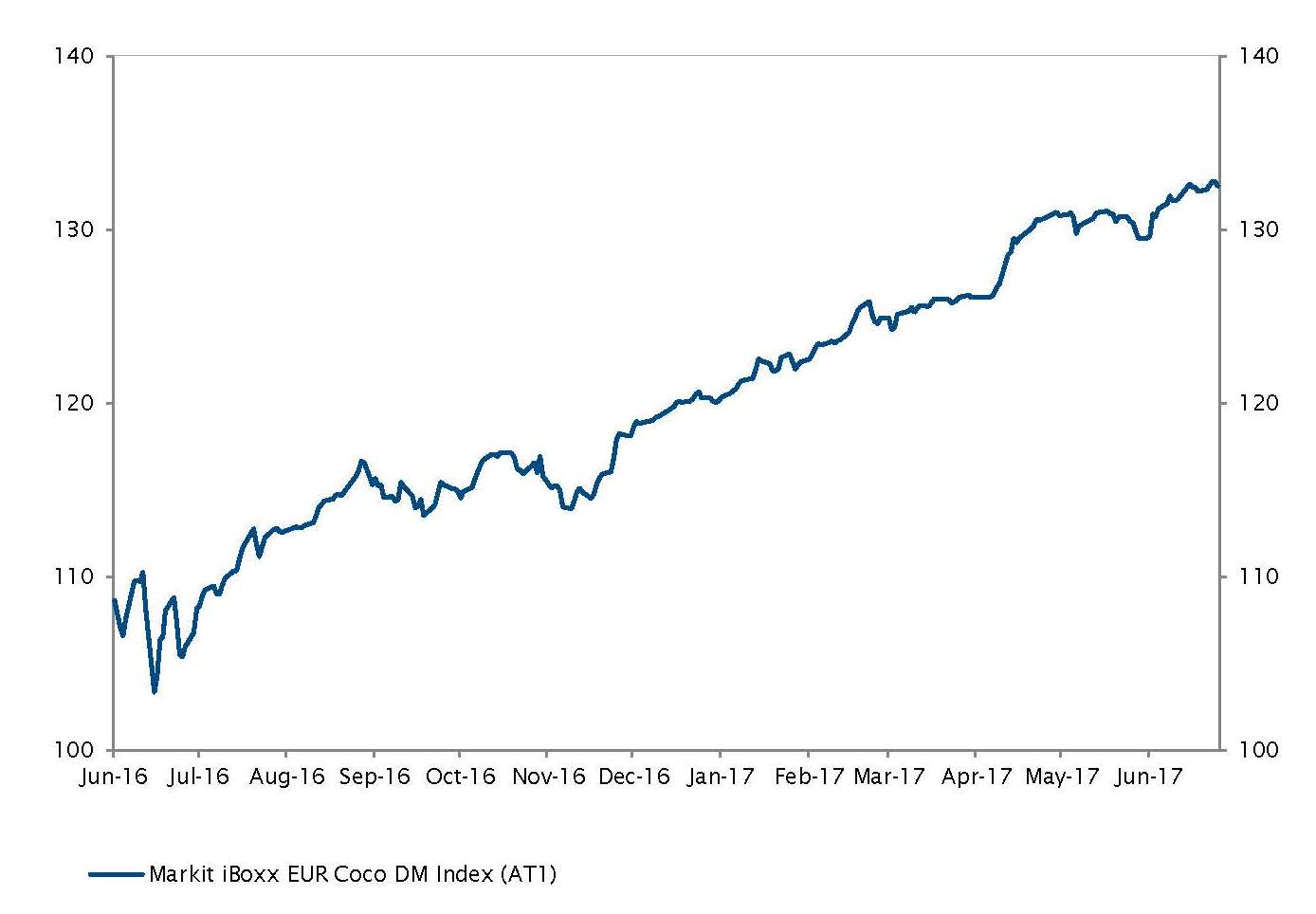

The collapse of Spanish and Italian banks has had no negative impact on markets

Source: Bloomberg, SYZ Asset Management. Data as of: July 2017

Eurozone - European bank saga continues

Investor and analysts of European banks experienced a June full of action. The beginning of the month saw the collapse of Spanish lender Banco Popular who was acquired for one euro by Santander. The European regulator applied strictly the rules designed to avoid using tax payer money as subordinated bonds (AT1 and Tier2) disappeared while senior bond holders enjoyed the bail-in.

Italy had its share of action at the end of June with the failure of two regional banks, Popolare di Vicenza and Veneto. However, Italy issued a decree, with the support of the European authorities, to bail-out the two failed lenders using EUR 17bn of tax payer money. Intesa Sanpaolo acquired the good assets while the State was left with non-core exposure.

Although the rules used in the two countries were different, markets welcomed the events as they removed weak links of the European banking system.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)