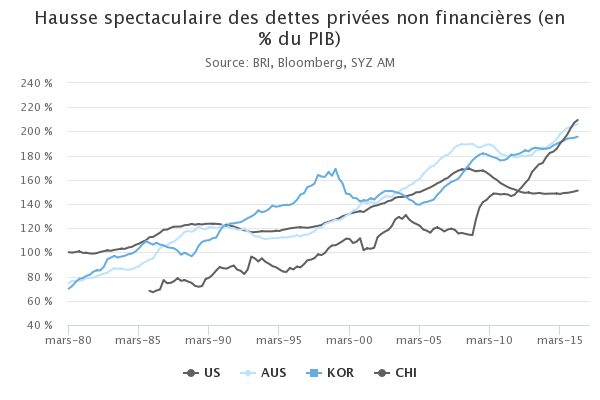

High debt levels make global growth very sensitive to rates

Much has been said in the past few years about the negative side effect of extended ultra-loose monetary policies and their ineffectiveness in spurring growth and inflation. This has even supported the idea that a normalization of rate levels would ultimately be welcome to offset some of those side effects.

Unfortunately, as much as it is impossible to assess if the global economy would have been better off without those policies, it is equally impossible to move backward or ignore one of its main consequences : a large build up in debt at a global level, especially in some Emerging economies with a significant part being USD-denominated debt.

With such a stock of debt, interest rates matter enormously to the global growth dynamic. The impact of monetary policy has become very asymmetric, with limited sensitivity to additional easing but very high sensitivity to any form of tightening. The Fed and fellow central banks are unlikely to be able to normalize their policies as they used to in the past.

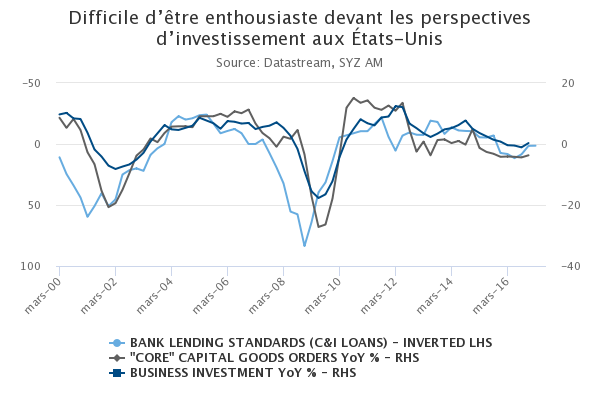

US business investment unlikely to take off in 2017

Since 2015, US economic growth has relied exclusively on household consumption. US GDP ex-consumption has been contracting, amid falling oil prices, US dollar strength, inventory reduction and unfavourable corporate profit backdrop. Recently, these trends have stabilized, helping to fuel expectations of a long overdue growth acceleration based on a rebound in business investment.

However, fundamental drivers do not provide ground for such optimism : capacity utilisation rate is low implying no pressing need for capacity-enhancing investment; corporate profit growth is only just recovering; and financing conditions remain on a tightening trend, with banks reporting marginally tighter lending conditions for a 6th consecutive quarter.

A potential game changer to one of those headwinds could be the fiscal reform promised by Donald Trump. But the other headwinds will remain there, hampering CEOs’ propensity to use those proceeds for productive investment. Assuming the tax cut will effectively be "phenomenal", something that should not be taken for granted!

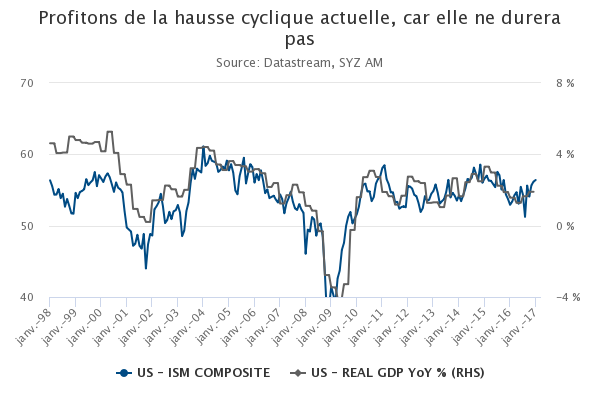

A strong start for US growth, that will not last long

If much uncertainty continues to cloud the medium-term outlook of the US economy, 2017 has started on the same strong footing on which 2016 had closed. All US cyclical indicators are exhibiting a positive dynamic that suggests above-trend GDP growth for the 1st quarter.

Confidence surveys among households and businesses have been fairly strong since the end of last summer and have received an additional boost after Donald Trump’s election. The composite ISM index points to annualized GDP growth around 2.5% in Q1, above current potential growth rate (1.7%).

Unfortunately, this trend is unlikely to extend beyond Q1. Beside business investment (see above), household spending remains supported by strong employment. But real purchasing power growth is slowing down as oil-price driven inflation is not compensated by nominal wage growth. Lending conditions are already getting tighter for consumer credit. Let’s enjoy the current cyclical dynamism as it is likely to be short lived.

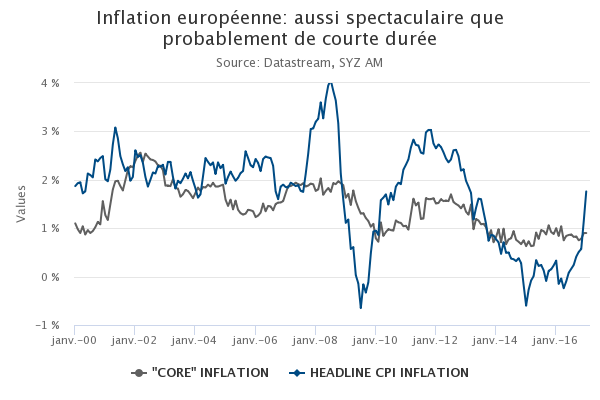

Euro area: a spectacular but short-lived inflation spike

In January, something "unbelievable" happened: inflation numbers surprised significantly on the upside in the euro area. They jumped to +2.0% in Germany, +3.0% in Spain, and drove the Euro area headline inflation rate up to +1.8%. What a change from a year ago, when inflation numbers were in negative territory !

There is a simple explanation : headline inflation rates have been largely driven, since 2014, by oil prices. Their collapse led inflation rates to err around zero by 2015 and their rebound since early 2016 has logically inflated inflation recently.

Over the period, "core" inflation, excluding oil & energy prices, has remained stable just below 1%, far from the ECB target. Assuming stable oil prices, headline inflation will converge toward this level after Q1. Therefore, the current inflation spike is unlikely to trigger an immediate reaction from the central bank. The ECB has already done the mistake twice (in 2008 and 2011) and was forced each time to backtrack rapidly.

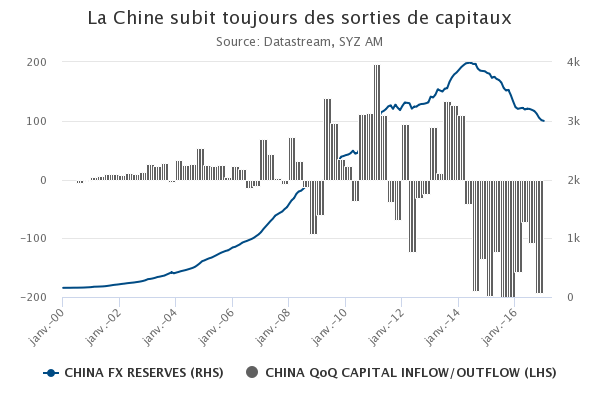

China: capital outflows continue

China has been much less of an immediate concern for global investors in 2016 than it had been in 2015. GDP growth has stabilized just below 7%, supported by an accommodative mix of looser monetary and fiscal policy and a depreciation of its currency (-6% in 2016).

However, one of the destabilizing factors of 2015 has remained in place last year, even if at a milder intensity. Capital outflows have continued, despite attempts to crack down on the various "leaks" of the capital account. They amounted to half a trillion USD in 2016, after USD 800bn in 2015. As a result, FX reserve have extended their decline, falling below USD 3 trillion, their lowest level in 6 years.

The combination of anti-corruption campaigns and tighter regulation in China, lower domestic growth prospects, a seemingly lasting downward trend for the yuan and expectations of higher rates in USD continue to lure Chinese capital outside China.

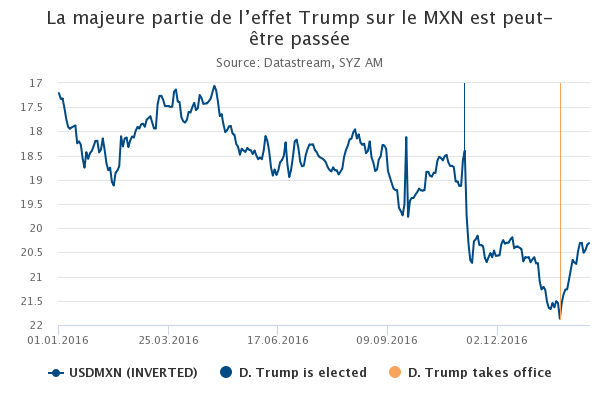

Mexican peso: the worst may be over

Avant les élections présidentielles américaines, le peso mexicain faisait figure de baromètre des chances de Donald Trump, compte tenu de la rhétorique anti-mexicaine du candidat. Au lendemain du scrutin, le MXN a logiquement plongé et a poursuivi sa chute en janvier, étant donné que l’activisme du président élu Trump poussait les constructeurs automobiles américains à annoncer des changements dans leurs plans d’investissement au Mexique. Le peso a atteint un plancher historique face au dollar US... à la veille de l’entrée officielle de Donald Trump à la Maison-Blanche.

Depuis que M. Trump est au pouvoir, le MXN a rebondi en dépit de tensions diplomatiques lors des tout premiers jours de son mandat et de la volonté réitérée du président américain de renégocier l’ALENA, et de «construire le mur».

Alors qu’une partie du rebond s’explique par la position très conquérante de la banque centrale mexicaine, il est également possible que les récents mouvements du peso mexicain soient le résultat d’une légère variation du vieil adage boursier : «vendre la nouvelle, acheter la mesure».

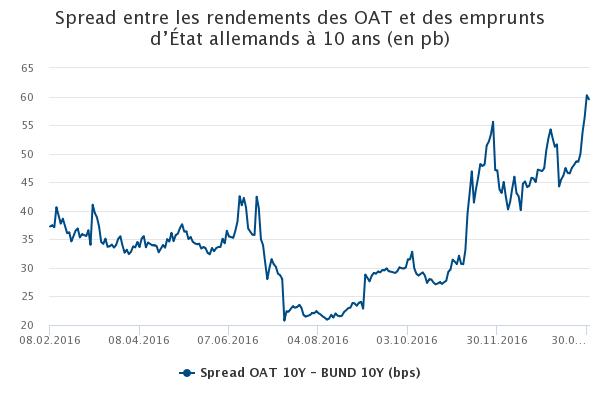

Bonds: French political risk on the rise

Since last summer, spreads of French OAT started to widen against German Bunds in the run up to the Presidential election in France. At their lowest level in 2016, the spread level was at 22bps and stands at the end of January as much as 60bps. This compares to level not reached since 2014.

The major trigger for the latest spread widening comes from the high uncertainty concerning the future President in France following the loose of faith towards Francois Fillon and the tail risk of the far-right party gaining more ground. As a consequence, the centrist candidate Emmanuel Macron is building momentum.

French OAT will probably continue to be a source of volatility until the result of the election taking place on the 7th of May followed by the legislative election starting on the 10th of June.

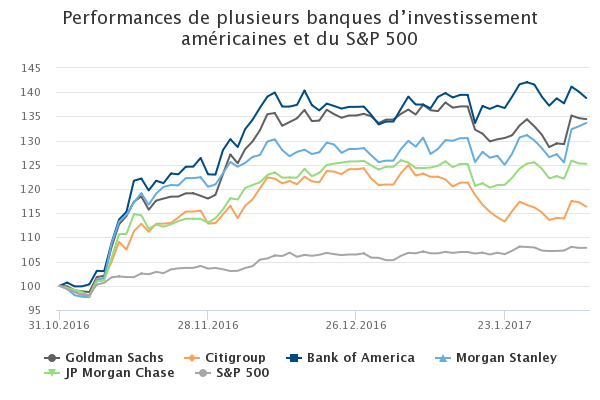

Equities: Better environment for US Investment Banks

Major US Investment Banks that reported earnings in January beat on their revenues mostly driven by strong results on their fixed income, currency, and commodity division. Moreover, US banks EPS had also been revised up last quarter.

The Trump effect is perceived to be positive for US banks as net interest income is generally improving coupled at the same time with potentially lower corporate taxes and by allowing the return of excess capital at US banks leading to more share buybacks.

Banks profitability is improving and pushing their share price up because of higher short-term interest rates, forward inflation expectations picking up and stronger growth in the US. More recently, Donald Trump’s intention to unwind Dodd-Frank regulation also fuelled the rally.

In this context, the performance of the S&P 500 Banks index since the end of October was up +24.7% (on the back of a stepper yield curve) compared to +7.8% for the S&P 500.

UK: An interest rate hike may come sooner rather than later

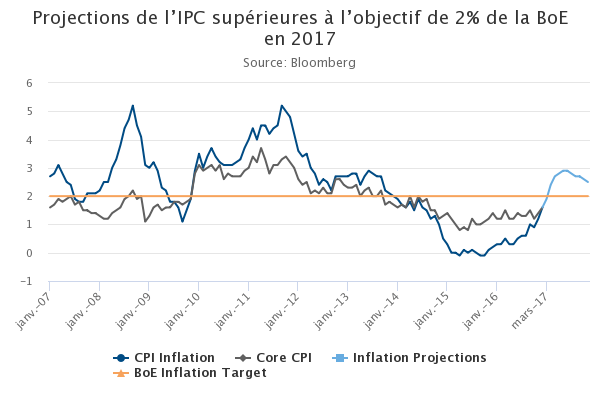

The acceleration of inflation might become an issue for the monetary policy. While the discussion turned around another rate cut only three months ago, the BoE has recently indicated that interest rates could move in either direction, signalling its growing concern on inflation.

A weaker Pound following the Brexit vote, the rate cut of August last year, as well as higher commodities prices have all contributed to drive inflation higher. As a consequence, the CPI has beaten expectations in December at 1.6% and reached its highest level since 2014. Inflation is now foreseen to be above the Central Bank’s target of 2% at the end of 2017 (around 2.7%) and probabilities of a rate hike during this year are increasing (around 50%).

The sharp slowdown anticipated by the BoE did not materialize and, if economic figures continue on a strong path, the BoE might change the direction of the interest rate cycle.

Risk: Two measures with opposite signals

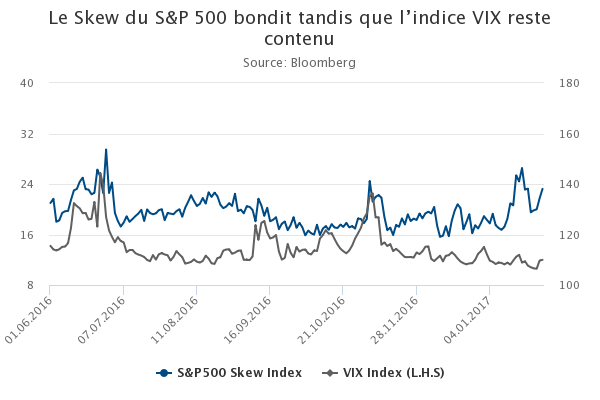

While the S&P Index trades near all-time highs in an environment of growing political uncertainty, the VIX index reflects relative calm mood and trades below its long-term average. Short volatility strategy has reached record levels and act as compression factor to the VIX Index.

But the SKEW index, another measure of stress, points toward a solid demand for tail risk hedges. This index, which typically ranges from 100 to 150, determines the implied skew of the S&P returns distribution (a high reading implies that a large move is expected). It reached 146 in January and remains in its high range since then.

Both indicators have already moved in opposite direction, but such a prolonged period of dislocation might lead to a spike of the VIX. Although economic figures still depict a stronger economy, a growing number of investors are hedging their long exposure through S&P puts amid political uncertainty and a potential tightening of monetary policy.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document. (6)